FHA 203k Loan Eligibility Requirements and Guidelines

In this blog, we will cover and discuss the FHA 203k loan eligibility requirements and guidelines. The United States Department of Housing and Urban Development, also known as HUD, is the parent of the Federal Housing Administration, also referred to as FHA. FHA Loans are the most popular mortgage loan program in the United States.

What Is The Benefit of Getting an FHA Loan?

Dale Elenteny, a senior loan officer at Gustan Cho Associatesc. is an expert FHA 203k mortgage loan officer.

FHA Loans are ideal for veteran home Buyers, first-time home buyers, and home buyers with bad credit. FHA’s role is to promote homeownership for hard-working Americans with little down payment and less-than-perfect credit. HUD has an acquisition and construction loan program through FHA known as the FHA 203k Loan Program. Click here to apply for a FHA loan

What Is The FHA 203k Renovation Mortgage Loan?

FHA 203k Renovation Loans enables home buyers who want to purchase a home that is in need of rehab. A home buyer can purchase a foreclosure or REO ( REAL ESTATE OWNED ) property that needs work. HUD 203K Loans enables home buyers of fixer-uppers to have the first mortgage as well as the construction loan all in one mortgage closing.

What Is The Down Payment on FHA 203k Loans?

Minimum of 3.5% down payment on the after-improved value of the property. HUD launched the FHA 203k Loan program to promote home ownership in areas where homes need rehabilitation and to promote the revitalization of neighborhoods. Per FHA 203k Loan Eligibility Requirements, this loan program is for one to four-unit owner-occupant residential properties.

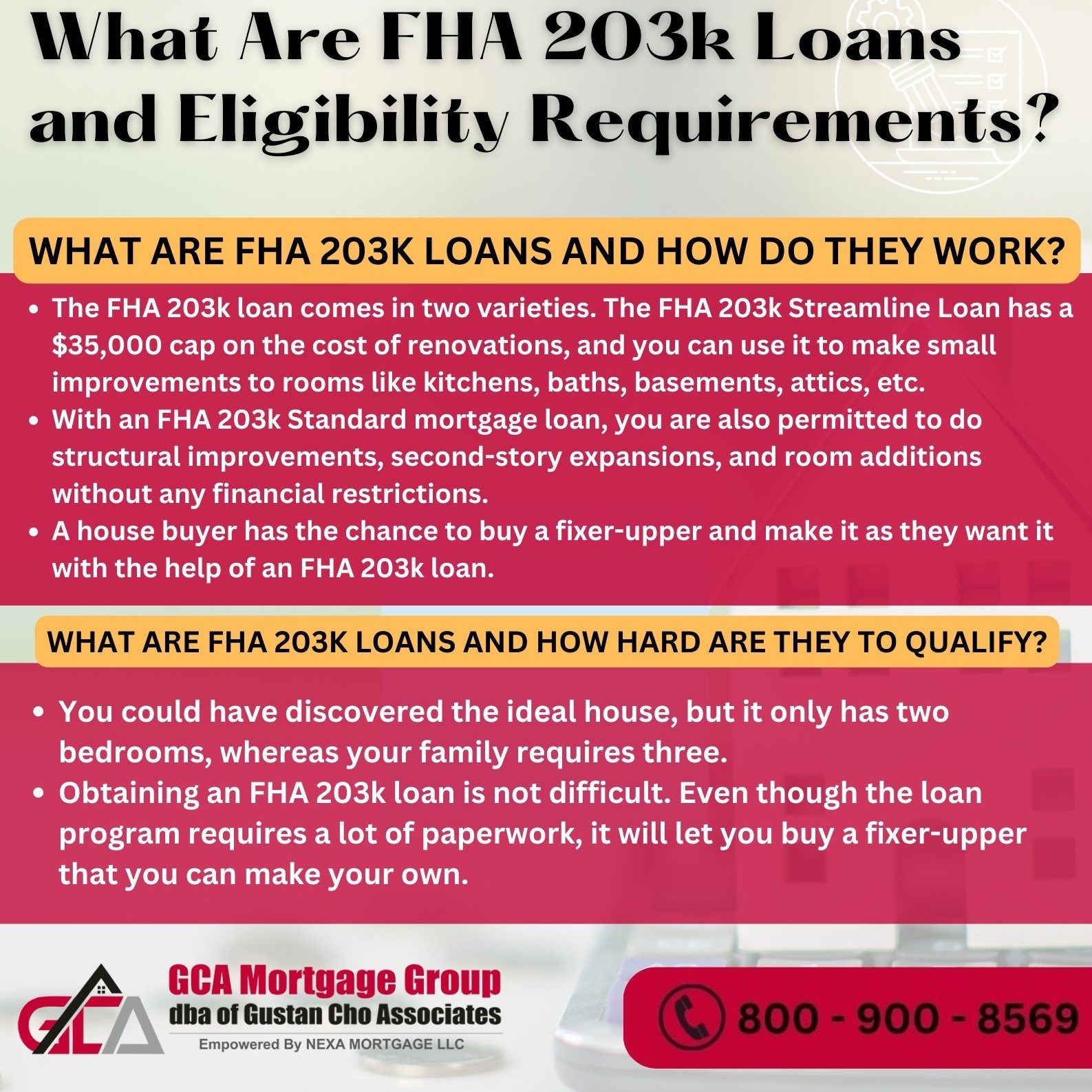

Types of FHA 203k Loans

There are two types of FHA 203k Loan programs. FHA 203k Loan Eligibility Requirements are the same for both types of renovation loan programs.

FHA Loan Eligibility Requirements on Streamline Renovation Loans

The first type of HUD’s 203k Loan program is the FHA 203k Loan Streamline where the maximum construction loan amount limit is $35,000. The FHA 203k Loan Streamline program is restricted to minor repairs. Homeowners cannot do any repairs that require structural changes to the existing home or any room additions. Home buyers who are qualified for FHA 203k Streamline loans can do minor repairs such as the following:

-

- remodeling kitchens

- bathrooms

- flooring

- replacing windows

- replacing doors

- basement remodeling

- attic remodeling

- new appliances

- siding

- roofing

- gut rehab but on the existing foundation

- HVAC

- other repairs that do not change the structure of the house

The second type of FHA 203k loan is the full standard FHA 203k Loan program. There is no maximum construction loan amount. As long as the home buyer gets an as is an as complete appraisal, the maximum loan amount will be based on the after repaired value of the subject property. With the standard FHA 203k loan program, homeowners can do all the renovations allowed with Streamline FHA 203k Loans plus the following:

-

-

- major structural changes

- room additions

- second story additions

- full-blown gut rehab

-

What Are FHA 203k Loan Eligibility Requirements

Most lenders will have lender overlays on FHA 203k Renovation Loans. Mortgage Lender Overlays are additional mortgage guidelines on top of the minimum FHA Guidelines. However, Gustan Cho Associates has no mortgage overlays on FHA 203k Loans. FHA 203k Loan Eligibility Requirements are no different than any traditional FHA Loans. Get Connect with our experts for your FHA 203K loans

FHA 203k Loan Eligibility Requirements on Standard Renovation Loans

Standard FHA guidelines apply for someone to qualify for an FHA 203k Loan. The minimum credit score required is 580 for a 3.5% of the after repaired value appraisal value down payment. For example, here is a typical case scenario. If you are purchasing a home for $100,000 and need a $100,000 construction loan, the after-repair value is $200,000.

FHA 203k Loan Eligibility Requirements on Credit Scores

The homebuyers of this fixer-upper home need 3.5% of the $200,000 required as the down payment, or $7,000. Most home buyers do not have to worry about closing costs because HUD allows up to 6% seller concessions to cover closing costs. The minimum credit score required to qualify for an FHA 203k Loan is 580. For any home buyer who has credit scores under 580, a 10% down payment is required.

Can You Have Non-Occupant Co-Borrowers on FHA 2o3k Loans?

Non-Occupant Co-Borrowers are allowed to be added to the main borrowers on FHA 203k Loans. FHA 203k Loan’s greatest benefit is it gives creative home buyers the opportunity to purchase fixer-uppers and customize them the way they want. Creative home buyers can really benefit from buying a fixer-upper and doing a complete gut rehab renovation project with FHA 203k Renovation Loans.

FHA 203k Loan Eligibility Requirements For Purchase and Refinance

FHA 203k Loans are available for both purchase and refinance transactions. Homeowners who need a renovation loan and have a current mortgage can refinance their home loan with an FHA 203k Rehab Loan. The new 203k lender will pay off the existing mortgage and start a new FHA 203k Loan. Once the renovations are completed, the loan converts to an end 30-year fixed rate FHA Loan. Click here to get eligible for purchase and refinance

Frequently Asked Questions (FAQs)

- What are the eligibility requirements for an FHA 203k loan?

Occupancy: The property must serve as your principal place of residence

Type of Property: Eligible properties include single-family homes, 2-4 unit properties, HUD-approved condominiums, and properties that have been torn down, provided the original foundation remains.

Credit Score: Usually, a credit score of at least 500 is required, but it is recommended to have a credit score of 580 or higher to qualify for better loan conditions.

Down Payment: A down payment as low as 3.5% is possible for credit scores of 580 or higher. Credit scores between 500 and 579, a down payment of 10% is necessary. - What are the guidelines for the renovation process?

Types of Renovations: Repairs must be significant and add value to the property. Eligible renovations include structural alterations, modernizations, health and safety hazard elimination, enhanced accessibility for disabled persons, and energy conservation improvements.

Consultation Requirement: You must work with a HUD Consultant if the renovation costs exceed $35,000 or if structural changes are planned.

Contractor Selection: Contractors must be licensed and insured. All work must begin within 30 days of closing and be completed within six months. - What are the loan limits?

FHA 203k loans have the same county-specific loan limits as standard FHA loans, which vary depending on the area and the cost of living. - Are there any other fees or costs?

In addition to the usual closing costs that come with FHA loans, 203k loans require a supplemental origination fee, and the HUD Consultant may charge fees. Borrowers should also set aside a contingency reserve amounting to 10% to 20% of the total renovation costs to handle unforeseen expenses during the renovation. - Can I do the work myself?

DIY work may be permitted for minor renovations if the borrower can demonstrate expertise and the lender approves. However, funds for labor will be released after some time, and the work must meet all local building codes and ordinances. - What happens if the renovation costs exceed the estimates?

The contingency reserve may be utilized to address minor excess costs. The borrower must finance these costs out-of-pocket if significant additional funding is required.

For more information about FHA 203K loan eligibility requirements, you can contact GCA Mortgage Group by calling us at 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!