FHA Loan After Loan Modification Mortgage Guidelines

This guide will cover qualifying for an FHA loan after loan modification mortgage guidelines. A loan modification is an alternative to foreclosure, where the homeowner’s current mortgage lender will modify their home loan. Loan Modifications are done and granted by lenders because the borrower cannot afford their current mortgage payment.

Borrowers who cannot afford their payments either because they had a reduction of household income or the mortgage went substantially higher due to an adjustable-rate mortgage.

Loan modifications are done by either reducing the interest rate or forgiving part of the mortgage loan balance, making the mortgage payments affordable to the homeowner. Lenders do not want the property and rather work with homeowners than take the property through foreclosure.

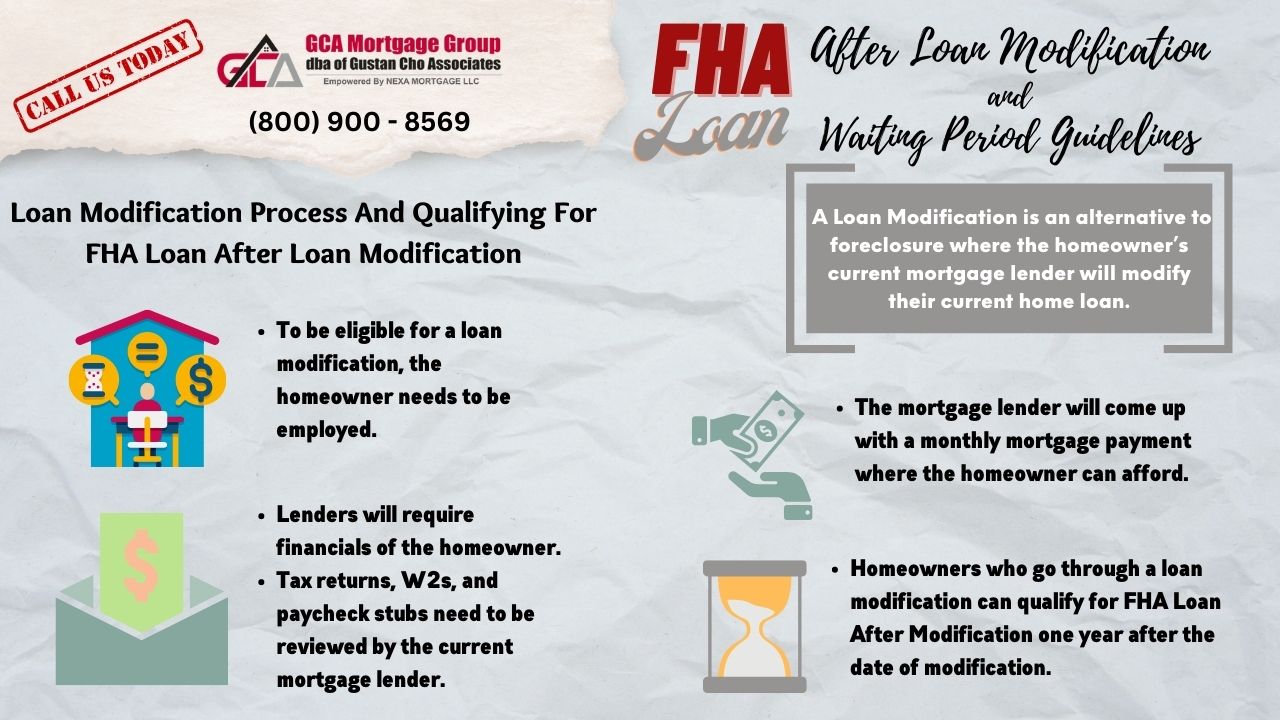

Modification Process and Qualifying For FHA Loan After Loan Modification

To be eligible for a loan modification, the homeowner must be employed. Lenders will require the financials of the homeowner. The current mortgage lender must review tax returns, W2s, and paycheck stubs. The mortgage lender will come up with a monthly mortgage payment that the homeowner can afford. Homeowners who undergo a loan modification can qualify for an FHA loan after modification one year after the modification date.

Loan Modification Alternative To Foreclosure

Modify mortgage loan is an alternative to foreclosure for homeowners who cannot afford their current loan payment. It helps modify the current mortgage so the homeowner can afford the newly modified mortgage.

The true purpose of modifying one’s mortgage is for homeowners to be able to make their mortgage payments.

All delinquent mortgage payments can be added to the back of the loan balance or forgiven. A loan modification is a second chance the lender gives to homeowners with sudden income changes or other extenuating circumstances.

Loan Modification Process Timeline

Loan modifications have long gotten a bad rap with lenders. Homeowners are given a trial period. Lenders had a reputation for giving homeowners a trial period and not approving loan modifications. Lenders often foreclose upon a property instead of granting loan modification after a trial period. The process for a loan modification can be initiated in one of two ways as follows.

Loan Modification: What Is HAMP?

Homeowners with Fannie Mae or Freddie Mac Conventional loans may be eligible for a loan modification through the Home Affordable Modification Program, also known as the HAMP. The HAMP, of course, has fairly stringent inclusion. There are specific terms, such as the loan must have been initiated on or before Jan 1st, 2009. The borrower must be able to prove beyond a reasonable doubt their financial hardship (and thus the need for a loan modification). This is a fantastic option for anyone seeking a loan modification.

Private Mortgage Modifications

Homeowners who have a mortgage should be aware that private mortgage lenders are not required to honor HAMP, but they certainly have the option to do so. There are quite a few companies who may contact you to speed up the entire program. Using services like this is risky, as they can’t guarantee success.

Truly only Fannie Mae and Freddie Mac loans are sure to be eligible for a loan modification. To determine eligibility, visit http://makinghomeaffordable.gov site, which will give homeowners great advice on what to do.

Of course, another good option is to contact the mortgage lender and discuss it with them. Pay your mortgage during the loan modification application and trial process.

Understanding Private Mortgage Modifications: A Comprehensive Guide

Introduction

Private mortgage modifications offer a lifeline for homeowners facing financial difficulties. Unlike government-backed loan modifications, these are negotiated directly between the borrower and their private lender. This guide explores the intricacies of private mortgage modifications, outlining the process, benefits, and potential pitfalls.

What is a Private Mortgage Modification?

A private mortgage modification is a negotiated change to the terms of a current mortgage loan that is not backed by government entities such as Fannie Mae, Freddie Mac, or the FHA. These modifications are tailored to help borrowers struggling to make monthly mortgage payments due to financial hardship.

Why Consider a Private Mortgage Modification?

Borrowers may seek a private mortgage modification for several reasons:

- Financial Hardship: Loss of income, medical emergencies, or other unexpected fees can make it difficult to keep up with mortgage payments.

- Avoiding Foreclosure: Modifications can help homeowners stay in their homes by making payments more manageable.

- Interest Rate Adjustments: Borrowers with adjustable-rate mortgages (ARMs) might seek to lock in a lower fixed interest rate.

- Term Extensions: Extending the loan term can reduce monthly payments by extending the loan term to distribute the loan balance over a longer timeframe

Types of Private Mortgage Modifications

Several kinds of modifications can be made to a private mortgage:

- Interest Rate Reduction: Lowering the interest rate to reduce monthly payments.

- Loan Term Extension: Extending the loan term to reduce the monthly payment amount.

- Principal Forbearance: Temporarily reducing or suspending principal payments, with the deferred amount added to the loan balance.

- Principal Reduction: Reducing the principal balance, though this is less common and often harder to negotiate.

The Process of Obtaining a Private Mortgage Modification

- Assess Your Situation: Understand your financial situation and determine if a modification is best. Gather all relevant financial documents, including income statements, tax returns, and a detailed budget.

- Contact Your Lender: Contact your mortgage servicer to discuss your hardship and request a modification. Be prepared to explain your situation and provide supporting documentation.

- Submit an Application: Complete and submit the lender’s modification application form and all required documentation. This may include proof of income, a hardship letter, and bank statements.

- Negotiate Terms: Work with your lender to deal with new loan terms that are affordable and sustainable for your financial situation. This may involve multiple discussions and submission of additional documentation.

- Review the Modification Agreement: Once an agreement is reached, carefully review the modification terms to ensure you understand the new payment structure, interest rate, and potential fees.

- Finalize the Modification: Sign and return the modification agreement to your lender. Then, start paying according to the revised terms.

Benefits of Private Mortgage Modifications

- Avoid Foreclosure: Modifications can help prevent foreclosure, allowing homeowners to stay in their homes.

- Lower Monthly Payments: Adjusted terms can make monthly payments more affordable.

- Flexible Solutions: Private lenders can offer more flexible and tailored solutions than government programs.

Potential Pitfalls and Considerations

- Impact on Credit Score: The modification process and any late payments leading up to it can negatively impact your credit score.

- Fees and Costs: Lenders may charge fees for modifying the loan.

- Temporary Relief: Modifications may provide temporary relief but not address underlying financial issues. Consider whether this is a short-term fix or part of a long-term financial plan.

Types of Loan Modification

There are various ways to renegotiate your mortgage. The way you do so could be any of the following. A reduction in your monthly payments. Possibly for a fixed period. Interest rate reduction. Switching to a fixed-rate mortgage. There are many other ways to modify a mortgage loan. Make sure to contact us with any questions on this topic.

It’s a mortgage insured by the Federal Housing Administration. It is designed to help lower-income borrowers or those with lower credit scores to obtain home financing.

2. What is a Loan Modification?

It’s a change made to a lender’s terms of an existing loan. This might include adjusting the interest rate, extending the term, or changing the type of loan to make the payments more affordable for the borrower.

3. Can I get an FHA loan after a loan modification?

Yes, you can qualify for an FHA loan after a loan modification. However, you must meet specific guidelines and waiting periods before you can qualify.

4. What is the waiting period for an FHA loan after a loan modification?

The waiting period for an FHA loan after a loan modification is typically 12 months. During this time, you must demonstrate a history of timely payments.

5. What credit score do I need for an FHA loan after a modification?

The FHA requires a minimum credit score 580 to qualify for an FHA loan with a 3.5% down payment. However, individual lenders might have higher requirements.

6. What documentation is needed for an FHA loan after a modification?

You will need to provide standard documentation such as proof of income, employment verification, credit history, and loan modification details.

7. Will my interest rate be higher after a loan modification?

The interest rate on an FHA loan is not directly affected by a previous loan modification. However, your credit score and overall financial profile will impact the rate you receive.

8. Can I refinance an FHA loan after a loan modification?

Yes, you can refinance an FHA loan after a loan modification. However, you must meet the same eligibility requirements and waiting periods.

9. Are there any special requirements for the property with an FHA loan after a modification?

The property must obtain the FHA’s minimum property standards, which include safety, security, and soundness requirements.

10. How do I apply for an FHA loan after a loan modification?

After a loan modification, you should contact an FHA-approved lender to apply. They will guide you through the application process and help you gather the necessary documentation.

11. What are compensating factors, and how can they help me qualify?

Compensating factors are aspects of your financial profile that can help offset a higher risk in lending. These include a larger down payment, significant cash reserves, or a stable employment history.

12. Can I use gift funds to repay an FHA loan after a modification?

Yes, FHA allows gift funds to be used for a down payment. The gift must be from a family member or another approved source, and proper documentation is required.

13. Will a loan modification affect my debt-to-income ratio (DTI) for an FHA loan?

Your debt-to-income ratio will be assessed based on your current financial obligations. If the loan modification has reduced your monthly payments, it could positively impact your DTI ratio.

14. What is the maximum loan amount for an FHA loan after a loan modification?

The maximum amount for an FHA loan varies by location. It is determined by the FHA loan limits in your area.

15. After a loan modification, Can I get pre-approved for an FHA loan?

After a loan modification, you can get pre-approved for an FHA loan. Pre-approval will give you a clear comprehension of how much you can loan and help streamline the home-buying process.

Waiting Period After Loan Modification: 2023 Update

After a loan modification, a one-year mandatory waiting period exists to qualify for FHA Loan. For more information on this or other mortgage-related topics, don’t hesitate to contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.