Using Freddie Mac Versus Fannie Mae AUS For Home Loans

In this blog, we will cover using Freddie Mac versus Fannie Mae AUS for home loans. Using Freddie Mac instead of Fannie Mae AUS is one of the options most loan officers do not use. There are two different types of automated underwriting systems (AUS). Fannie Mae Desktop Underwriter (DU) and Freddie Mac Loan Prospector (LP).

The majority of lenders and mortgage brokers use Fannie Mae’s Desktop Underwriter (DU) as their preferred automated underwriting system of choice. The main reason for this is that most lenders prefer Fannie Mae and are not set up as Freddie Mac lenders. In this article, we will cover and discuss the differences between DU and LP automated underwriting systems.

Getting Automated Underwriting System Approval

It is often more difficult to get an approve/eligible Freddie Mac versus Fannie Mae AUS. There are countless cases where borrowers can often get an automated underwriting system approval (AUS APPROVAL) using Freddie Mac instead of Fannie Mae.

Many borrowers and realtor partners at Gustan Cho Associates do not realize that we are a direct lender with no overlays on both Fannie Mae and Freddie Mac AUS FINDINGS.

Getting Freddie Mac Versus Fannie Mae AUS Approval

In this blog, we will discuss the differences between Freddie Mac Versus Fannie Mae AUS in getting an automated underwriting system approval.

There are instances where borrowers may not get an automated system approval on Fannie Mae but will with Freddie Mac. Loan officers who get puzzled in not getting an AUS Automated Approval on Fannie Mae should run it through Freddie Mac and see if they can get an approve/eligible per AUS.

What Is Easier To Get Approval Freddie Mac Versus Freddie Mac AUS FINDINGS

HUD, the parent of FHA, recently toughen up its credit standards to get an automated underwriting system approval with Fannie Mae for borrowers under 640 FICO. It is becoming tougher to get approve/eligible per AUS for borrowers under 640 FICO with outstanding collections, charge-off accounts, late payments, and higher debt-to-income ratio. It has come to our attention that many files can get an AUS Approval with Freddie Mac versus Fannie Mae AUS Findings.

This holds especially true if the borrower has under 640 credit scores, lower income, higher DTI, little to no seasoned credit tradelines, and less-than-perfect credit. The main reason we are getting lucky with Freddie Mac versus Fannie Mae is the fact Freddie Mac reads credit reports differently. There are times when using Freddie Mac versus Fannie Mae AUS will view AUS favorably when Fannie Mae does not.

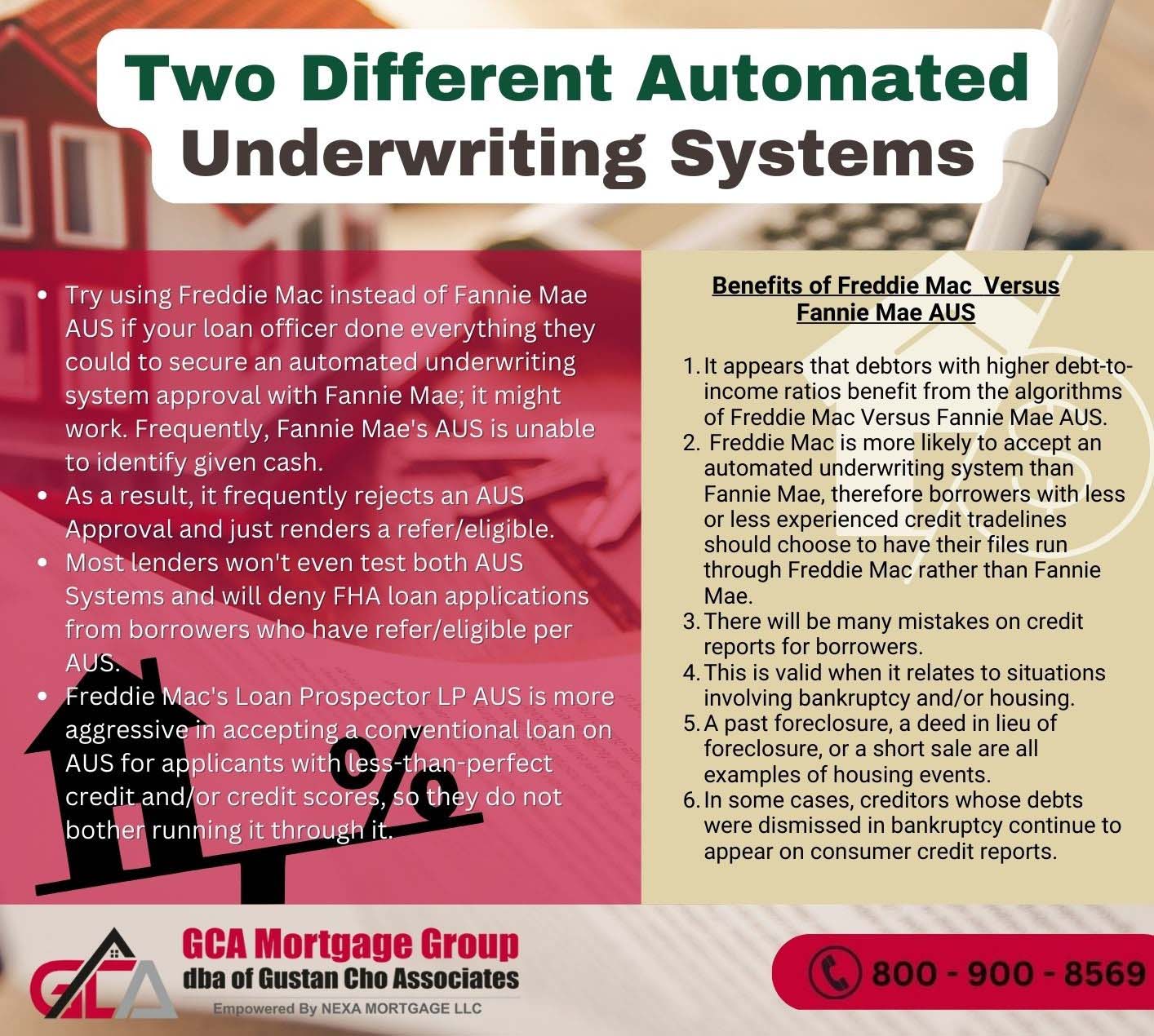

Two Different Automated Underwriting Systems

If your loan officer did everything possible to get an automated underwriting system approval with Fannie Mae, try using Freddie Mac versus Fannie Mae AUS. Using Freddie Mac versus Fannie Mae AUS may do the trick. Gifted funds for the down payment are not viewed favorably by lenders.

Fannie Mae’s AUS often cannot determine gifted funds on AUS. Due to this, it can often turn down an AUS Approval and just render a refer/eligible. Most lenders will not bother trying both AUS Systems and turn down borrowers with a refer/eligible per AUS on FHA loans. They do not bother running it through Freddie Mac’s Loan Prospector LP AUS. Freddie Mac’s AUS is more aggressive in approving a conventional loan on AUS for borrowers with less than perfect credit and/or credit scores.

Benefits of Freddie Mac Versus Fannie Mae AUS

It seems that the algorithms of Freddie Mac Versus Fannie Mae AUS are beneficial for borrowers with higher debt-to-income ratios. Borrowers with limited less seasoned credit tradelines should opt towards getting their file run and Freddie Mac Versus Fannie Mae AUS.

Freddie is more apt to render an automated underwriting system approval versus Fannie Mae. Many borrowers will have errors on their credit reports. This holds true when it is related to bankruptcies and/or housing events. A housing event is a prior foreclosure, deed in lieu of foreclosure, or short sale. There are instances where creditors who had the debts discharged in a bankruptcy that is still reporting on consumer credit reports.

Which AUS Is More Lenient

Fannie Mae will often flag this and will deny the automated approval. Freddie Mac is lenient in overlooking these errors and rendering an approve/eligible per AUS. Both Fannie Mae and Freddie Mac have similar lending guidelines on conventional loans. However, when it comes to getting an automated underwriting system approval, Freddie Mac seems much more aggressive in rendering automated approvals.

If your loan officer gets you a refer/eligible per AUS findings, make sure he or she runs the file through using Freddie Mac versus Fannie Mae AUS as well. If they are less cooperative with you, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays. Over 35% of our files go through using Freddie Mac versus Fannie Mae AUS. Freddie Mac’s Loan Prospector (LP) AUS.

This article on using Freddie Mac versus Fannie Mae AUS was updated on November 21st, 2022.