Mortgage Interest Rates Forecast On Home Loans

This ARTICLE On 2020 Mortgage Interest Rates Forecast On Home Loans Was PUBLISHED On March 20, 2020.

The stock market has been extremely volatile in the past three weeks due to uncertainty and fear from the coronavirus.

- The financial market is a great predictor of the economic impact of the near future

- The markets will take into account upcoming news and expectations

- However, one thing the financial markets do not like is the unknown, the uncertainty, fear, and panic

- As a right-hand rule, mortgage rates drop if the stock market drops and the 10-year U.S. Treasury yields go lower

- This is what has been happening

- The Dow Jones dropped over 3,500 last week which was a drop of 13%

- The stock markets were all over the map this week

- On Monday, the Dow surged 1,293 points

- On Tuesday, the Dow plummeted close to 800 points

- On Wednesday, the Dow Jones skyrocketed over 1,100 on political news Joe Biden is the frontrunner for the Democrats

- This morning, the Dow Jones opened 800 plus points lower

- With all the chaos in the equity markets, mortgage rates are nearing all-time lows

- This is great news for both homebuyers and homeowners to refinance their home loans

- The 2020 housing market forecast remains strong

- This holds true with the uncertainty from the coronavirus scare

- The 2020 mortgage interest rates forecast cannot be better with the chaos in the markets

In this article, we will discuss and cover the 2020 Mortgage Interest Rates Forecast On Home Loans.

2020 Mortgage Interest Rates Forecast During The Coronavirus Fear

Mortgage rates hit a 50 year low this morning.

- The 2020 mortgage interest rates forecast was strong

- However, due to many economic factors, the 2020 mortgage interest rates forecast has never been stronger

- This will not only benefit homeowners refinancing but homebuyers as well

- There was a 26% rise in new mortgage applications last week

- Many lenders are hitting new records in taking new mortgage applications due to low mortgage rates

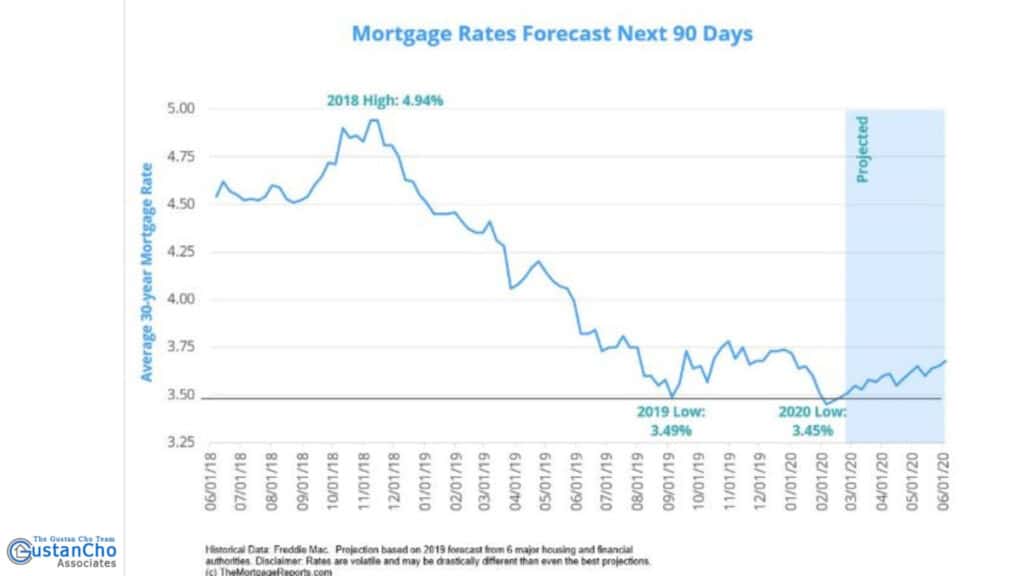

- Prior to the market selloff, mortgage rates hit a 4 year low in February

- As uncertainty over the coronavirus continues, mortgage rates are expected to plummet lower

- According to data from Freddie Mac, the average loan amount is $300,000

- A $300,000 home loan balance now costs $250 less per month than it did in 2018

- Many of our viewers at Gustan Cho Associates are asking if they should wait to refinance

- Unfortunately, nobody has a crystal ball on what the bottom is when it comes to mortgage rates

- However, there are more upside risks on mortgage rates than the downside

There is a possibility of mortgage rates sliding below 3.0%. However, rates can easily go over 4.0% again depending on the financial markets and other factors.

2020 Mortgage Interest Rates Forecast For The Spring Market

Even though the 2020 mortgage interest rates forecast is expected to hit historic lows.

- However, mortgage rates do fluctuate

- They do not just fluctuate daily, but hourly

- Just like the stock markets, mortgage rates are expected to be extremely volatile

- Breaking news in the market can trigger volatility in rates

- Locking your rates early is key to securing low rates

- This holds especially true for homeowners refinancing

- Rates are expected to greatly swing between 3.125% to 4.0% during the short-term when the coronavirus fear is effective

Below is a chart of the 2020 HUD Chapter 13 Guidelines On FHA Loans:

The Coronavirus Triggered Plummeting Mortgage Rates

The stock market selloff and market correction of last week were triggered last week due to the fear of the coronavirus.

- The Dow lost 3,500 points which are 13% of the value

- The first death in the U.S. was reported over the weekend in Washington State

- The state of Washington and California declared a state of emergency due to the growing cases of the coronavirus

- The financial markets have been a mess this week

- The Dow surging and plummeting every other day

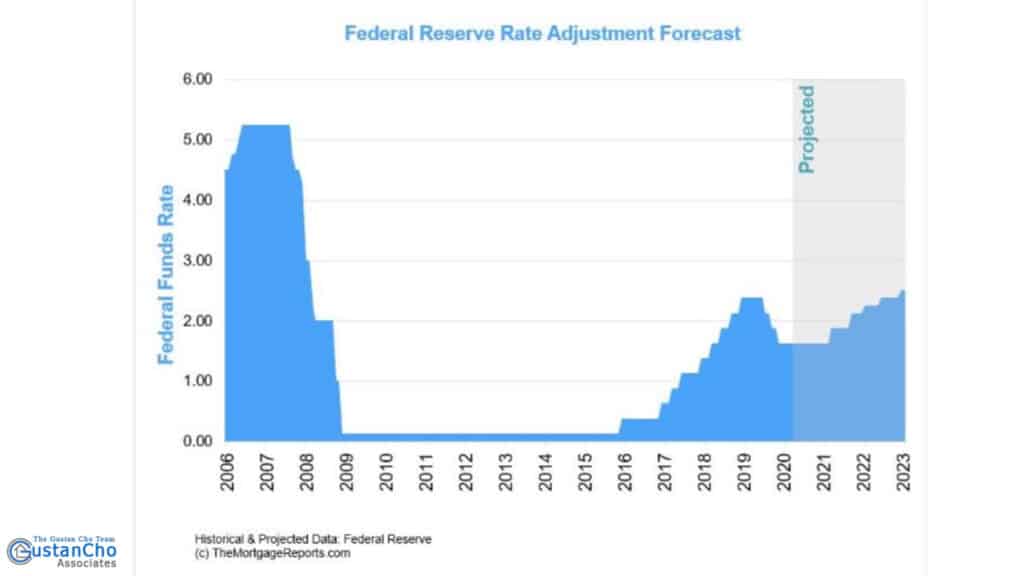

- This has caused the Feds to drop interest rates by 50 basis points in an emergency move

- Panic in Wall Street sent stocks lower after the news of the 50 basis point rate drop

- The markets took the announcement as a negative and desperate panic measure by the Federal Reserve Board

- Both the financial equities markets and mortgage rates will be volatile depending on the developments in the fight against the coronavirus

- There is no cure and/or vaccine of the coronavirus, which is also called COVID-19

- The virus was initially discovered in China in December 2019 and was spreading in many countries outside of China

The market was aware of the virus since December. The discovery of the virus affected a volatile financial market worldwide. As mentioned earlier, mortgage rates drop when there are times of uncertainty and fear.

Avoiding Major Market Selloff And Economic Uncertainty

The markets had major up and downswings due to the developments of the coronavirus.

- To add to the volatility, the Democrats Super Tuesday elections were held with many candidates dropping out

- The Trump Administration is trying to be transparent and avoid panic to Americans

- Wall Street cannot figure out which direction to go

- One day, the Dow is up 1,000 points while it drops 1,000 points the next day

- Mortgage rates will follow this trend

- Until there is a vaccine for the coronavirus, both stocks and mortgage rates will be very volatile

- The market selloff has been somewhat limited due to the proactive measures the Trump Administration is taking

- The Feds cut interest rates by 50 basis points in an emergency interest rate cut to stimulate the economy or avoid the further panic of a recession

- The government is putting restraints on travel to and from Wuhan China which is a major trade and export center in China

- The halt of travel to and from Wuhan, which is one of China’s largest cities will most likely trigger a worldwide economic slowdown

- U.S. businesses are getting affected due to product shortages from China and other affect countries

According to Mike Gracz of Gustan Cho Associates who has been following the effects of the coronavirus to mortgage rates, he issued the following statement:

Additionally, economic growth could slow on a global scale as factory production slows, people travel less, and overall activity lessens. In mid-February, Apple, one of the world’s largest companies, announced it would miss revenue projections for the quarter. It blamed factory closings in China and a slower return to normal conditions than expected. Additionally, demand in China slowed, as people were hesitant to enter stores. The case of Apple is just one indicator of how a larger outbreak could slow the pace of the global economy. Of course, no one wants a global health situation, but one unexpected outcome could be lower rates through March and perhaps beyond.

2020 Mortgage Interest Rates Forecast Versus The Central Bank Cuts

The emergency interest rate cut by the Central Bank on Tuesday surprised everyone.

- The stock market soared 1,293 points on Monday in anticipation of a 50 basis point rate cut by the Feds

- However, the markets did not react too well with the interest rate cuts so soon

- It took it like the Feds were desperate and panicky

- The Dow dropped almost 800 points the day the Feds cut interest rates by 50 basis points

- All other equity markets followed the Dow’s drop

According to Mike Gracz of Gustan Cho Associates:

In February, markets suggested a 90% chance that the Fed would hold rates to current levels. As the month drew to a close, the chance of a rate cut grew to 100%, according to CME Group’s FedWatch tool. Additionally, there’s a 50/50 chance that the Fed will cut its rate by 0.50%, not just 0.25%. The reason? The rise of the coronavirus and the disease’s potential to damage the economy. The March 17-18 Federal Reserve meeting could be an interesting one indeed. The Fed broadcasted again and again that it wished to maintain the level of its benchmark rate, called the fed funds rate. But that was before COVID-19. After slicing the rate three times in 2019 — in the face of one of the greatest expansions in U.S. history — the Federal Reserve wasn’t enthusiastic to provide more stimulus to an already-hot economy.

2020 Mortgage Interest Rates Forecast On More Rate Cuts By The Federal Reserve Board

Unemployment is near 50-year lows, the stock market was at all-time highs before its historic slide the week of February 24.

- Mortgage rates hit a 50-year low today at 3.125% for prime borrowers

- However, rates are going to be higher for lower credit score borrowers with loan level pricing adjustments

- A prime borrower is a borrower with at least a 740 FICO and 20% down payment and/or 80% LTV

- The Federal Reserve Board emergency 50 basis point interest rate cut is good news

- Mortgage rates follow interest rates by the Feds

- The Fed is open to more rate cuts

- Fed Chairman Jerome Powell said the Fed will have a wait and see approach going forward

- The COVID-19 is definitely the main influencer on how the Fed will react for future interest cuts in 2020. The stock market can drop a lot more. However, there are so much mortgage rates can drop

- With mortgage rates at a 50-year low, there is not much room for a substantial downsize with what rates are today

Look at the chart below:

2020 Mortgage Interest Rates Forecast On Rate Volatility

Mortgage rates hit a 50-year low this morning. 30-year mortgage rates for prime borrowers hit rock bottom this morning at 3.125%.

- However, experts warn that the upside is much greater than the downside

- There are so much mortgage rates can drop

- However, a sudden uptick can trigger mortgage rates north of 4.0% any day

- With stocks, it is different

- The Dow Jones Industrial Average can drop another 10,000 points or more with bad news

- However, 2020 mortgage interest rates forecast expect mortgage rates to trade under 4.0% for the remaining of 2020

Mortgage borrowers should expect volatility in mortgage rates until a vaccine for the coronavirus hits the market.

Factors Affecting 2020 Mortgage Interest Rates Forecast

Besides the fear of the coronavirus, there are other factors that affect the stock market and mortgage rates.

- One of the major factors prior to the coronavirus led stock market selloff was the China and overseas trade war

- The trade war is expected to continue, thus triggering additional stock market volatility

- As mentioned earlier, there is so much downside on mortgage rates due to the pricing of mortgage-backed securities also commonly referred to as MBS

- Individual mortgage loans are packaged up as mortgage-backed securities and are traded in the secondary markets

Massimo Ressa of Gustan Cho Associates explains how MBS works:

Mortgage-Backed Securities are financial instruments, bought and sold by investors worldwide. As rates fall in other economies (Japan and Germany are now issuing negative-rate bonds), U.S. mortgages are looking awfully attractive. Even a 3% return on investment is better than 0% or even negative. Imagine if you had to pay to keep your money in a savings account. That’s exactly what investors in many economies are doing. U.S. mortgage bonds will continue to deliver positive returns, so investors will pile in. This demand drives down consumer mortgage rates.

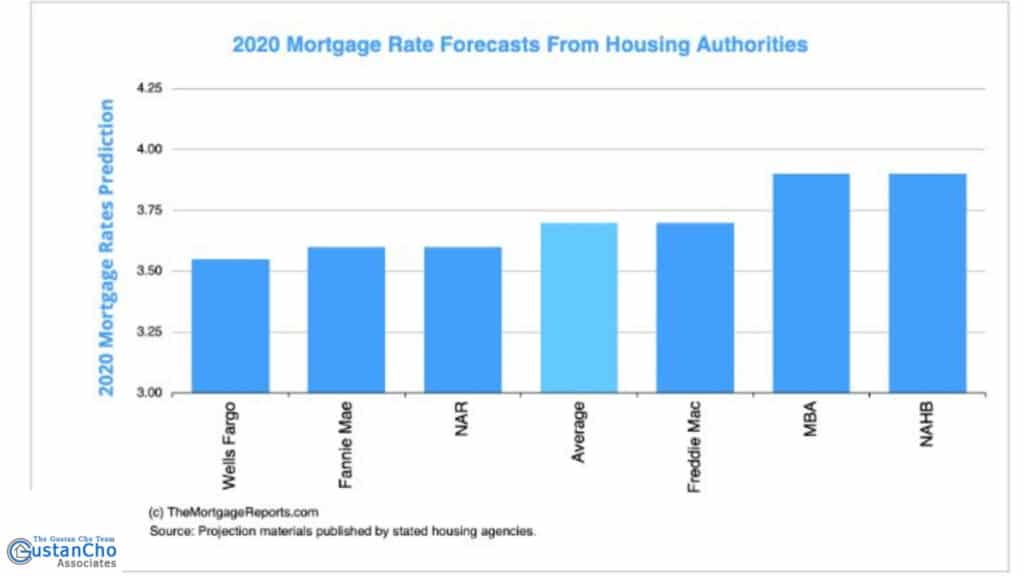

2020 Mortgage Interest Rates Forecast From National Mortgage Agencies And Institutions

Both government and private mortgage agencies are all in agreeance that the 2020 mortgage interest rates forecast will yield near-record-low mortgage rates.

See chart below about the forecasts on 30-year home mortgages by the following agencies:

| Agency | 30-Yr Rate Prediction |

| National Association of Realtors | 3.60% |

| National Association of Home Builders | 3.90% |

| Mortgage Bankers Association | 3.90% |

| Freddie Mac | 3.70% |

| Fannie Mae | 3.60% |

| Wells Fargo | 3.55% |

| Average of all agencies | 3.70% |

All in all, the results seem promising and diversified.

2020 Housing Demand Versus Home Inventory

Mortgage companies nationwide are busy taking mortgage applications. Mortgage applications were up 26% last week. Homeowners are flocking to their loan officers to refinance their home mortgages at today’s historic low rates. However, there is more demand for homes than housing inventory. Many homebuyers with pre-approval letters are getting frustrated due to little inventory of housing. Homebuilders are scaping up any buildable land to meet demand. Due to strong housing demand and low housing inventory, home prices are skyrocketing. Home prices have been skyrocketing for the past four years. Home prices are expected to continue to rise in 2020. Many homebuyers are now more aggressively looking for a home due to historic low mortgage rates.