Factors Affecting Mortgage Rates

Factors you control:

- What raises your mortgage rate – Anything that adds risk to the lender like a small down payment, low credit score, or a longer loan term.

- What lowers your mortgage rate – Anything that decreases risk to the lender like improving your application, choosing a different loan program, or paying discount points.

Factors outside your control:

- These could raise or lower your mortgage rate – The government does not set mortgage rates for FHA, VA, or USDA loans – so these mortgage rates vary among lenders.

Factors Affecting Mortgage Interest Rates

Understand Mortgage Rates and Save Money

You cannot go online without being bombarded with advertisements for mortgage loans. They show very low-interest rates, but most advertised quotes apply only to the most qualified borrowers buying a single-family, traditional-build home with at least 20% down. Oh yes, and that quote is “subject to change without notice.”

In most cases, the advertised rate won’t apply to you.

That’s because your mortgage rate is unique to you. To know what rate you really qualify for, you need to contact a lender, answer a few questions, and let the loan officer help you choose the right program and the most affordable rate for your situation.

What Affects Mortgage Rates?

Your mortgage rate depends on factors that you control and some you don’t. Here’s a quick rundown:

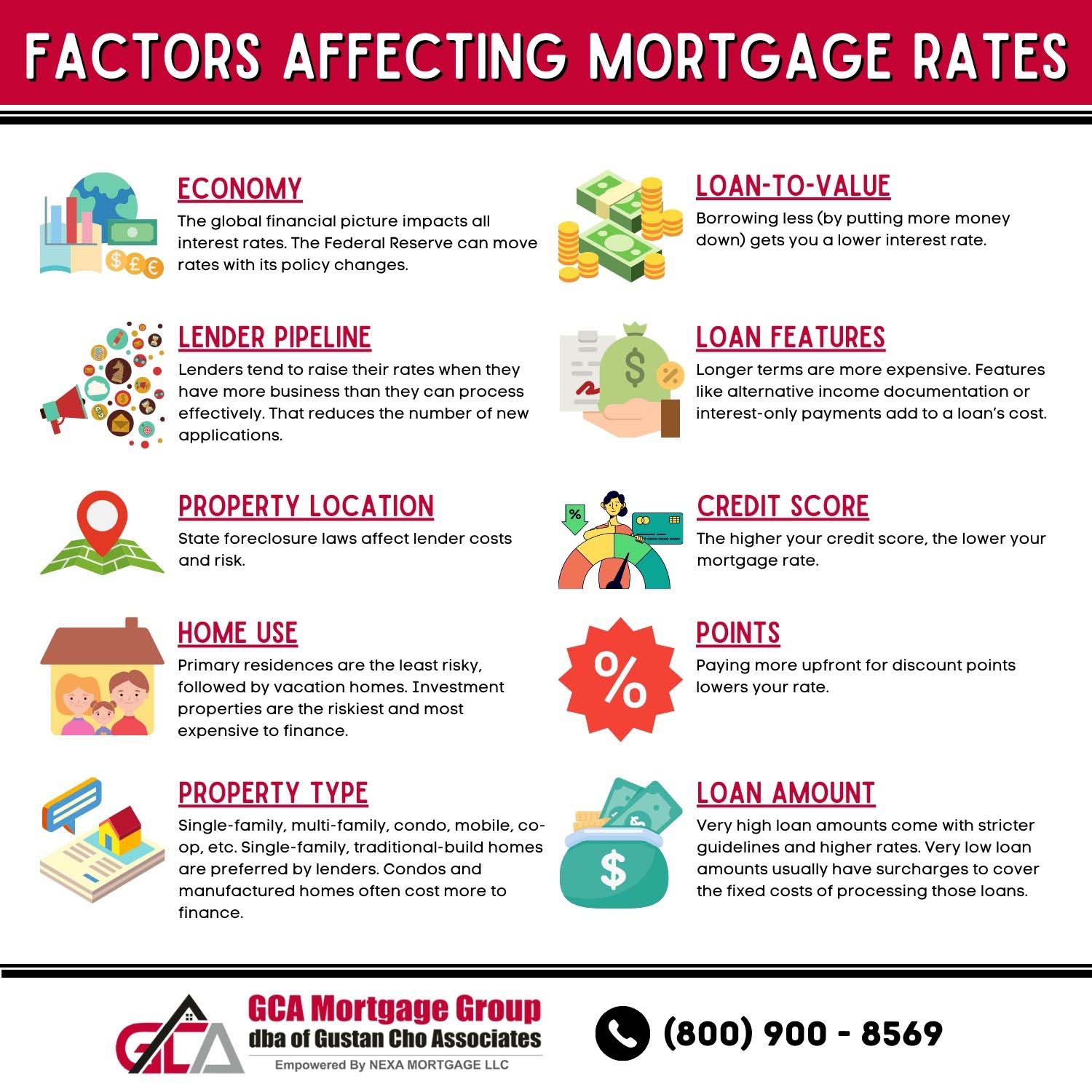

- Economy – The global financial picture impacts all interest rates. The Federal Reserve can move rates with its policy changes.

- Lender pipeline – Lenders tend to raise their rates when they have more business than they can process effectively. That reduces the number of new applications.

- Property location – State foreclosure laws affect lender costs and risk.

- Home use – Primary residences are the least risky, followed by vacation homes. Investment properties are the riskiest and most expensive to finance.

- Property type – Single-family, multi-family, condo, mobile, co-op, etc. Single-family, traditional-build homes are preferred by lenders. Condos and manufactured homes often cost more to finance.

- Loan-to-value – Borrowing less (by putting more money down) gets you a lower interest rate.

- Credit score – The higher your credit score, the lower your mortgage rate.

- Loan features – Longer terms are more expensive. Features like alternative income documentation or interest-only payments add to a loan’s cost.

- Points – Paying more upfront for discount points lowers your rate.

- Loan amount – Very high loan amounts come with stricter guidelines and higher rates. Very low loan amounts usually have surcharges to cover the fixed costs of processing those loans.

The lowest advertised mortgage rate will probably apply to you if you have a big down payment, a very high credit score, and you’re buying a traditional, single-family primary residence. Everyone else will be subject to risk-based pricing adjustments.

Mortgage Rates Change All Day Long

Another challenge you’ll face when shopping for a mortgage is the fact that a quote you get on the phone right now may be worthless in four hours. That’s because interest rates react quickly to the news.

Recently, one Federal Reserve governor made a speech saying the Federal Open Market Committee might take action to raise rates in the near future. Markets were shaken up and mortgage rates spiked immediately.

If you are paying attention, you can lock in your mortgage rate before an event like that costs you money. We analyze what could affect mortgage rates every day and make recommendations about locking in your rate.

Take Control to Get a Better Mortgage Rate

You can’t control many of the things that impact your mortgage rate (unless, maybe, you’re the head of the Federal Reserve). But by understanding the factors you can control, you can take steps that help you qualify for better interest rates.

Loan term

In general, loans with shorter terms are less risky for lenders. So they typically offer lower rates for these loans.

- The shorter the term of the mortgage loan, the lower the interest rate.

- A 15-year, fixed-rate mortgage offers a lower interest rate than a 30-year, fixed-rate mortgage.

- Loans with longer terms but shorter fixed periods (like the 5/1 mortgage which has a 30-year term but is fixed for five years) often come with lower rates. That’s because the borrower assumes the risk if rates rise.

Credit scores

Statistically, the lower a borrower’s credit score, the more likely he or she is to default on the loan and end up in foreclosure. So lenders who finance people with bad credit want to be paid more to take on that risk.

You can reduce the impact of this by looking for lenders that want your business. And of course, you can reduce your costs by raising your credit score. Even a few points can move you into a slightly better pricing tier with fewer risk-based surcharges.

Property type

If you’re comparing a single-family home and a condo, make sure to factor in the difference in financing costs. You might still end up paying more, but it won’t come as a surprise.

Down payment

The larger your down payment, the safer the loan is for your lender. That’s because if you fail to repay your loan, the lender will probably be able to recoup the loan balance by foreclosing and selling the property. Otherwise, lenders require you to buy mortgage insurance to reduce their risk.

Obviously, it’s ideal to increase your down payment if possible. But you might not want to wait until you save up 20%. There are other options:

- Borrow money that you can put into your savings, wait two or three months to season it, and use it to make a bigger down payment.

- Look into down payment assistance (DPA) programs to increase your down payment.

- Many of these programs are grants that you don’t have to pay back.

- Gift funds from family can increase your down payment.

- Choose a cheaper house.

- Your down payment will go further.

Loan amount

The cheapest loans fall between $100,000 and the conforming loan or FHA loan limit for your area. Jumbo or super jumbo loans are harder for lenders to sell and create more risk. So most lenders charge more to do them.

Very small loans present a different problem. If the loan isn’t big enough to generate enough interest income, the lender can’t cover the fixed costs of processing it. The only way lenders can afford to process very small loans is to add a surcharge.

Loan features

If you have a challenge like a self-employment, low credit scores, or a high debt-to-income ratio, you might need a loan with special features. Here are a few examples:

- Bank statement loans allow self-employed applicants to prove their income without using their tax returns.

- Interest-only payments keep payments lower for a few years.

- Non-prime loans help borrowers with bankruptcies or foreclosures buy homes faster.

A good loan officer can help you determine if one of these products is right for you. Or if you can, get financed with an FHA, VA, or USDA loan instead. Your unique profile determines what the best and lowest cost mortgage is for you, and a good lender can help you find the right loan.

Ask an Expert

For more information about the contents of this article, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. You can also email us at gcho@gustancho.com.

The team at Gustan Cho Associates Mortgage Group is available 7 days a week, evenings, weekends, and holidays. We are direct lenders with no lender overlays on government and conforming loans. Gustan Cho Associates are also experts in non-QM and alternative financing. We also cater to self-employed borrowers with our bank statement mortgage loans for self-employed borrowers.