USDA Guidelines

In this guide on Gustan Cho Associates we will be covering USDA guidelines and the eligibility requirements for USDA loans. USDA loans are one of three government-backed mortgage loan programs. The other two government-backed mortgages are FHA and VA loans.

USDA guidelines are set by the U.S. Department of Agriculture Rural Development.

USDA loans are one of the best mortgage loan programs for homebuyers in rural areas designated by the USDA Rural Development. Private mortgage lenders who are approved mortgage lenders by the USDA originate, process, underwrite, and fund USDA loans. In the following paragraphs, we will cover USDA guidelines.

What Underwriting System Does USDA Use?

USDA loans are different than other government-backed mortgage loan programs. All mortgage lenders need to follow the minimum USDA guidelines on USDA loans. USDA has a team of mortgage underwriters that underwrite USDA loans initially underwritten by the lender’s mortgage underwriters. Per USDA guidelines, USDA loans have two processes of mortgage underwriting. One is from the lender and the second underwriting is done by the USDA. USDA loans need to meet all USDA guidelines by the U.S. Department of Agriculture Rural Development (USDA).

Ready to Buy a Home with No Down Payment?

Contact us today to see if you qualify for a USDA loan and start your homeownership journey with no down payment required.

What Are USDA Loans?

Frequently asked question from our viewers and clients is what are USDA Loans? Also, another FAQ is what are the eligibility requirements and USDA guidelines to get approved for USDA loans? A USDA home mortgage is a 0 down price loan for eligible rural homebuyers. USDA loans are issued to private mortgage lenders backed by the USDA Rural Development Guaranteed Housing Loan Program, a division of the U.S. Department of Agriculture.

USDA Rural Home Loans Explained

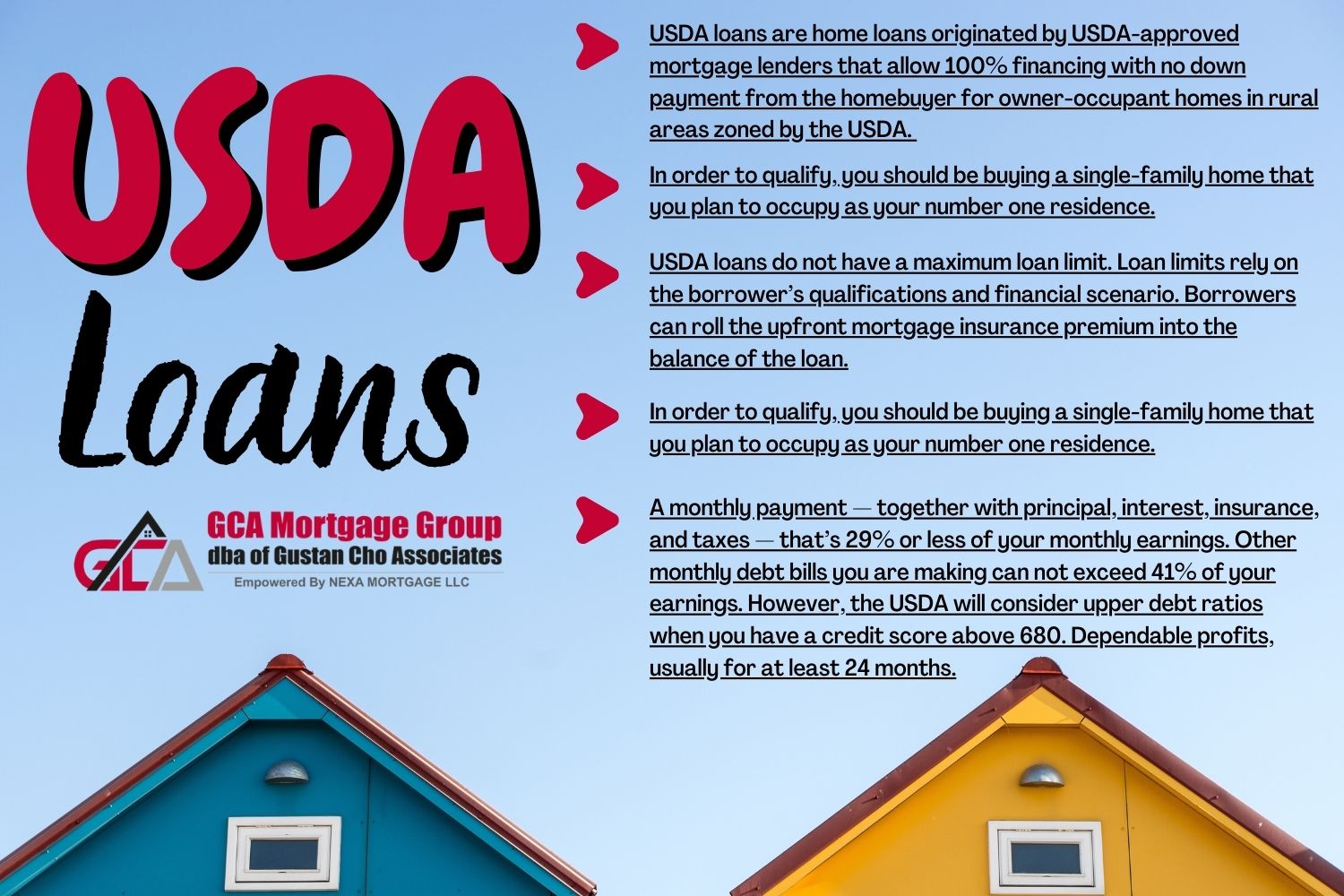

USDA loans are home loans originated by USDA-approved mortgage lenders that allow 100% financing with no down payment from the homebuyer for owner-occupant homes in rural areas zoned by the USDA. USDA loans benefit first-time homebuyers who are living within the median household income for the specific area they are purchasing a home. USDA loans would be ideal for homebuyers who love to live in rural areas versus the hustle and bustle of city life.

About USDA Guidelines Rural Development Guaranteed Housing Loan Program

In 2017, as part of the U.S. Department of Agriculture Rural Development Housing Loan Program, the USDA helped some 127,000 households purchase and improved their houses. The application is designed to “enhance the financial system and first-class of existence in rural America.” It insures USDA loans originated by private mortgage lenders at low-interest rates and no down payment requirements. Homebuyers, especially first-time homebuyers are amazed to discover just how easy and streamlined it is to qualify for a USDA home loan.

How Hard Is It To Get a Home Loan From USDA?

In this section, we will go over how difficult it is to get a home loan from USDA and how USDA loans work based on USDA guidelines. Another frequently asked question we often get is with all kinds of mortgage loans to pick from, how do you realize whether a USDA mortgage is the best mortgage loan option for me? We will also cover how the USDA mortgage process works.

What Are The Different Types of USDA Home Loans

There are three different types of USDA home loans. The USDA insures home loans originated and funded by private mortgage lenders. USDA is a government agency and works similarly to HUD and the Veterans Administration. While USDA loans stand out for being ultra-affordable, many borrowers prefer an FHA mortgage for its looser underwriting requirements.

There are no income limits when you apply for an FHA loan, and you might be able to get away with a lower credit score and higher debts than USDA or conventional lenders would allow.

HUD insures FHA loans and the VA insures VA loans originated and funded by private mortgage lenders. Due to the government guarantee, mortgage lenders are more than eager to aggressively originate government-backed mortgage loans at low or no down payment with competitive mortgage rates.

USDA Guidelines on Guaranteed USDA Loan

The guaranteed USDA loan is when USDA joint ventures with local mortgage lenders to offer USDA-guaranteed mortgage loans. The primary difference between USDA direct loans and USDA guaranteed loans is who funds the actual loan. With the USDA direct loan, the USDA acts as the lender. Conversely, with the guaranteed loan program, private lenders fund the loan while the USDA backs each loan against default.

Direct USDA Loan

USDA Direct loans are issued for qualifying low-earnings borrowers with interest charges as little as 1%. Direct USDA loan is where USDA funds home loans directly to the borrowers. Direct loans are issued by the USDA. USDA direct loans are mortgages for low- and really low-income mortgage loan applicants. Income thresholds vary by region. With subsidies, interest prices may be as little as 1%.

How Does The Direct USDA Loan Program Work?

The USDA generally issues direct loans for homes of 2,000 square feet or much less, with a marketplace value under the place mortgage limit.

Also known as the Section 502 Direct Loan Program, this program helps low- and very-low-income applicants buy decent, safe, and sanitary housing in eligible rural areas by providing payment assistance to increase their applicant’s repayment ability. Again, that’s a shifting goal relying on where you stay. Home loans may be as excessive as $500,000 or more in highly-priced real estate markets like California and Hawaii and as little as simply over $100,000 in parts of rural America.

USDA Guidelines on USDA Home Improvement Loans

USDA Home development loans are for homeowners to make upkeep or upgrades on their houses. These loans help low-income Americans repair or enhance their homes. Home development loans and grants:

These loans or outright economic awards allow house owners to restore or improve their houses. Packages can also combine a mortgage and a grant, supplying up to $27,500 in help.

Going one step further in assisting prospective homebuyers, per USDA guidelines, the USDA insures mortgages to candidates deemed to have the best need. That means a person or family that: Is without “decent, secure and sanitary housing.” Is not able to secure a home mortgage from traditional sources. Has an adjusted income at or under the low-income limit for the place where they stay

USDA Loans with No Down Payment – Is It Right for You?

Get in touch now to find out how a USDA loan can help you save on your home purchase.

Qualifying For a USDA-Sponsored Loan Guarantee

Qualifying for a USDA-sponsored loan guarantee. Financial limits to qualify for a home loan assure vary by area and rely on family size. To discover the loan assure income limit for the county where you stay, seek advice from this USDA map and table. USDA home loans are for owner-occupied primary residences.

USDA Guidelines on Debt-To-Income Ratio

A monthly payment together with principal, interest, insurance, and taxes that’s 29% or less of your monthly earnings. Other monthly debt bills you are making can not exceed 41% of your earnings. However, the USDA will consider upper debt ratios when you have a credit score above 680. Dependable profits, usually for at least 24 months.

USDA Guidelines on Credit

An applicable credit score history without an account transformed to collections in the last 12 months, among different criteria. If you could show that your credit score was affected by situations that were temporary or outside of your control, together with a clinical emergency, you could still qualify.

How Does The USDA Mortgage Loan Process Work?

“Suppliants with a credit score of 640 or better receive streamlined processing. Below that, you ought to meet more stringent underwriting standards. You can also be eligible with a non-traditional credit score history.”

Applicants with a credit score of 640 or better receive streamlined processing.

Those with ratings under that ought to meet more stringent underwriting standards. And the ones without a credit score, or a limited credit score history, can qualify with “nontraditional” credit score references, such as rental and utility price histories.

USDA Guidelines on Eligible Homes

Not every home can qualify for a USDA Loan. USDA guidelines only allow owner-occupant primary homes in a USDA-designated county eligible for USDA loans. One to four-unit homes can qualify for a USDA loan. You cannot use a USDA loan to purchase a second home or investment property. Metropolitan regions are normally excluded from USDA programs. However, pockets of opportunity can exist in the suburbs. Rural places are constantly eligible.

How Do I Apply For USDA Loans

To apply for a USDA-backed mortgage, speak to a participating lender. If you’re interested in a USDA direct loan or home development mortgage, or grant, contact your state’s USDA office.

Qualification is easier than for many other loan types since the loan doesn’t require a down payment or a high credit score. Homebuyers should make sure they are looking at homes within USDA-eligible geographic areas because the property location is the most important factor for this loan type.

A program sponsored by the USDA may appear to be focused on farmers and ranchers. However, your career has nothing to do with the qualification process. Eligibility is definitely a matter of earnings and location. And no, you don’t need to understand sorghum from a soybean.

Things Homebuyers Should Know About USDA Loans

If you are considering a USDA mortgage, borrowers need to keep the following in mind. USDA loans include up-front and annual mortgage insurance premiums. Borrowers who choose a USDA mortgage may have a one-time 1% up-front mortgage insurance premium and a 0.35% annual mortgage insurance premium. The annual mortgage insurance premium is amortized into 12 monthly bills and is part of the monthly housing payment.

USDA Guidelines on Loan Occupancy

You have to plan to stay at the property. USDA loans can’t be used on earnings-generating residences or 2nd houses. The standard debt-to-income (DTI) ratios for the USDA home loan are 29%/41% of the gross monthly income of the applicants. The maximum DTI on a USDA loan is 34%/46% of the gross monthly income.

USDA will allow these DTI ratios with compensating factors. With a USDA loan, you don’t have to use a co-borrower but it can be useful if it allows you to meet the income requirements or strengthens your creditworthiness.

Note that the co-borrower must be someone who lives with you, and they’ll need to meet the same credit, income, and debt guidelines as you. In order to qualify, you should be buying a single-family home that you plan to occupy as your number one residence.

Maximum Loan Limit on USDA Loans

There is no maximum mortgage amount on USDA loans. Unlike FHA and traditional loans, which has a maximum loan limit. Things like unverifiable income, undisclosed debt, or even just having too much household income for your area can cause a loan to be denied. Talk with a USDA loan specialist to get a clear sense of your income and debt situation and what might be possible. USDA loans do not have a maximum loan limit. Loan limits rely on the borrower’s qualifications and financial scenario. Borrowers can roll the upfront mortgage insurance premium into the balance of the loan.

Need a Home Loan with No Money Down?

Reach out today to learn how you can qualify for a USDA loan and start your path to homeownership.

Types of USDA Loans

USDA loans offer various options to help individuals and families with different financial needs and goals. Here are the primary types:

USDA Guaranteed Loan

- Purpose: Helps moderate-income individuals and families buy a home in eligible rural areas.

- Lender: Issued by approved lenders and guaranteed by the USDA.

- Income Limits: Designed for moderate-income borrowers (up to 115% of the median income for the area).

- Down Payment: No down payment is required.

- Credit Requirements: Generally requires a credit score of at least 640, but some lenders may have different requirements.

- Loan Terms: Typically, a 30-year fixed-rate mortgage.

- Mortgage Insurance: Requires an upfront guarantee fee (1% of the loan amount) and an annual fee (0.35% of the loan balance).

USDA Direct Loan (Section 502 Direct Loan)

- Purpose: Assists low- and very low-income households in obtaining homeownership.

- Lender: Issued directly by the USDA.

- Income Limits: This program is for low—and very low-income borrowers (up to 80% of the area’s median income).

- Down Payment: No down payment is required.

- Credit Requirements: There is no minimum credit rating, but applicants must be able to repay the loan.

- Loan Terms: Typically, a 33-year fixed-rate mortgage (38 years for very low-income borrowers).

- Interest Rates: May be subsidized to as low as 1% based on the borrower’s income.

- Property Eligibility: Must be modest in size, design, and cost and meet USDA property standards.

USDA Home Improvement Loans and Grants (Section 504 Home Repair Program)

- Purpose: Helps low-income homeowners repair, enhance, or modernize their homes or remove health and safety issues.

- Lender: Issued directly by the USDA.

- Income Limits: For very low-income homeowners (below 50% of the median income for the area).

- Loan Amount: Up to $20,000 for loans; grants up to $7,500 for eligible homeowners aged 62 or older.

- Loan Terms: Loans have a fixed interest rate of 1% with a repayment period of 20 years.

- Grants: Only need to be repaid if the property is sold within three years.

USDA Streamlined Refinancing

- Purpose: Allows homeowners with existing USDA loans to refinance to a lower interest amount without a new appraisal.

- Eligibility: Borrowers must have made timely mortgage payments for the past 12 months.

- Credit Requirements: Often does not require a new credit check.

- Loan Terms: Generally offers a 30-year fixed-rate mortgage.

- Closing Costs: Can be added to the new loan amount.

USDA Single Family Housing Repair Program and Grants

- Purpose: Provide funds to elderly and low-income homeowners to repair and improve their homes.

- Lender: Issued directly by the USDA.

- Income Limits: Homeowners must be very low-income (below 50% of the median income for the area).

- Loan Amount: Up to $20,000 in loans and $7,500 in grants.

- Interest Rate: Loans have a fixed interest rate of 1%.

- Eligibility: Homeowners must own and occupy the home, cannot obtain affordable credit elsewhere, and have a family income below 50% of the area median wages.

These USDA loan options address the various needs of rural and suburban homeowners, from purchasing a new home to refinancing or repairing an existing one.

Frequently Asked Questions (FAQs): USDA Guidelines

1. What is a USDA loan?

The United States Department of Agriculture offers a mortgage option to help low—to moderate-income families purchase homes in rural and suburban areas.

2. Who can avail of a USDA loan?

As per USDA guidelines, eligibility depends on income, property location, and credit requirements. Generally, it would help if you meet income limits, have a credit rating of at least 640, and the property must be located in a USDA-eligible rural area.

3. What are the income limits to be eligible?

It varies by location and household size. The limits are 115% of the area’s median household income. You can check specific limits on the USDA website.

4. Are there any deductions allowed when calculating income eligibility?

Certain deductions are allowed, such as child care and medical costs for elderly or disabled family members and annual deductions for each minor child.

5. What properties are eligible for USDA loans?

Eligible properties must be in a designated rural area and used as primary residences. The home must be modest in size and design and meet USDA standards for safety and livability.

6. Can I buy a fixer-upper with a USDA loan?

Yes, It can be used to buy a home that needs repairs, provided the cost of the repairs does not exceed the loan amount and the home is brought up to USDA standards.

7. What is the interest rate for USDA loans?

USDA loan interest rates are typically competitive and vary based on the lender and market situations. They are often lower than conventional loans.

8. Are there any fees associated with USDA loans?

USDA loans have an upfront guarantee fee, typically around 1% of the loan amount, and an annual fee, usually about 0.35% of the loan balance. This cost can be financed into the loan.

9. What credit rating is needed for a USDA loan?

Most lenders need a minimum credit rating of 640. However, those with lower scores may still qualify with compensating factors, such as a stable employment history or low debt-to-income ratio.

10. Can I qualify for a USDA loan with no credit history?

Based on USDA guidelines, you can qualify even if you don’t have a traditional credit report. In that case, the USDA allows you to establish one using non-traditional credit, such as rental payments, utility bills, and insurance payments.

Ready to Get Started?

At Gustan Cho Associates, we specialize in USDA loans with no lender overlays. That means we approve loans that many other lenders deny. Low credit scores, High DTI, Manual underwriting available. If you have questions about USDA guidelines, call us today at 800-900-8569 or email us at gcho@gustancho.com to get pre-approved with no stress, no nonsense, and no lender overlays.

Want to Buy a Home in a Rural Area?

Contact us today to check if your desired property is eligible and get pre-approved!