DACA Mortgage Loans

In this guide, we will be covering all about DACA mortgage loans. DACA is an administrative relief that protects eligible immigrants who came to the United States once they have been children from deportation. DACA offers undocumented immigrants.

DACA is also a coverage put in the vicinity by the Obama administration that is supposed to defend children who were introduced to America unlawfully with the aid of enabling them to obtain a 2-12 months deferral on deportation.

The premise of the program is to refuge DACA recipients from deportation and allow them to gain work lets, Social Security numbers, and state-issued picture identity to maintain to stay inside the United States without the worry of being dispatched back to their u. S . Of foundation.

Talk to Us and Learn More About DACA Mortgage Loans

How to Get DACA Mortgage Loans

Obtaining a loan can be horrifying and tough for homebuyers with the Deferred Action for Childhood Arrivals (DACA) application. We get it.

Getting approved for DACA Mortgage Loans does not have to be a complicated procedure as long as you know who offers them. DACA recipients needing to qualify for DACA Mortgage Loans probably have plenty of questions. That’s why we’ve put together this manual. To assist you in understanding the mortgage process and avoid the pitfalls many DACA recipients experience along the way.

Whether you’re shopping for your first home, a 2d home, or funding property, or in case you’re seeking to refinance and lower your month-to-month payments, test out our sources under to discover how to get your loan through our smooth, online utility.

Do All Mortgage Lenders Provide DACA Mortgage Loans?

We will go over frequently asked questions about DACA Mortgage Loans. Below are the most common frequently asked questions about DACA Mortgage Loans:

- Do all mortgage creditors provide DACA loans?

- Am I eligible for a DACA mortgage?

- What sort of assets can I purchase with a DACA mortgage?

- How good a deal will a DACA mortgage price be?

Do I qualify for a DACA mortgage? - Before making use of a DACA mortgage.

- Get authorized for a DACA loan, Step-through-Step.

Let’s get your questions replied to. Can DACA Recipients Buy a House? The brief answer is yes. Regardless of your residential reputation inside the U.S., There are no limits on who can purchase and own belongings in the U.S.. Because of this, DACA recipients can also purchase houses. That said, a DACA recipient can cozy a mortgage within the U.S. It is constrained, and there are few help packages available to help acquire a home.

Prequalify for a DACA Mortgage Loan in Just 5 Minutes!

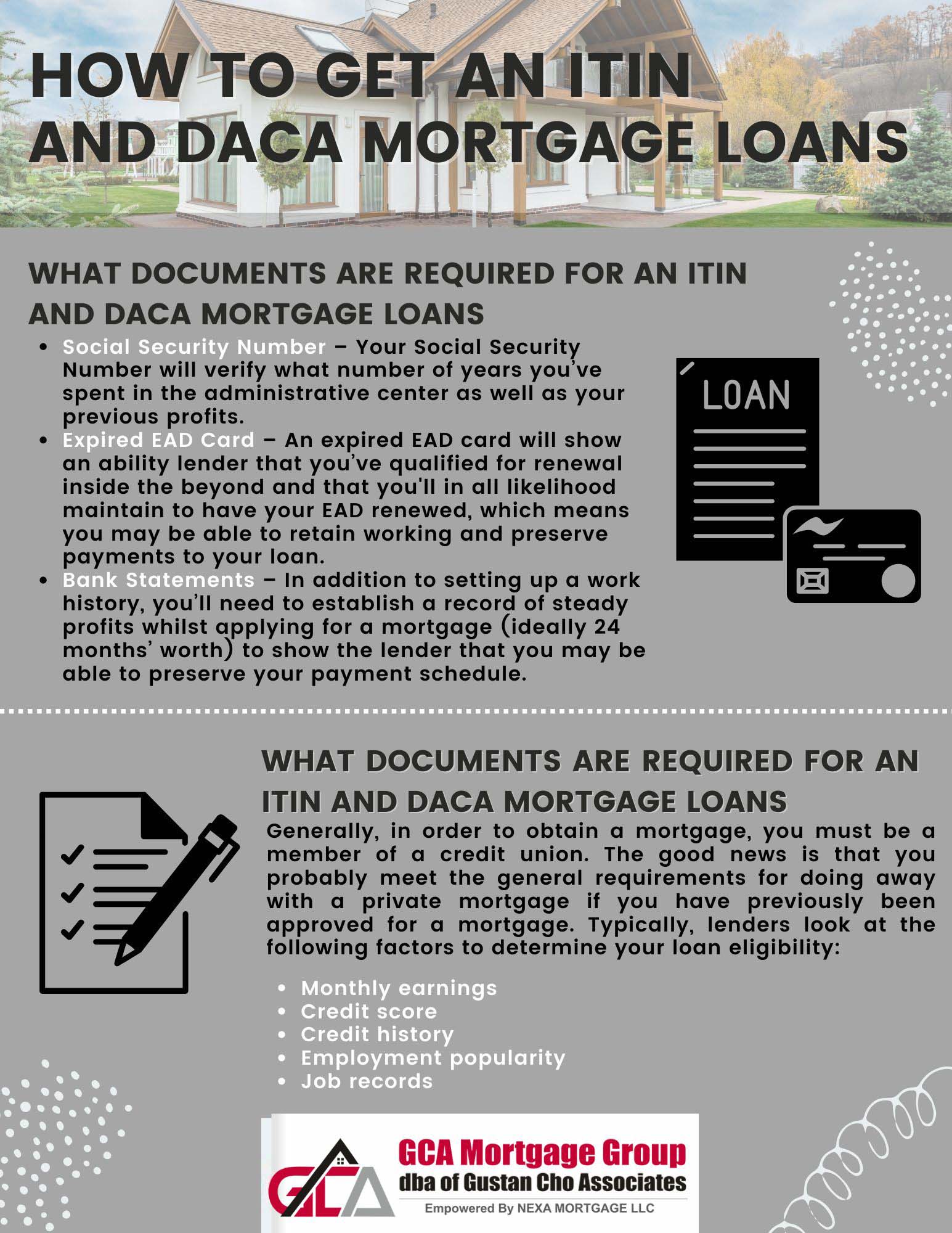

What Documents Are Required For a DACA Mortgage Loans

Receiving DACA home loans will only be a viable case if you provide a few particular documents. This documentation will verify your employment and your residency popularity for capacity creditors. When making use of a DACA mortgage, you may need to offer:

- Social Security Number – Your Social Security Number will verify the years you’ve spent in the administrative center and your previous profits.

- Expired EAD Card – An expired EAD card will show an ability lender that you’ve qualified for renewal inside the beyond and that you’ll in all likelihood, maintain to have your EAD renewed, which means you may be able to retain working and preserve payments to your loan.

- Bank Statements – In addition to setting up a work history, you’ll need to establish a record of steady profits while applying for a mortgage (ideally 24 months’ worth) to show the lender that you may be able to preserve your payment schedule.

Additional Income Documents Required

Additional Income Documents – You will even need to offer extra earnings-associated documentation, which includes federal income tax returns, W-2 statements, and pay stub copies while applying for a loan. The greater evidence of consistent income you can offer, the extra religion the lender can have that you can pay the loan again.

Private DACA Mortgage Loans

Regardless of the house’s value, most creditors select homebuyers to make a down fee of 20%. Of direction, the exceptional option for a down fee is to pay it in cash. However, most people can’t afford the huge out-of-pocket cost. If you can’t pay your down payment in cash, your next option will be a personal loan from a credit union or a personal lender. Both provide private loans that may be carried out towards the price down price. However, each may have exclusive requirements to borrow.

Generally, you should be a part of a credit union to take a mortgage. The appropriate news, though, is that in case you’ve already been certified for a mortgage, you likely meet the overall criteria for doing away with a private mortgage. Generally, creditors examine the following to decide whether or not you are eligible for a loan:

- Monthly earnings

- Credit score

- Credit history

- Employment popularity

Job records

FHA Loans for DACA

The FHA introduced in June 2019 that it would not be backing DACA mortgages. In a letter, the Housing and Urban Development Assistant Secretary “Determination of citizenship and immigration reputation isn’t always the obligation of HUD, and the Department relies on other government businesses for this information. Accordingly, due to the fact DACA does no longer confer lawful fame, DACA recipients remain ineligible for FHA loans.” DACA FHA Requirements DACA debtors using an FHA mortgage need the following.

- They require a minimal 3.5% down fee and a minimum 580 credit score.

- The assets need to be the borrower’s primary house.

- The borrower has to have a valid Social Security quantity (SSN).

- The borrower needs to be eligible for paintings inside the U.S. And offers an Employment Authorization Document (EAD) declaring such to the lender.

- The EAD should be issued through the U.S. Citizenship and Immigration Services (USCIS) inside the C33 category.

- The application should protect any expired EAD card(s).

- Otherwise, the FHA necessities for obtaining a mortgage are the same for DACA recipients.

Other DACA Home Loan Options

More alternatives are likely to be introduced as other companies update their regulations, particularly in light of converting presidential administrations and political sentiments. However, here’s a present-day list of all mortgage alternatives for the ones within the DACA application.

Next Steps

If you’re a DACA recipient who desires to own a domestic inside the U.S., the best news is that it’s viable. It received the necessary clean to find a mortgage. However, it’s far possible. So, once you find a domestic and apply for a loan, you want to take advantage of any present assistance packages and put together money in your charge.

Talk to Us and Learn More About DACA Mortgage Loans

Frequently Asked Questions (FAQs)

- What are DACA mortgage loans?

DACA mortgage loans are specialized home loans available to individuals who receive the Deferred Action for Childhood Arrivals (DACA) program. These loans cater to DACA recipients with restricted entry to conventional mortgage products due to their immigration status. - How do DACA mortgage loans differ from conventional loans?

DACA mortgage loans differ from conventional loans in that they are specifically designed for DACA recipients who may not have a lawful immigration status but have been granted deferred action by the U.S. government. These loans often have different eligibility requirements and may offer more flexible terms to accommodate the unique circumstances of DACA recipients. - Can DACA recipients qualify for mortgage loans in the United States?

DACA recipients can qualify for mortgage loans in the U.S. However, they may face challenges due to their immigration status. DACA mortgage loans provide a solution for these individuals by offering financing options tailored to their needs. - What are the eligibility requirements for DACA mortgage loans?

Eligibility requirements for DACA mortgage loans vary depending on the lender. However, DACA recipients must typically provide proof of their status, employment authorization, and other documentation to demonstrate their ability to repay the loan. - Are DACA mortgage loans available for all types of properties?

DACA mortgage loans may be available for properties, including single-family homes, condominiums, and townhouses. However, eligibility requirements may vary depending on the lender and property type. - Can DACA recipients apply for pre-approval for a mortgage loan?

DACA recipients can typically apply for pre-approval for a mortgage loan. Pre-approval allows borrowers to determine how much they can afford to borrow and assures sellers that they are serious about purchasing a property. - Are DACA mortgage loans subject to higher interest rates or fees?

The interest rates and fees associated with DACA mortgage loans could differ depending on both the lender and the financial position of the borrower. While DACA recipients may face additional scrutiny due to their immigration status, they are entitled to fair lending practices under U.S. law. - How long does it take to process a DACA mortgage loan?

The duration for processing DACA mortgage loans might fluctuate based on factors such as the lender’s criteria, the complexity of the borrower’s financial situation, and the time needed to gather the required documentation. It may take several weeks to a few months to process these loans.

Click Here To Know The Options Available for You.