Fixing Your Credit To Qualify For Home Loan Pre-Approval

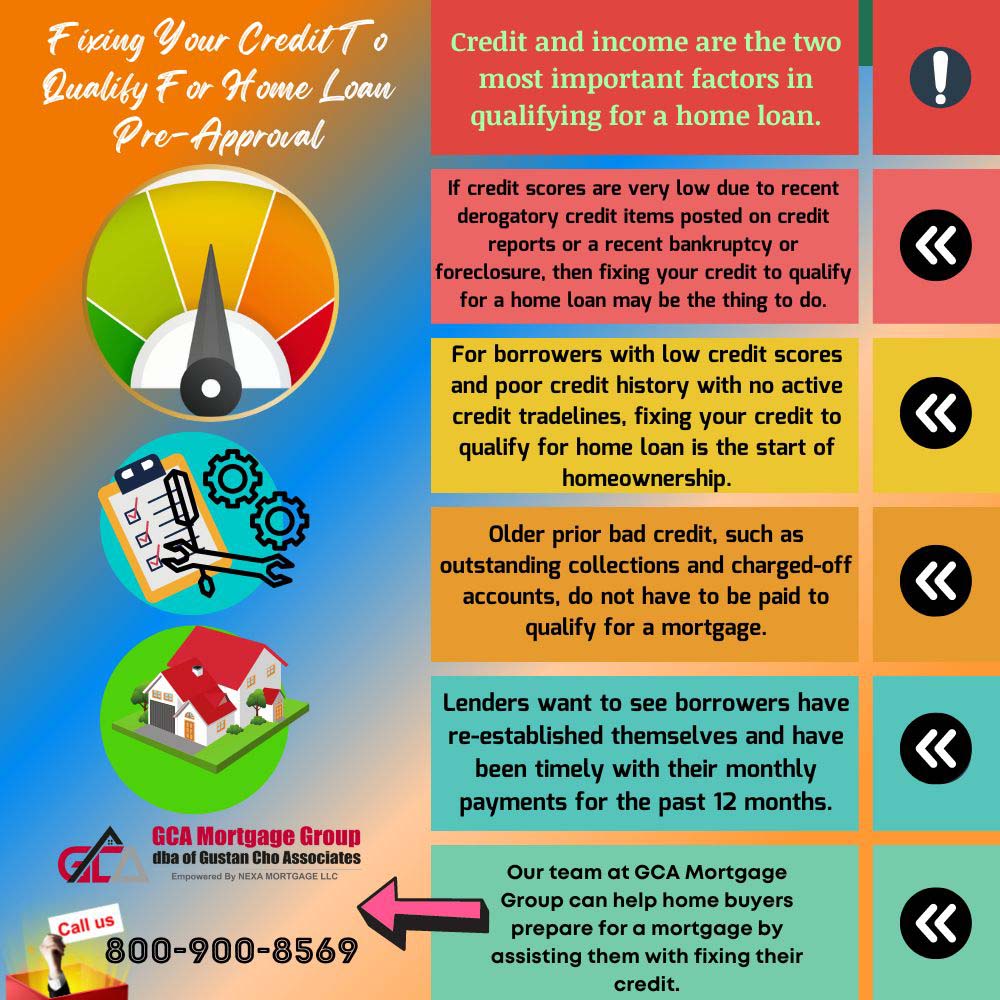

In this article, we will cover fixing your credit to qualify for home loan to get pre-approved. Credit and income are the two most important factors in qualifying for a home loan. Homebuyers can have the best credit and credit scores, but with no documented income, they will not qualify for a mortgage loan.

Borrowers with documented income but less than perfect credit will qualify for a home loan. Potential home buyers need to know that having bad credit does not mean they cannot qualify for a mortgage. Borrowers can qualify for a mortgage with prior bad credit. However, mortgage borrowers must have re-established their credit and have been timely with their payments for the past 12 months.

Older prior bad credit, such as outstanding collections and charged-off accounts, do not have to be paid to qualify for a mortgage. Lenders want to see borrowers have re-established themselves and have been timely with their monthly payments for the past 12 months. In the following paragraphs, we will discuss fixing your credit to qualify for home loan and get pre-approved for a mortgage loan.

Bad Credit Versus Recent Late Payments

Lenders understand that consumers go through periods of bad credit due to extenuating circumstances such as unemployment, loss of business, medical issues, and divorce. Periods of bad credit are very common.

Most folks who go through periods of bad credit rebound. They re-establish their credit, and the bad credit on their credit reports is a blemish that will eventually not affect them as time passes. Now the question is how bad the credit is.

If credit scores are very low due to recent derogatory credit items posted on credit reports or a recent bankruptcy or foreclosure, then fixing your credit to qualify for a home loan may be the thing to do. For borrowers with low credit scores and poor credit history with no active credit tradelines, fixing your credit to qualify for home loan is the start of homeownership.

What Do Underwriters Look at Borrower’s Credit Report

Mortgage underwriters will review borrowers’ credit scores and credit reports. Homebuyers need a specific credit score to qualify for a home loan.

For example, for a 3.5% down payment FHA home purchase loan, buyers need a minimum of a 580 credit score. However, to get an approve/eligible per automated underwriting system (AUS), you need timely payments on all your monthly debt payments in the past 12 months.

Most often, Fannie Mae’s Automated Underwriting System will request verification of rent for borrowers with credit scores of 620 and under. If you cannot verify rent and have credit scores of 620 FICO or under, you may need to try to boost your credit scores to at least 620.

Case Scenario

Let’s go over this case scenario if a buyer wants to purchase. A condominium and the condo complex are not FHA-approved. Need to qualify for a conventional loan.

If borrowers’ credit scores are under 620 and they want that condominium, they may need to try to improve their credit scores to 620 or higher to qualify for a conventional loan. Borrowers need a 620 credit score or higher to qualify for a conventional loan.

First-time homebuyers or renters thinking of purchasing a home soon but with less-than-perfect credit scores may want to start fixing their credit to qualify and get pre-approved.

How Mortgage Lenders Review Credit Reports

Just because borrowers meet the minimum credit score requirements to qualify for a particular mortgage loan program does not automatically guarantee them a loan approval. Besides looking at credit scores, underwriters will also review the credit report. Mortgage underwriters will review the payment history, especially the past 12 to 24 months. Most lenders want to see timely payment history in the past 12 months.

Lenders will not approve borrowers with multiple recent late payments in the past 12 months. Borrowers with late payments in the past 12 months may need to wait until they have shown timely payment history. Consumers who just got a recent 30-day late payment and have a record of paying that creditor on time contact the creditor.

Try to see if they can get a one-time reprieve and retract the 30 days late for one-time goodwill for a loyal customer. One thirty days late payment can plummet one’s credit score by more than 50 points. If the customer service representative says no, ask politely to speak to a supervisor. Most creditors will give a one-time reprieve to loyal customers with a reputation for paying their bills on time. This holds especially true for customers who have been with the creditor for many years.

Quick Fixes In Fixing Your Credit To Qualify For Home Loan

There are a few quick fixes in fixing your credit to qualify for home loan. For consumers with maxed-out credit card balances, paying those balances down to a 10% balance-to-credit limit ratio will greatly improve credit scores.

Getting three to five secured credit cards will greatly boost credit scores for consumers with no credit tradelines and no active credit accounts. Never pay off an old dormant collection account. Paying off older dormant collection accounts will re-activate the late payment and derogatory on the credit reports and can drop credit scores.

You can add yourself to a family member’s credit card as an authorized user. However, if the main user of the credit card is late on his or her credit card monthly payments or has maxed out credit cards, this will hurt credit scores.

Best FHA Lenders For Bad Credit With No Overlays

Homebuyers who are planning on purchasing a home in the new future and have lower credit scores or bad credit should think of fixing your credit to qualify for home loan.

Rebuilding and re-establishing your credit to qualify for a home loan does take time. It cannot get done overnight. Plan ahead. It is never too late to start a credit repair regimen. You do not need to hire a credit repair company. Whatever a credit repair consultant can do, you can do it yourself. Or your loan officer will help you without charging you a cent.

Our team at Gustan Cho Associates can help home buyers prepare for a mortgage by assisting them with fixing their credit. Don’t hesitate to contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Homebuyers can also email us at gcho@gustancho.com.