Buying a House in Alaska With Bad Credit and Low FICO Scores

This article will cover buying a house in Alaska with bad credit and low FICO credit scores. Are you looking to buy property in one of the most stunning landscapes with open wilderness in the United States and don’t mind the cold weather? If so, you should check out Alaska! Here is the thing, not many people know much about Alaska other than the fact that it is cold and snowy, which is true, by the way!

Many people’s dreams is to relocate to Alaska. Buying a house in Alaska with bad credit is doable. You do not need perfect credit and a 20% down payment to buy a home in Alaska. The team at Gustan Cho Associates has helped countless homebuyers with credit scores down to 500 FICO, borrowers with outstanding collections, homebuyers just out of bankruptcy and foreclosure, and borrowers with bad credit qualify for a mortgage loan to buy a home of their dreams.

But if you were to dig a bit deeper, you would realize that it has one of the most vibrant property markets in the U.S. Now, the other problem could be that you know more about Alaska and would actually like to reside there, but you are not sure you can get a mortgage with your bad credit history. This article ‘hits two birds with one stone.’ We will tell more about what you can do when you have a bad credit history, and we will also delve a bit deeper into the state’s property market. So, stick around to find out more.

What Homebuyers Need To Know About The Population in Alaska?

Homebuyers buying a house with bad credit in Alaska should know about the state’s population. In terms of population, it is the third-least populous state. The large state with such small population makes it the most sparsely populated state in the United States.

The costs of goods in Alaska is high because of the state being sparsely populated. Home values are higher than most states because it costs substantially more to transport building materials.

Compared to all the other regions located north of the 60th parallel, Alaska is the most populous region. The majority of the population in the state lives within the Anchorage metropolitan area.

What Is The Capital of Alaska?

The state’s capital is Juneau and is the second-largest city by area in the U.S, with Sitka, which was the state’s former capital, as the largest city by area. Now, while Alaska has the smallest state economies, its per capita income is, in fact, among the highest in the U.S.

Juneau is the second largest city as well as the capital of Alaska. Many people think Anchorage is the state capital. Americans driving through Alaska from mainland U.S.A. via ferry or boat will need to to provide passport to Canadian authorities.

The major drivers of the state’s economies are fishing, oil, and natural gas, all of which are abundant. Also, tourism and the U.S military bases also contribute significantly to the economy. Most of the land is federally owned, including national parks, forests and wildlife refuges.

Important Things Homebuyers Should Know About Alaska

If you are planning on relocating to Alaska from another state and buying a house, you should be familiar with some facts about the state. In this section, we will cover some basic general facts about Alaska that homebuyers should find it interesting. Here are some more facts about this great state:

- Population of the state of Alaska: According to the 2020 census, the state of Alaska had 736,081 people, which was an increase from the last 2010 census.

- Population growth of Alaska: The population growth rate is 3.6%; considering all the data from the past few censuses

- Median Income of Alaskan wage earners: The median household income in the state is $77,800, while the individual income averages $34,900

- Tax rate in the state: The local sales tax rate is 7.5% and the average combined state and local sales tax rate of 1.76%.

- The property tax rate average at about 1.18%

- Education System in Alaska: There are 53 school districts in Alaska, and the state has ten colleges.

- Also, over 65% of the residents in Alaska have attained college degrees to master degree level.

- Economy in Alaska: The gross state product stands at $50 billion, with the oil and gas industry contributing over 80% of the state’s revenues.

- It also has an unemployment rate of 4.8%, much lower than the national rate.

- Weather The state experiences an arctic climate with super long and cold winters and short summers.

- Sometimes the sun doesn’t appear at all during the winter, while it appears throughout the summer.

- Median home prices The median home price in Alaska is about $301,000, an increase from the past year.

- Cost of living The average cost of living in Alaska is $48,700 per year, which is pretty high compared to other states in the U.S

Data on renters vs. owners home ownership is 35% less expensive than renting in the state. Also, the burden of housing costs has been falling over the last three years, making it better and more cost effective to buy a home than rent.

Can You Get a Mortgage With Bad Credit in Alaska?

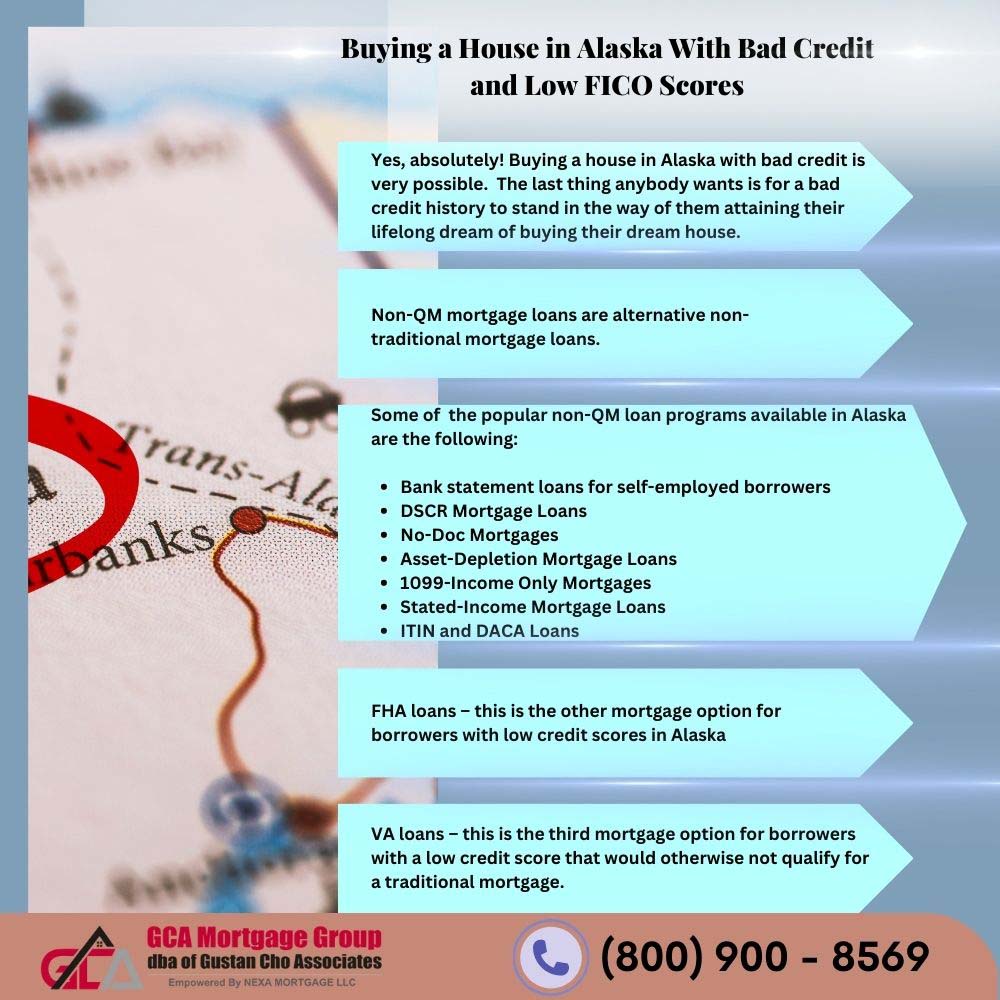

Can you get a mortgage buying a house in Alaska with bad credit? Yes, absolutely! Buying a house in Alaska with bad credit is very possible. The last thing anybody wants is for a bad credit history to stand in the way of them attaining their lifelong dream of buying their dream house. This holds true especially for first-time homebuyers. So, here is the thing, there are a number of mortgage options available for aspiring homeowners buying a house in Alaska with bad credit.

The team at Gustan Cho Associates can help homebuyers buying a house in Alaska with bad credit with credit scores down to 500 FICO. Gustan Cho Associates, powered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states including DC, and Puerto Rico. Gustan Cho Associates has lending partnerships with over 210 wholesale mortgage lenders. We are experts in helping borrowers buying a house in Alaska with bad credit.

Gustan Cho Associates are experts in helping homebuyers buying a house in Alaska with bad credit. Homebuyers do not need perfect credit when buying a house in Alaska with bad credit. There are many mortgage options that don’t require a not-so-perfect credit score. In the following sections, we will go over the many mortgage options buying a house in Alaska with bad credit.

Buying a House in Alaska With Non-QM Loans

Homebuyers in Alaska who cannot qualify for traditional conforming mortgage loans may be eligible to qualify for non-QM loans. Non-QM mortgage loans are alternative non-traditional mortgage loans. Non-QM loans are not hard money loans. Non-QM loans are mortgage loans that are offered by portfolio lenders and do not meet conforming mortgage guidelines. There are over 100 non-QM mortgage loan programs. Some of the popular non-QM loan programs available in Alaska are the following:

- Bank statement loans for self-employed borrowers

- DSCR Mortgage Loans

- No-Doc Mortgages

- Asset-Depletion Mortgage Loans

- 1099-Income Only Mortgages

- Stated-Income Mortgage Loans

- ITIN and DACA Loans

Gustan Cho Associates, powered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states including Washington, DC, and Puerto Rico. We have lending relationships with over 210 wholesale lending partners. A large percentage of our wholesale lending partners are non-QM wholesale mortgage lenders. You will not find any other lender in the nation with such a wide variety of non-QM mortgage loan options like you will at Gustan Cho Associates.

How to Qualify For Non-QM loans To Buy a Home in Alaska

This is one of the mortgage options that borrowers with a credit score that’s as low as 500 FICO would qualify for. These mortgage options do not conform to the current Fannie Mae and Freddie Mac limits and are available even to self-employed individuals who don’t have a consistent monthly income.

The requirements for these non-QM mortgages are very relaxed and flexible, which is why you will be able to qualify even with bad credit history. There are several options under this category, including Jumbo loans, bank statement loans, 1099 loans, asset financing loans, etc. And all these options are offered in Alaska. Jumbo loan limits in all 29 counties surpass the conforming loan limit of $970,800.

Buying a House in Alaska With FHA Loans

FHA loans – this is the other mortgage option for borrowers with low credit scores in Alaska, as a credit score of as low as 500 FICO is acceptable. FHA loan limit in all the counties in Alaska ranges from $420,680 to $511,750. These loans happen to be the most popular in the state, given that over 40% of mortgages in the nation are these FHA mortgages.

Getting Pre-Qualified With VA Loans Buying a House in Alaska With Bad Credit

VA loans – this is the third mortgage option for borrowers with a low credit score that would otherwise not qualify for a traditional mortgage. As a matter of fact, this option doesn’t have a minimum credit score or DTI ratio limits, and also doesn’t have a maximum loan limit. This option is quite popular among the veterans’ community in Alaska since they are designed only for military service members and veterans as well.

The property market in Alaska.

The Housing Market in Alaska

The property market in Alaska had ragged behind other U.S states, especially after the great recession a decade ago, and the situation worsened during the pandemic. This resulted from economic setbacks, largely due to state-wide job losses, especially in the oil sector. This literary sank Alaska into recession when the rest of the U.S was prospering.

As a result, more people were migrating to the U.S mainland for better lives, which in turn, led to a rapid decline in the property market. However, despite all these obstacles, the state seems to be bouncing back. The economy is starting to improve, income growth has resumed, and all these means that the housing market is starting to improve as well. In fact, the market is slowly surpassing other U.S states to be one of the best states to buy property in.

Home Values in Alaska For Homebuyers

To put everything into perspective, let’s look at property prices. Now, the median property value in Alaska is about $301,673. About a decade ago, before everything started going haywire, the home value stood at $235,000. This represents a 28.3% jump. Compare this to the home value in the U.S, which stands at $298,933 and has grown approximately 82.3% over the last ten years.

The Homebuying Process in Alaska

The home-buying process in Alaska is the same as the continental United States with the exception of the time zone. To most people, buying a home is the biggest investment decision they have, or could ever make. And to be honest, the whole process could be a little intimidating, particularly to first-time buyers. It’s even worse if the investment is in one of the most challenging environments in the United States, Alaska. You don’t have to worry though as we have broken the process down for you. Even though there may be small variations here and there, the process is similar across the board.

First Step To Buying a House in Alaska With Bad Credit

Step 1 – organize your finances – if you are planning to buy property in Alaska, whether you are in Alaska or U.S mainland, the very first step would be to organize your finances. And by this, we mean that you have to decide how you are going to finance the investment. While there are those who decide to pay cash, the majority choose to apply for a mortgage. If you are planning to do the latter, you need to get every document that you will need ready.

Getting Pre-Approved Buying a House In Alaska With Bad Credit

Step 2 – get pre-approved for a mortgage – get a reliable and reputable mortgage broker in Alaska to guide you through the application process. This is important at this stage because you will know how much you qualify for so that when you begin the search, you will know which houses to look at, based on your budget.

If you have a bad credit history, you will be looking for mortgage brokers or lenders who offer the type of mortgages we already looked at earlier in the article. You need to get pre-approved first before you begin your search.

Getting a Real Estate Agent After Being Pre-Approved

Step 3 – get a real estate agent – and while it is possible to buy a home alone, a real estate agent, especially a local one, who is familiar with the real estate market in Alaska, would be essential. He or she would help a lot, especially when it comes to looking through property listings, arranging for the property viewing, handling the paperwork and negotiations, and most importantly, ensuring that the process runs smoothly from start to finish. There are many estate agents in Alaska who would help you, so do your research well and find the right one.

Finding The Home of Your Dreams in Alaska

Step 4 – find a home – this is the most critical step as it is where you officially begin the search for your dream home. Now, there is a lot that goes into this. Most importantly, you will need to figure out the location you want to invest in before you even begin the search. Having said that, here are the top places you should really consider in Alaska.

Is Juneau, Alaska a Good Place To Buy a House?

Juneau – this is home to the best and most highly rated schools, which makes it the perfect place to raise a family. According to Zillow, the median home value is $355,100, with the median rent at $1262. The town has a population of 32,100, with a median household income of about $88,100.

Juneau is the capital of Alaska. Many people and families migrate to Juneau, Alaska due to the strong economy, higher wages, and the beautiful landscape. The cost of living in Juneau is substantially higher than the national average. Recent data show a 21.5% higher than the national average cost of living in Juneau but lower than the national Alaska cost of living averages.

The majority of the jobs in the town include government and tourism jobs, and given that this is home to the Tongass National Park, which is the largest national forest in the country, you can see why tourism is such a big deal here. So, even though the homes may not be as affordable as in other towns, the competitive median income and nature do make it up for it.

Buying a House in Anchorage, Alaska

Anchorage – this is where you will find over 40% of Alaska’s population, which is over 292,100 people. The median home value is about $320,100, and the median rent is $1,310. The main jobs in the city include military, tourism, and air cargo shipping. The median household income is $84,800, which is pretty good.

Anchorage is a great place to buy a house for first-time homebuyers and those who are migrating to Alaska from a different state. The housing market in Anchorage is great for homebuyers. Anchorage is a buyers market. That means there are more houses for sale than there are homebuyers. What this means is home prices are not skyrocketing like the rest of the nation.

In this city, some of the top neighborhoods you should look at include South Addition, Rogers Park, Airport Heights, Turnagain, and North Star, among others. Also, being home to Chugach National Park as well as Kenai Fjords National Park, residents are always motivated to live an active lifestyle. We also have to mention that the ever-popular Iditarod Trail Sled Dog Race happens in this city, so you have a lot to enjoy here.

Is Kodiak Alaska a Good Place To Buy a House?

Kodiak – this town experiences the harshest winter, and since it isn’t connected to the mainland, you can access it through ferries to Chenega Bay and Port Lions. It has a population of about 6,000 people, a median home value of $260,800, and a median rent of $1,200. The main jobs in the area include commercial fishing, tourism, and military from the navy and coast guard facilities in the town. Hunting of elk, Kodiak bear, and black-tail deer is very popular in this town.

Kodiak, Alaska is one of the best regions in Alaska to buy a house and raise a family. The economy is great, and the high paying jobs are plentiful. Great place for raising a family. Great schools, beautiful landscape, plenty of outdoor activities for families such as hiking, and fishing. Great place to meet new people and make lifelong friends.

So, even though the weather isn’t that favorable, everything else, from the attractive median household income to a stable and thriving economy, should definitely make you choose this town. The property market is doing well, as many people are still moving to this area.

Other places you should look at include Ketchikan, Sitka, Fairbanks, and Wasilla, all of which have a pretty decent median household income, diverse populations, and jobs and the school system is top-notch.

Making an Offer Buying a House in Alaska With Bad Credit

Make an offer on a House– after going through the listings in most of these areas, when you find your dream house, the next step would be to make an offer. The offer should include things like the price, closing date, and contingencies based on the inspections and appraisals among others. Your estate agent will help you come up with a compelling, fair, realistic offer, even to the seller.

Make sure you are fully qualified and pre-approved before making an offer on a home. It is not how much house you can qualify but rather how much house you can afford. Remember mortgage underwriters do not take debts that do not report into account when they are qualifying your debt-to-income ratio.

Remember, you must stick to your budget. When it comes to inspections, you need to get a professional to do it. If you come across any serious issues, be sure to consider them while negotiating. And given that the weather in Alaska can be harsh, you should pay special attention to the home’s heating systems. They must be working perfectly.

Closing on Your House in Alaska

Step 6 – closing the deal – this is the final step where the ownership of the property is transferred to you. Your estate agent and the attorney will guide you through this process. Alaska is gradually becoming a place where many people are considering moving.

Remember that not all mortgage lenders are the same. Each lender can have their own higher lending requirements called lender overlays. Just because one lenders denies you a mortgage loan does not mean a different lender cannot approve you. Over 80% of the homebuyers who come to Gustan Cho Associates are borrowers who got denied at other lenders. Many homes in Alaska sit on acreage. Make sure the lender you commit to does not have a lot of overlays that can affect your mortgage loan approval.

Frequently Asked Questions (FAQs)

- Can I buy house in Alaska with bad credit and a low FICO score? Yes, buying a house in Alaska with bad credit and a low FICO score is possible, but it can be more challenging. Your options may be limited, and you may face higher interest rates.

- What is considered a bad credit score? Typically, a FICO score under 580 is regarded as a poor credit score. However, credit score requirements can vary among lenders.Is it possible to get a mortgage with a credit score below 580? Certain lenders might extend mortgage offers to individuals with credit scores under 580. Still, they often come with higher interest rates and stricter requirements.

- How can I enhance my credit score before buying a house? To increase your credit score, make sure to pay bills on time, decrease outstanding debts, contest any inaccuracies on your credit report, and refrain from opening new lines of credit.

- Are there government programs that help buyers with bad credit in Alaska? Yes, FHA and USDA loan programs have more forgiving credit score prerequisites, rendering them attainable for buyers with diminished credit scores.

- Should I consider a co-signer with better credit? Including a co-signer with a strong credit history can enhance your likelihood of securing approval and secure better terms. Still, it also means they share responsibility for the mortgage.

- What down payment is required for buyers with bad credit? Buyers with bad credit may need a larger down payment, typically around 10% or more, to compensate for their credit history.

- Can I work with a credit counselor to improve my credit for a mortgage? Enlisting the services of credit counseling can assist you in formulating a strategy to enhance both your credit standing and financial stability, increasing your chances of mortgage approval.

- Are there lenders specializing in bad credit mortgages in Alaska? Certain lenders specialize in mortgages designed for individuals with poor credit, and they may demonstrate greater willingness to collaborate with borrowers possessing lower credit scores.

- How do I find a real estate agent experienced with buyers with bad credit? Look for real estate agents with experience working with buyers facing credit challenges. They can guide you through the process and help you find suitable homes.

- What other factors besides credit score are considered when applying for a mortgage? Lenders considers factor such as income, employment history, debt-to-income ratio, and the magnitude of your down payment when assessing mortgage applications.

- Can I refinance to a better mortgage rate after improving my credit? Once you’ve improved your credit, you can explore mortgage refinancing options to secure a better interest rate and terms.

If you are in the market buying a house in Alaska with bad credit, Gustan Cho Associates has a national reputation for being able to do mortgage loans other lenders cannot do. The team at Gustan Cho Associates has a reputation for being a one-stop mortgage lending shop. Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington, DC, and Puerto Rico. We have a network of over 210 wholesale lending partners. Gustan Cho Associates has hundreds of traditional and non-traditional mortgage loan programs.

You can contact us by calling (800) 900-8569 or text us for a faster response. You can also email us at alext@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!