Freddie Mac HomeOne Mortgage Guidelines With Low Down Payment

This Article Is About Freddie Mac HomeOne Mortgage Guidelines With Low Down Payment

Freddie Mac HomeOne Mortgage Guidelines allow home buyers to qualify for conventional loans.

- Freddie Mac HomeOne Mortgage Guidelines allows first time home buyers to qualify for home purchase with a 3% down payment

- Freddie Mac created Freddie Mac HomeOne Mortgage Guidelines to promote homeownership to first time home buyers

- Freddie Mac HomeOne Mortgage Guidelines low down payment of 3% is lower requirements than FHA’s 3.5% down payment

- HomeOne Mortgages are similar to Freddie Mac Home Possible

The benefit per Freddie Mac HomeOne Mortgage Guidelines is that income limits do not apply. In this article, we will cover and discuss Freddie Mac Homeone Mortgage Guidelines With Low Down Payment.

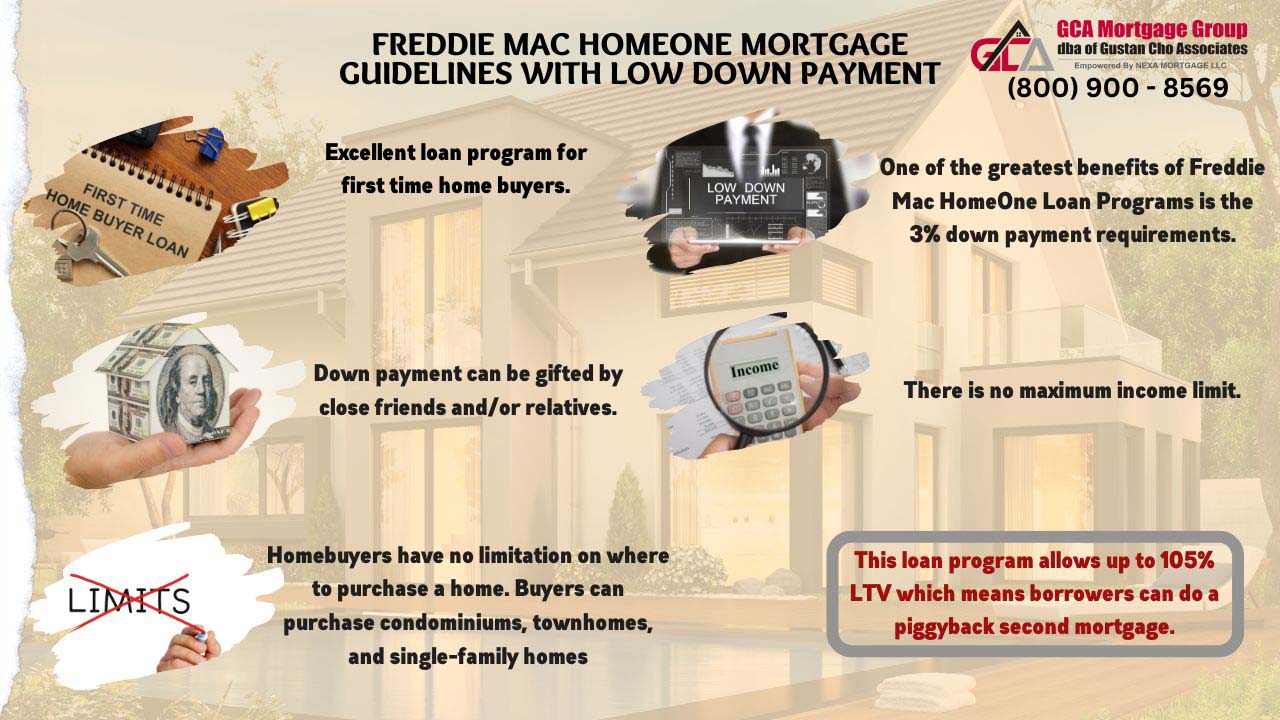

What Are The Benefits Of Freddie Mac HomeOne Mortgage Loans

One of the greatest benefits of Freddie Mac HomeOne Loan Programs is the 3% down payment requirements. Buyers can qualify for this loan program with a 3% down payment on their home purchase. Excellent loan program for first time home buyers. This loan program allows up to 105% LTV which means borrowers can do a piggyback second mortgage. Regular conventional loan programs limit the CLTV to 97%. There is no maximum income limit. Homebuyers have no limitation on where to purchase a home. Buyers can purchase condominiums, townhomes, and single-family homes. Down payment can be gifted by close friends and/or relatives.

Freddie Mac HomeOne Mortgage Underwriting Process

The first step to qualify for Freddie Mac HomeOne Mortgages is to get qualified and pre-approved by a loan officer:

- Need to be first time home buyers purchasing a new home

- First time home buyers are defined by Freddie Mac as follows:

- The borrower had not had ownership in a property in past three years

- Needs to be owner occupant properties only

- Only one borrower if multiple borrowers on the loan that needs to meet the first time home buyer guidelines

- Only single-unit homes qualify

- Multi-Family homes do not apply and/or qualify for HomeOne Mortgages

- Fixed-rate mortgages only qualify

- Get an automated underwriting system approval and meet the guidelines of Loan Product Advisor

- Gifted funds for the down payment and closing costs is allowed

Borrowers need to enroll in CreditSmart and/or other equivalent online housing counseling programs for first-time homebuyers.

Other Comparable Conforming Loan Programs Similar To HomeOne

Home Possible Advantage And Home Possible are similar conforming loan programs like HomeOne. All require a 3% down payment on home purchases. Home Possible Advantage and Home Possible are conventional loan programs for lower and/or moderate-income borrowers.

Here are the highlights of these loan programs:

- Maximum LTV is 97%

- For single-family properties

- Townhomes, condominiums, and single-family homes

- 2 to 4 unit multi-family properties do not qualify for a 3% down payment but will qualify for a 5% down payment

- Income limits and property eligibility does apply

More On HomeReady Loans

HomeReady Loans was created and launched by Fannie Mae to help lower to moderate-income families qualify for home purchases with a low down payment. Loan To Value is capped at 97% for one-unit properties. 2-4 unit multi-family units require the borrower to occupy one of the units. Only first-time homebuyers qualify. Fannie Mae and Freddie Mac define first-time homebuyers as a buyer who has not had ownership of a home in the past three years. There are income limits since the loan program is geared towards lower to moderate-income buyers. The HomeReady income eligibility tool can be used for borrowers to determine income qualification.

Borrowers needing to qualify for a home loan with a mortgage company licensed in multiple states with no lender overlays on government and conforming loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and on holidays. Gustan Cho Associates has a national reputation of not just having no lender overlays on government and conventional loans, but for being a one-stop mortgage company. This is because Gustan Cho Associates has dozens of lending partnerships with non-QM wholesale and alternative financing mortgage lenders. If there is a non-QM mortgage loan program in today’s market, you can rest assured GLC Mortgage Group has it available.