1099-Income-Only Mortgages For Borrowers

In this mortgage guide on Gustan Cho Associates, we will cover qualifying for 1099-income-only mortgages. Many people are 1099-income-only wage earners and have a lot of unreimbursed business expenses on their tax returns. Mortgage lenders use the adjusted gross income and not the income from the income tax returns. Adjusted gross income is the income after all unreimbursed business expenses. In many instances, borrowers cannot qualify for a mortgage due to unreimbursed business expenses. Homebuyers and homeowners can now qualify for 1099-income-only mortgages without income tax returns.

Can I Get a Mortgage With 1099-Income-Only Mortgages?

Are you a 1099-income worker, and you are looking for a home loan? Even though it is slightly complicated, you can qualify for a mortgage. Given the nature of their work, life can be more challenging for 1099-income workers compared to salaried individuals.

1099-income-only mortgages are available for homeowners, given that the requirements for securing mortgages are way beyond their reach.

Something had to be done to assist this group of people in realizing a seemingly impossible dream of owning a home. This article will tell you all there is to know about 1099-income-only mortgages, their requirements, and how you can qualify for them.

What are 1099-Income-Only Mortgages?

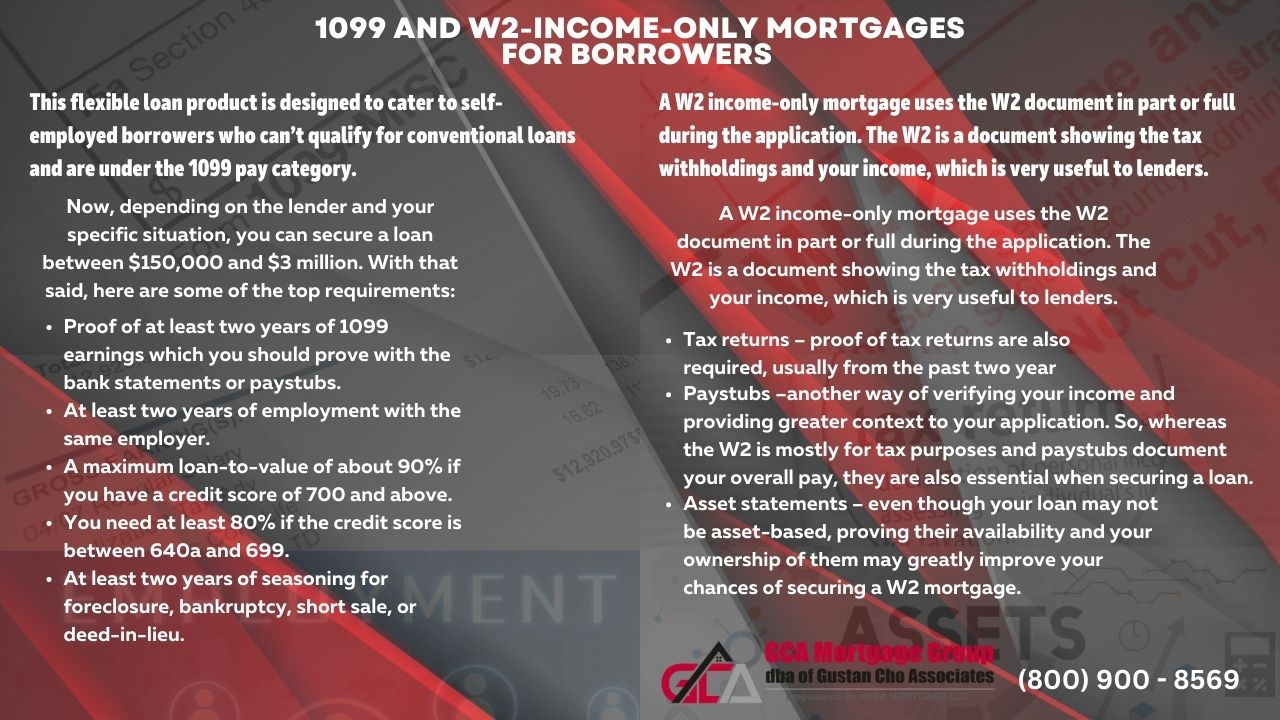

This flexible loan product is designed to cater to self-employed borrowers who can’t qualify for conventional loans and are under the 1099 pay category. These workers use the 1099 form, especially when filing their taxes. This includes contractors, freelancers, and gig economy workers who aren’t eligible for conventional loans.

W2-Income-Only Mortgages

Documents Required For 1099 and W2-Income-Only Mortgages

Immigration Documents

- As a foreigner working in the U.S.,

- You must provide a valid visa.

Proof of Tax Returns

Mortgage lenders want to see the sole proprietors’ 1099 incomes, which helps to prove your salary, but as for independent contractors, tax declarations are required.

Proof of 1099 Income

- Borrowers who cannot justify a Form 1099-MISC

- This is probably because they work in different companies.

- Need to provide other documents such as bank statements, checks, or other proof of payments.

Financial Statements for Your Business

The lenders would also want to assess your business’s state, enabling them to evaluate your ability to repay the loan accurately or whether you can afford it in the first place.

Your Credit Card and Loan Statements

The lenders will assess these documents to know the state of your credit history.

Mortgage Loans With Income Documentation

Now, depending on the lender and your specific situation, you can secure a loan between $150,000 and $3 million. With that said, here are some of the top requirements: Proof of at least two years of 1099 earnings, which you should prove with the bank statements or paystubs. At least two years of employment with the same employer. A maximum loan-to-value of about 90% if you have a credit score of 700 and above. You need at least 80% if the credit score is between 640a and 699—at least two years of seasoning for foreclosure, bankruptcy, short sale, or deed-in-lieu.

W2-Income-Only Mortgage Loan Requirements

For W2 income mortgages, the documents you will need are mortgage documents required but not federal income tax returns. The W2s are the essential documents for any W2 income mortgage. These documents demonstrate your total income, which is a major factor in determining whether or not you qualify for a loan. In many cases, the lender will ask for a W2 for two years, so if you need that information, request it from your employer.

You will need a down payment to secure a W2 income mortgage, and you must prove it with documents to the lender. You are only exempted if you are applying for VA or USDA loans. Essentially, when we talk of down payment proof, we refer to documents that prove the availability of capital to support the purchase. The exact amount of the down payment varies with the lenders.

Tax Returns

Proof of tax returns is also required, usually from the past two years. The lenders ask for these documents to gauge and reassure you that you have a stable income, especially if you work as an independent contractor.

Paystubs –another way of verifying your income and providing greater context to your application. So, whereas the W2 is mostly for tax purposes and paystubs document your overall pay, they are also essential when securing a loan.

Asset statements – even though your loan may not be asset-based, proving their availability and your ownership of them may greatly improve your chances of securing a W2 mortgage. And by ‘assets,’ we refer to anything from bank or investment accounts to property, machinery, or jewelry.

Tips How To Qualify For No-Tax Return Mortgages

To qualify for a mortgage, other than providing the lender with the relevant documents, here are a couple of tips that will help you get approved. Watch your credit score – you need to keep track of your credit score since the lenders watch a decent credit history, as it assures them of your ability to pay for the mortgage, should they give you.

How To Maximize Your Credit Scores For 1099 and W2-Income-Only Mortgages

So, make sure you pay your bills on time and that any debt payments are made on time to increase your credit score. Review your last two tax returns – these documents help lenders determine your average income. Ideally, it would help if you had returned for the past two years. Also, with these returns, you can manage your expectations concerning the amount of mortgage you can afford.

How Debt-To-Income Ratio Affects Ability To Repay Mortgage

Maintain a low debt-to-income ratio – a low debt-to-income ratio is one of the many requirements from mortgage lenders for approval. So, if your DTI ratio is higher, make an effort to reduce it before applying for any of these mortgages to increase your chances for approval. Minimize your taxable deductions – even though this might seem unattainable, reducing taxable deductions is very much possible and can go a long way in improving your chances of getting approved.

Mortgage Loans For Independent Contractor Wage Earners

Many independent contractors tend to have many taxable deductions, reducing the taxable income and lowering your chances of qualifying for a mortgage. On the other hand, fewer taxable deductions increase your taxable income, which then convinces a lender of your eligibility for the mortgage.

Increase your compensating factors – when it comes to 1099 or W2 income mortgages, the lenders require much additional evidence to agree to give you a mortgage.

This is why having substantial compensating factors will increase your chances of getting approved. Factors such as having substantial savings or a large down payment will greatly boost your chances, even with a below-average application.

Getting Approved For No-Tax Return Mortgages

In conclusion, 1099 and W2 income-only mortgages offer an attractive option for self-employed people or receive income from multiple sources seeking to purchase a home. This type of mortgage helps those who may not have the traditional income source qualify for a loan and get into the home of their dreams. However, 1099 and W2-income-only mortgages also require paperwork and documentation.

All mortgage lenders must ensure the borrower can repay their new mortgage loan. Documentation and paperwork determine whether mortgage underwriters determine whether the borrower can afford to pay the mortgage loan.

It is important to weigh all the pros and cons before deciding. If you need more information on 1099 and W2-Income-Only Mortgages, contact Gustan Cho Associates, Inc. experts at 262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates team is available seven days a week, evenings, weekends, and holidays. This mortgage guide on 1099 and W2-income-only mortgages was updated on October 13th, 2023.