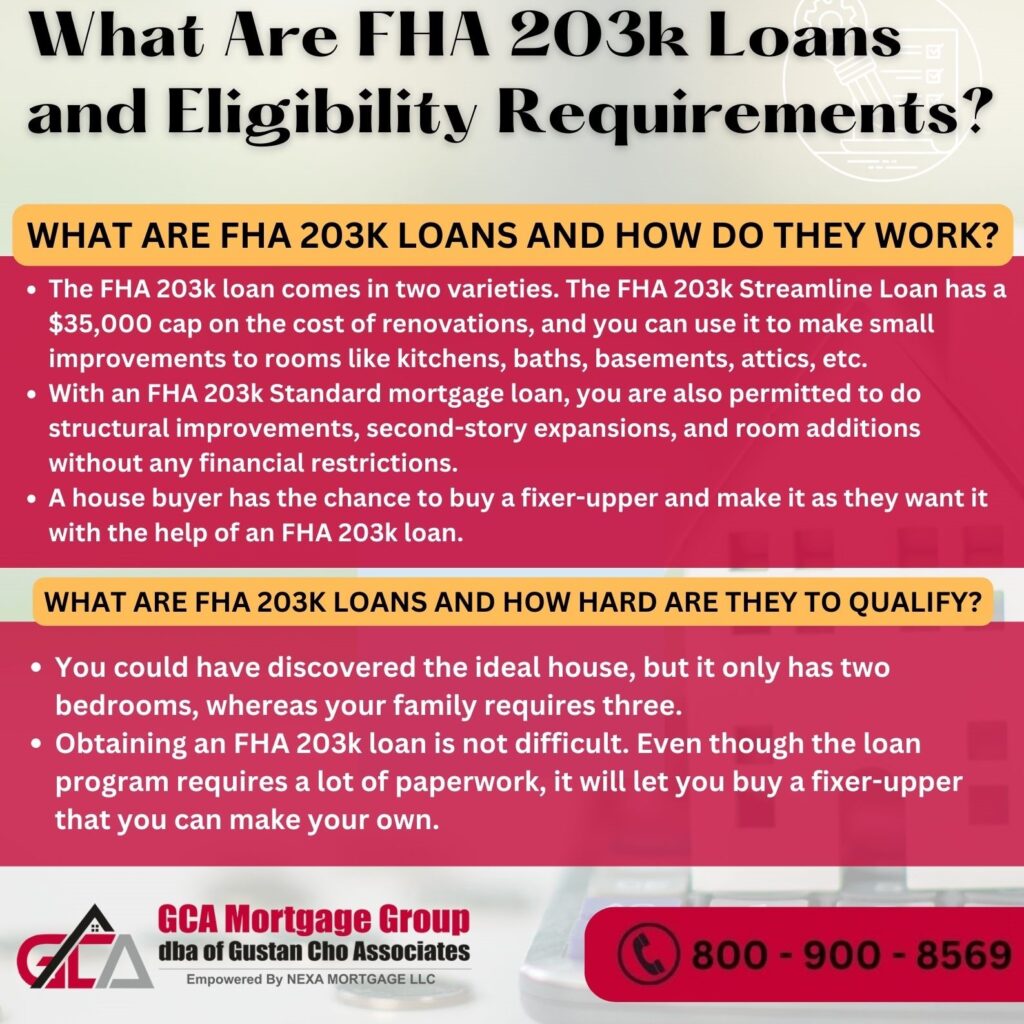

Buying A House With A FHA 203k Loan Explained

In this guide to buying a house with a FHA 203k loan, we will go over what the FHA 203k loan is and how it works. Many home buyers think that there is a lot of red tape involved in Buying A House With A FHA 203k Loan. This is not the case and an FHA 203k Rehab Loan is an excellent mortgage loan product for home buyers of fixer-uppers to use and have the home of their dreams where they can remodel it like they see fit and some can even have the next thing to a brand new home.

What Can You Do With FHA 203k Loans?

Home buyers can do a complete gut and rehab project with an FHA 203k Rehab Loan. You are allowed to do almost anything with an FHA 203k Loan. You can do a room addition, or second-story addition, remodel your unfinished basement, and remodel your unfinished attic. You can do new bathrooms, kitchens, new appliances, new HVAC systems, new millwork, new windows, new siding, new roofing, new flooring, and a complete gut and rehab construction project.

Talk to Us to Learn More About Buying A House With A FHA 203k

How Does The 203k Mortgage Process Work?

An FHA 203k Loan is the closest to a new construction home you can have with a 3.5% down payment on the after-improved value. FHA 203k Loan programs are becoming more and more popular throughout the United States and more and more home buyers are buying a house with an FHA 203k Loan.

Types Of FHA 203k Loans

There are two different types of FHA 203k Loans. The first is the FHA 203k Loan Streamline which limited the construction budget to a maximum of $35,000 and the second and more popular FHA 203k Loan Program is the Full Standard FHA 203k Loan which there is no construction budget limit. With the FHA 203k Streamline Loan, you cannot do structural changes to the home or do any room additions.

What Scope of Work Can Be Done With FHA 203k Loans

You can do kitchen remodeling, bathroom remodeling, basement remodeling, attic remodeling, HVAC, millwork, roofing, siding, windows, flooring, and any other repairs that do not include structural changes or room additions to the existing home.

With the full standard FHA 203k Loan, everything goes and you can do second-story room additions, room additions, and whatever you can do with the FHA 203k Streamline Loan. You cannot do luxury construction with any FHA 203k Loans such as adding an inground swimming pool, tennis courts, outdoor spa and jacuzzi, and outdoor kitchens.

Benefits of Buying A House With A FHA 203k Loan

Buying a house with a FHA 203k loan offers several benefits, as it provides a unique financing option for purchasing a home that needs renovation or repairs. Here are the advantages of using an FHA 203(k) loan:

- Financing for Repairs and Renovations: The primary benefit of an FHA 203(k) loan is that it enables you to fund both the acquisition of the property and the expenses associated with necessary repairs or renovations in a single mortgage. This can be particularly helpful if you buy a fixer-upper or a home needing updates.

- Low Down Payment: FHA 203(k) loans typically have lower down payment requirements than conventional renovation loans. You can put down as little as 3.5% of the total loan amount.

- Flexible Credit Requirements: FHA loans are known for being more forgiving regarding credit scores. While there are still credit requirements, they may be more lenient than conventional renovation loans.

- Streamlined Process: Two types of FHA 203(k) loans are Standard and Limited. The Limited 203(k) is designed for less extensive repairs, and it has a streamlined simplifies the application procedure, facilitating borrowers’ access to funds more conveniently. for smaller projects.

- Interest Rates: FHA 203(k) loans often have attractive interest rates that may lead to reduced monthly payments compared to other renovation financing options.

- Resale Value: By renovating a home with an FHA 203(k) loan, you can potentially increase its value, making it a lucrative investment.

- Option for First-Time Homebuyers: FHA 203(k) loans are accessible to both individuals purchasing their first home and those who are repeat buyers, this accessibility makes them suitable for a broad spectrum of borrowers.

- Repairs Can Address Safety Issues: You can use the loan to address safety and health-related issues in the home, which can be crucial for ensuring the property is livable.

- Potential for Customization: You can customize the renovations to your preferences, allowing you to create the home you envision.

- Experienced Lenders and Consultants: FHA 203(k) loans typically involve working with experienced lenders and consultants who can guide you through the renovation process, ensuring that the work meets FHA standards.

Buying A House With A FHA 203k Loan Eligibility Requirements

FHA 203k Loans are considered riskier mortgage loans than standard FHA Loans. Mortgage interest rates are generally higher than standard FHA Loans. Most mortgage lenders require higher credit scores on FHA 203k mortgage loan borrowers.

However, I have approved and closed many FHA 203k Loans for borrowers with lower credit scores and higher debt-to-income ratios. Just because you are told that you do not qualify for an FHA 203k Loan with one mortgage lender does not mean that you do not qualify for an FHA 203k Loan with a different FHA 203k Mortgage Lender.

What Is The Minimum Credit Score For Buying a House With a FHA 203k Loan?

Buying a house with a FHA 203k loan with a 3.5% down payment, HUD requires a 3.5% down payment. The borrower needs a minimum credit score of 580 FICO for a 3.5% down payment FHA loan.

Check if You Meet The Minimum Credit Score Requirement.

Is Buying a House With a FHA 203k Loan Guidelines Tougher Than Standard FHA Loan?

HUD does not have any higher lending requirements for buying a house with a FHA 203k loan versus a standard FHA loan. The minimum down payment required for buying a house with a FHA 203k loan is a 3.5% down payment which is the same as the minimum down payment for a standard FHA loan.

The down payment required is on the amount of the after-repaired value. For example, if a home buyer were to purchase a home for $100,000 and the cost of the renovation is an additional $100,000, the total cost of the acquisition and construction is $200,000.

Buying a House With a FHA 203k Loan Down Payment Requirement

The home buyer will need 3.5% of the $200,000 or $7,000 to go with this FHA 203k Loan transaction. There are more closing costs with an FHA 203k Loan than with a standard FHA Loan. Home buyers do not have to worry about closing costs as long as they can get a seller concession from the home buyer. HUD, the parent of FHA, allows up to 6% in seller concessions for home buyers. Seller concessions can be used to cover all closing costs but not the down payment.

What Are Common Closing Costs on Buying A House With A FHA 203k Loan?

Examples of closing costs are title charges, appraisal fees, HUD consultant fees, inspection fees, pre-paid such as two months’ escrows for taxes and insurance, one year’s homeowner’s insurance, upfront points to buy down rates, and other costs that are associated with the closing of the home purchase transaction.

Buying A House With A FHA 203k Loan Versus Standard FHA Loans

Mortgage lenders consider FHA 203k Loans riskier than standard FHA loans. Most FHA mortgage lenders do have overlays on FHA 203k Loans. To qualify for a standard FHA Loan, the borrower needs a 580 FICO credit score for a 3.5% down payment home purchase FHA Loan. However, most FHA 203k mortgage lenders will want to see a 620 FICO credit score. The maximum debt-to-income ratio for standard FHA Loans is 56.9% DTI. However, most FHA 203k mortgage lenders will cap the debt-to-income ratios to a maximum of 50% DTI.

Frequently Asked Questions (FAQs)

- What is an FHA 203k loan?

An FHA 203k loan is a mortgage option that permits borrowers to fund both the purchase of a home and the cost of renovations or repairs into one loan. It’s insured by the Federal Housing Administration (FHA). - What types of properties are eligible for a FHA 203k loan?

Eligible properties include single-family homes, multi-family homes (up to four units), and condominiums. The property must meet FHA minimum property standards. - How much can I borrow with a FHA 203k loan?

The borrowing limit is contingent upon the thresholds established by FHA loan guidelines and your lender’s requirements. Typically, the loan amount is based on the property’s projected value after renovations. - What repairs or renovations are allowed with a FHA 203k loan?

Eligible repairs and renovations include structural alterations, room additions, kitchen and bathroom remodels, roofing, flooring, plumbing, and electrical upgrades. Luxury upgrades and alterations that do not integrate as permanent fixtures of the property are not permissible. - Can I use a FHA 203k loan to purchase a fixer-upper?

Yes, one of the main purposes of a FHA 203k loan is to finance the purchase of a home that needs repairs or renovations. This allows buyers to purchase properties that might otherwise be out of reach due to their condition. - Do I need to hire a contractor for renovations?

Yes, renovations funded by a FHA 203k loan must be performed by licensed contractors. Typically, the lender will demand detailed renovation blueprints from you and cost estimates from approved contractors before approving the loan. - How does the renovation process work with a FHA 203k loan?

After closing on the loan, the renovation funds are typically held in an escrow account. As repairs or renovations are completed, the contractor submits requests for disbursement to the lender, who verifies the work and releases funds accordingly. - What are the advantages of using a FHA 203k loan?

Some advantages include a lower down payment requirement than conventional loans, flexible credit score requirements, and the capability to combine the purchase price and renovation expenses into a single loan. - Are there any drawbacks to using a FHA 203k loan?

Drawbacks may include stricter appraisal requirements, additional paperwork and oversight due to the renovation process, and potentially higher interest rates or fees than conventional loans. - How do I apply for a FHA 203k loan?

You can apply for a FHA 203k loan through an FHA-approved lender. The application process is similar to a traditional mortgage. Still, you’ll need to provide additional documentation related to the planned renovations.

We are one of the most aggressive FHA 203k Lenders in the country. If you are interested in buying a house with a FHA 203k loan, please contact us at Gustan Cho Associates at (800) 900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Fill up form and get free review , click here