How To Get a Mortgage For Property Flipping

This blog will discuss how to get a mortgage for property flipping. Property flipping is when you buy a house for a certain price and turn around and sell it for a higher price. There are various types of property flipping. Many real estate investors are buying fixer-uppers and doing a fix-and-flip. There are strict mortgage guidelines on property fix-and-flips.

HUD, the parent of FHA, does not allow homebuyers planning on buying a fix-and-flip home if the property is flipped within 90 days.

If the property is being flipped after 90 days, homebuyer buyers can purchase a property flip but need to have two home appraisals. HUD requires waiting period for homebuyers buying a fix-and-flip because they want to protect homebuyers who may be buying inflated homes that is being flipped without merit. In the following paragraphs, we will cover property flipping.

Can Property Flips Be Lucrative For Investors?

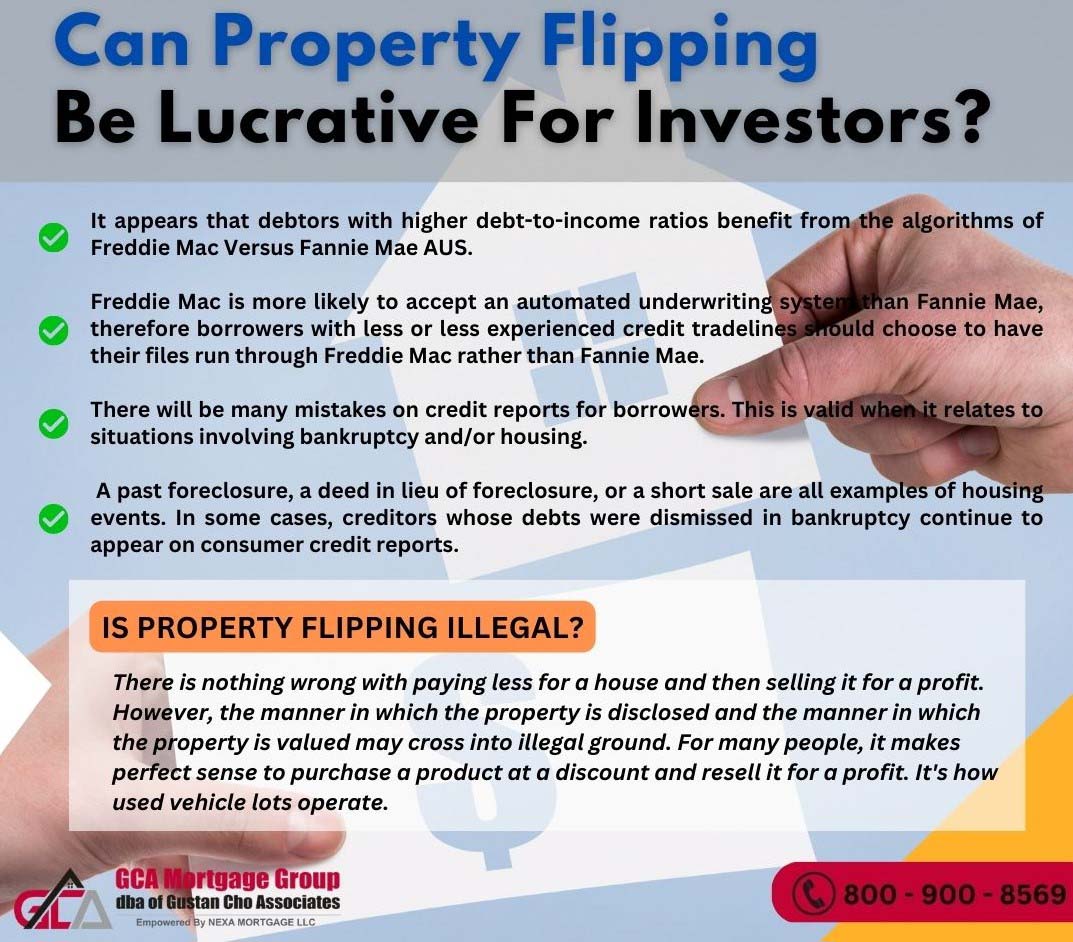

Property flips can be very lucrative for real estate investors. You are buying a property that is undervalued or from homeowners facing foreclosure or needing help selling a property. The investor will buy the house below market value and flip it at a profit. The extent of renovation they will do before flipping the property is up to the investor. They can flip it as is or do extensive renovations.

There are real estate investors buying a fixer-upper and flip the property to another investor without doing any work to the property.

Some real estate investors will do a property flip without doing any work to the property and flip it for a profit right away. Other investors will flip property by what you call a fix and flip. Fix and flip is when you buy a property that needs work and is not habitable and does renovation to the home where you make it habitable. Once the construction is done, you then sell it at a profit.

Is Property Flipping Illegal?

One of the frequently asked questions we often get asked at Gustan Cho Associates is whether property flipping is illegal. Why is property flipping illegal? Why property fix and flips can be illegal is determined by how the subject property is sold. Nothing is wrong with buying a property under market price and selling it for a profit. However, the way the property is disclosed and the way the property is priced can get into illegal territory.

Property Flipping can be very profitable for developers and benefit homebuyers. Real estate developers can make a decent profit during low inventory of homes. Homebuyers can get a gut rehabbed home for under market value.

So, why are the real estate regulators and mortgage fraud enforcement agents making such a big deal about property flipping being illegal? To many, common sense dictates that buying a product low and selling at a profit seems like a no-brainer. It is how used car dealerships work. They buy used cars low and flip to retail customers at a profit. So, what is the difference between properties? Read on…….

Becoming a Real Estate Investor of Property Fix and Flip

So, is it illegal to buy a fixer-upper at a low price, clean the property up a little, and then sell it at market price? When it comes to buying a house at a bargain under market value and turning around and selling it at a profit, it is called property flipping but not illegal property flipping.

Legal property flipping is done all the time. As long the investor did not artificially inflate the subject property, it is perfectly fine. Buying low and selling high is capitalism.

Getting a Fix and Flip Mortgage Loan For Real Estate Investors

Investors who do property flipping for a living can get short-term financing called the fix and flip mortgage loans. Fix and flip mortgage loans are non-QM loans for real estate investors. Fix and flip mortgages allow real estate investors to purchase fixer-upper properties, renovation funding, and short-term end funding until the property gets sold, which is the process of property flipping.

The way to fix and fix mortgage loans for property flipping works is the lender will require a down payment of 10% to 20% down payment on the after repaired value or the percentage of the after-improved value of the project.

Buying a Home That Is a Property Flip From a Real Estate Investor

Homebuyers cannot buy a property flip home within 90 days of the real estate investor flipping the property with an FHA loan. If the property flip has been seasoned for 3 to 6 months and the real estate investor is selling the home for more than 20% profit, you will need a second home appraisal. The borrower cannot pay for the second appraisal. Either the seller or the lender needs to buy the second appraisal.