Choosing The Right Mortgage Lender With No Overlays

Choosing the right mortgage lender is extremely important. There are thousands of mortgage lenders and which lender do you choose? Getting a referral from a close trusted friend can be one way. Realtors have a list of mortgage lenders they can recommend. Attorneys and accountants also have a list of mortgage lenders who they can recommend as well. Gustan Cho Associates has a national reputation for being able to do mortgage loans other lenders cannot do. Over 80% of our clients are folks who could not qualify at other mortgage companies due to their lender overlays.

Choosing the Right Mortgage Lender

Many homebuyers looking to purchase a home or homeowners considering refinancing their home often surf the internet for mortgage lenders. However, be careful when surfing the internet and make sure that the mortgage website being viewed is a lender and not a lead generation service. Lead generation websites sell consumer information to mortgage companies for a fee. Next thing consumers will be getting are cold calls from multiple mortgage companies

What Are Overlays Imposed By Mortgage Lenders?

Have you been in a situation where you knew that you met all agency mortgage guidelines and went to your local bank but were told you did not qualify? WTF, you may say. Why did I get denied for an FHA loan by Chase Bank with a 605 credit score when HUD guidelines state to qualify for a 3.5% down payment home purchase FHA loan you need a 580 credit score. Welcome to the mortgage world. It is called lender overlays.

Not all mortgage lenders have the same lending requirements for the same loan program. One lender may say not but another lender may say yes for the same mortgage program for the same borrower. All lenders need to meet the agency guidelines but can have higher lending standards of their own called lender overlays.

What if you have a lot of unreimbursed business expenses with negative adjusted gross income and the lender does not have no-income documentation mortgages. It is best to fully understand the basic mortgage process the the various mortgage loan programs that is best suited for your needs. In this guide, we will explain the basics on choosing the right lender for your best mortgage needs.

Looking for a Mortgage with No Overlays? We’ve Got You Covered!

Reach out now to discuss your options and get approved without the additional hurdles.

The Internet And Choosing The Right Mortgage Lender

When researching the internet, consumers will run into many reputable mortgage companies that advertise via Google Ad Words. Consumers will also run into mortgage websites when they Google for certain topics like the following:

- “Mortgage Lenders With No Overlays”

- ” FHA Loans With Under 620 Credit Scores”

- “Qualifying For Mortgage After Deed In Lieu Of Foreclosure”

- ” FHA Loans With Collection Accounts”, or other keywords

Popular mortgage websites will appear on page one or two of Google.

Doing Due Diligence When Shopping For A Lender Online

When viewing the mortgage websites, make sure that they are lenders and/or mortgage company and not a lead generation company. Consumers should not enter their personal information or apply for a formal online mortgage loan application until they have contacted them. They can contact them either by calling them or emailing them as to their inquiry. Ask them whether they are a licensed loan officer or licensed mortgage company. Many mortgage websites on the internet are not loan officers or mortgage companies. They are lead generation companies that will sell your name and contact information to multiple lenders for a fee.

Lead Generation Companies Versus Mortgage Lenders

Lead generation companies will ask for the following:

- name

- state you are buying

- phone number

- email address

- type of loan they are looking for, general credit and income profile

- a brief description of what type of mortgage loan they are looking for

In turn, what they do is sell this information to multiple mortgage companies for a fee. Mortgage companies purchase leads from lead generation companies for their loan officers. Nothing is wrong. It is totally legal for loan officers to purchase mortgage leads from lead generation companies. Consumers who fill out their interest on lead generation companies should be expecting multiple phone calls ( cold calls ) from various mortgage companies as early as the same day. These calls may continue for days if not weeks.

Choosing The Right Mortgage Lender By Interviewing Loan Officers

Consumers should check the internet for complaints when Choosing The Right Mortgage Lender. When shopping for the right lender, make sure that the mortgage website contains a loan officers name. Make sure the website is not generic such a BEST RATE MORTGAGES, MORTGAGE PROS, etc. . Read the About Us section of the mortgage website.

Check multiple websites for reviews. Reputable websites included Zillow, Yelp, BBB, BirdEye, and other name brand review sites. If the loan officer has nothing but five-star reviews, that is a sign of suspicion. If the loan officer has the same type of bad reviews that is consistent, that is another sign that something is not right.

Research the loan officer. Google the loan officer’s name and see if there are either positive and/or negative reviews, complaints, or public records. Check out the loan officer’s testimonials and you can always go to www.nmlsconsumeraccess.org and see if they have any disciplinary actions against them from any states. Once due diligence is done, contact the loan officer. Interview him or her on the phone.

No Overlays, No Hassles—Get the Mortgage You Deserve!

Contact us today to learn more about how we can help you get approved without additional restrictions.

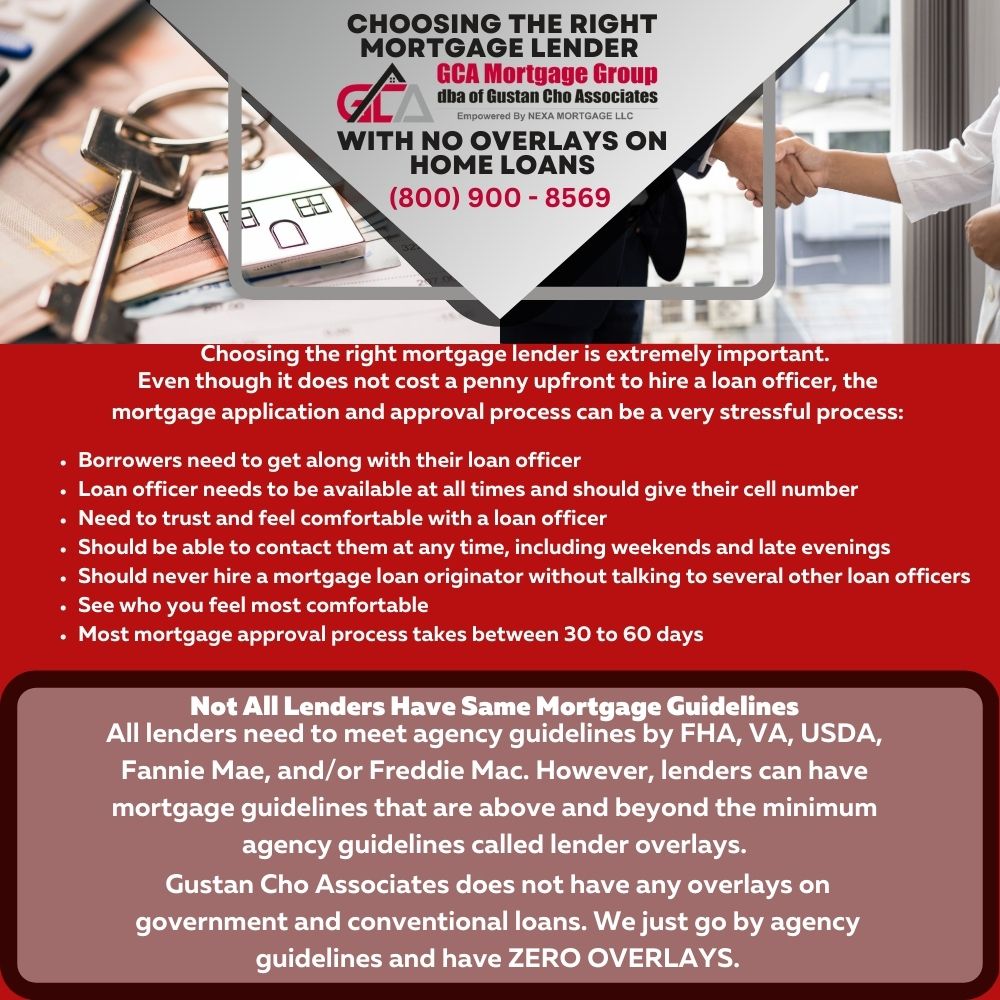

Stress During The Mortgage Process

Even though it does not cost a penny upfront to hire a loan officer, the mortgage application and approval process can be a very stressful process. Borrowers need to get along with their loan officer. Loan officer needs to be available at all times and should give their cell number. Need to trust and feel comfortable with a loan officer. Should be able to contact them at any time, including weekends and late evenings.

Every loan officer has their own way of doing business. Some loan officers do all the work themselves. Other loan officers have a system. They have a loan officer assistant and their very own mortgage processor. Other loan officers have a team of loan officers who report to them.

The mortgage process is a process. You will be working hand on hand with your mortgage loan officer and processor for at least thirty days. Interview several loan officers before you commit. Should never hire a mortgage loan originator without talking to several other loan officers. See who you feel most comfortable. Most mortgage approval process takes between 30 to 60 days. Borrowers will be dealing with a loan officer for quite some time until the mortgage loan closes.

Complaints Against Mortgage Lender and Loan Officer

Reviews should be carefully reviewed with any mortgage company and loan officer when Choosing The Right Mortgage Lender. With larger companies, there will obviously be bad reviews due to the volume that they do. Keep in mind that just because a loan officer works for a particular company with a few bad reviews that it does not mean the loan officer is not reputable.

Remember there are two sides of the story. Read the bad review. See if the loan officer replied. See who makes sense and who does not. There are many rotten people in the world and some people just write bad reviews for the sake of hurting someone. See if there is consistency. Is the loan officer getting similar bad reviews in other sites. If so, I would go look for a different loan officer.

One loan originator not returning the client’s phone calls and emails where the client writes a bad review about the mortgage company does not mean other loan officers working for the same company is not reputable. More importantly than a bad review against a mortgage company, is the review of the individual loan originator.

How To Analyze Customer Reviews of Loan Officers

Borrowers can have an incompetent loan originator working for the best mortgage company and the borrower can go through a bad experience. On the flip side, borrowers can have the best loan officer working for a lender with numerous bad reviews.

What is more important? Review of the individual loan officer or review of the lender? Both are equally important but I would put a little more weight on the review of the individual loan officer. What good is a great loan officer in a crappy company and what good is a low-life loan officer in a great company.

Reviews of the individual loan originator is more important than the reviews of a mortgage company since borrowers will be dealing with the individual loan originator. Again, a reputable stellar loan originator who does volume may have a few bad reviews because they cannot please everyone.

Not All Lenders Have Same Mortgage Guidelines

Not all mortgage lenders have the same mortgage guidelines on government and conforming loans. Just because a home buyer may not qualify at Mortgage Lender A does not mean they cannot qualify at Lender B. There are two types of mortgage guidelines:

- Agency Guidelines

- Lender Overlays

All lenders need to meet agency guidelines by FHA, VA, USDA, Fannie Mae, and/or Freddie Mac. However, lenders can have mortgage guidelines that are above and beyond the minimum agency guidelines called lender overlays. For example, HUD, the parent of FHA, requires a 580 credit score for homebuyers to qualify for 3.5% down payment FHA Home Loans. However, a lender may require a higher credit score of 640 for FHA borrowers. This higher standard required by the lender is called a lender overlay. Gustan Cho Associates does not have any overlays on government and conventional loans. We just go by agency guidelines and have ZERO OVERLAYS.

Benefits of Choosing the Right Mortgage Lender with No Overlays

- Easier Qualification:

- Flexibility in Credit Scores: Lenders with no overlays often adhere strictly to government agencies’ minimum credit rating requirements, making it easier for borrowers with lower credit scores to qualify.

- Higher Debt-to-Income Ratios: Such lenders may accept higher DTI ratios, providing more borrowing options for individuals with existing debts.

- Simplified Documentation Process:

- Less Paperwork: Fewer additional documentation requirements can streamline the application process and lessen the time and effort needed to gather and submit paperwork.

- Faster Approval: With fewer overlays, the underwriting process can be quicker, leading to faster loan approvals and closings.

- Increased Loan Options:

- Variety of Loan Programs: Lenders with no overlays often offer a broader range of loan programs, including FHA, VA, and USDA loans, without additional restrictions.

- Accessibility to Government-Backed Loans: These lenders are more likely to provide access to government-backed loan programs with standardized requirements.

- Greater Accessibility for First-Time Homebuyers:

- Lower Barriers to Entry: The more lenient requirements can help first-time homebuyers, who may need to build credit histories or substantial down payments.

- Support for Diverse Borrowers: Lenders without overlays are more accommodating to borrowers from various financial situations and backgrounds.

- Potential for Better Loan Terms:

- Competitive Interest Rates: While not always the case, some lenders with no overlays may offer competitive interest rates as they focus on adhering to standard guidelines.

- Tailored Loan Solutions: Borrowers can find loan solutions that are better tailored to their specific needs without the added restrictions of overlays.

- Improved Chance of Approval:

- Broad Eligibility: Borrowers who might be turned away by other lenders due to stricter internal guidelines have a better chance of getting approved.

- Focus on Standard Criteria: These lenders focus on meeting the primary criteria set by loan programs rather than imposing additional hurdles.

- Enhanced Flexibility for Unique Financial Situations:

- Non-Traditional Income Sources: Borrowers with non-traditional income sources or inconsistent employment histories may find qualifying easier.

- Special Circumstances: Lenders with no overlays are often more willing to consider unique borrower situations on a case-by-case basis.

- Reduced Stress and Hassle:

- Simplified Process: A more straightforward qualification process can reduce the stress and hassle of securing a mortgage.

- Clearer Expectations: With fewer additional requirements, borrowers understand what is needed to qualify.

- Potential Cost Savings:

- Lower Fees: Some lenders with no overlays may charge lower fees for the loan application and approval process.

- Avoidance of Private Mortgage Insurance (PMI): In some cases, lenders without overlays may offer options that help borrowers avoid PMI, resulting in cost savings.

Choosing a lender with no overlays can provide significant advantages, particularly for those who struggle to meet the additional requirements imposed by other lenders. This can lead to a smoother, more accessible path to homeownership.

Frequently Asked Questions (FAQs): Choosing The Right Mortgage Lender

What are mortgage overlays?

Mortgage overlays are additional guidelines or requirements imposed by lenders on top of the standard guidelines set by government agencies or Fannie Mae and Freddie Mac. These can include higher credit score requirements, lower debt-to-income (DTI) ratios, or additional documentation.

Why should I consider a lender with no overlays?

Choosing the right mortgage lender can provide more flexibility in qualifying for a mortgage. This means that the lender adheres strictly to the standard guidelines without imposing extra requirements, which can help borrowers with lower credit ratings or higher DTI ratios.

How can I identify if a lender has overlays?

Ask the lender directly about their guidelines and compare them with the standard requirements set by FHA, VA, USDA, or conventional loan programs. You can also ask a mortgage broker who is knowledgeable about multiple lenders and can help identify those with no overlays.

Do lenders with no overlays have higher interest rates?

Not necessarily. Interest rates depend on various factors, including market conditions, the borrower’s credit standing, and the loan type. Some lenders with no overlays might offer competitive rates, while others might have slightly higher rates to offset the risk.

What are the benefits of working with a lender with no overlays?

The benefits include easier qualification for a loan, fewer documentation requirements, potentially faster approval times, and greater flexibility for borrowers with unique financial situations.

Are there specific types of loans that typically come with no overlays?

Government-backed loans such as FHA, VA, and USDA loans often have lenders that offer no overlays. However, verifying with each lender is crucial, as policies can vary.

How can I compare different lenders with no overlays?

You can compare lenders by looking at their interest rates, fees, customer service reviews, and the flexibility of their underwriting process. Consulting with a mortgage broker can also give insights and help compare multiple lenders efficiently.

Are any risks associated with choosing a lender with no overlays?

The primary risk is that some lenders are more lenient in their lending practices, potentially leading to higher loan default rates. However, as a borrower, ensuring you meet the standard guidelines and manage your mortgage responsibly can mitigate this risk.

Can I get pre-approved with a lender that has no overlays?

Yes, you can get pre-approved with a lender that has no overlays. Pre-approval can help you better understand how much you can borrow and position yourself as a stronger contender in the mortgage market.

What should I prepare before approaching a lender with no overlays?

Prepare your financial documents, including income statements, tax returns, credit reports, and other relevant documentation. Being organized and transparent about your financial situation can facilitate a smoother loan approval process.

Final Selection In Choosing The Right Mortgage Lender

Be open-minded and do not just look at the few bad reviews but also look at the positive reviews the loan officer has. Remember that there are always two sides to the story. Do not hesitate to ask the loan officer about the bad review he or she may have posted online.

Over 80% of our clients at Gustan Cho Associates are borrowers who could not qualify at other lenders because they got a last-minute mortgage loan denial or because the lender did not have the mortgage option the borrower needed.

Sometimes a loan officer may do the very best he or she can do for a client. However, due to a mortgage underwriter denying the borrower’s loan, the borrower may place blame on the loan originator and post a bad review on the internet.

Ready for a Mortgage with No Overlays? Apply Today for a Hassle-Free Process!

Contact us now to see how we can help you get approved for your mortgage.