FHA Loans

In this mortgage guide, we will cover FHA loans. We will explain what are FHA loans. FHA loans are the most popular mortgage loan program for first-time homebuyers, and borrowers with less than perfect credit, and homebuyers with high debt-to-income ratios. In this guide, we will cover FHA loans and the benefits, the lending requirements, and why FHA loans can benefit you over other home mortgage loan programs. The Federal Housing Administration Loan- FHA is a division of the United States Department of Housing and Urban Development – HUD.

What is an FHA Loan?

Most first-time homebuyers or buyers who have not owned or purchased a home in years are often confused about what home loan program is best for them. Always everyone heard of FHA loans. But what is an FHA loan and what benefits do they have. Is an FHA loan better than a conventional? When purchasing a new home, it can be difficult for certain individuals to find a lender. There are many types of loans out there, but not all will be the best fit for each potential buyer. In the following paragraphs, we will be discussing Federal Housing Administration Loans, also known as FHA loans.

Interested with FHA Loans? Click Here.

How Does an FHA Loan Work?

The FHA loan is not new. It originated during the Great Depression. During this time, it was very hard for people to get loans and many potential buyers were required to put up to a 50% down payment and pay off the loan in 5 years. Well, it was the Great Depression. Most people were not able to pay for the mortgages they had (half of all mortgages in that time frame were in failure), much less buy a home.

What Did The National Housing Act of 1934 Help With?

Because housing was such a mess after the Great Depression, the National Housing Act was signed to help with lessening the number of foreclosures and making buying a home more available. This act was focused on low-income housing. It also acted to improve housing conditions. Another focus was to improve the construction industry, as almost 2 million workers had lost their jobs.

How FHA Loans Helped Families Become Homeowners During The Depression Era

Because of the depression, many people were unemployed and the industries that support the housing market, wood, concrete, etc were failing. HUD, the parent of HUD, would insure home loans which obviously made it more appealing for banks and lenders to loan money out to people who otherwise would not have had a large amount of money upfront (30-50% down payments were required). This was also the beginning of the federal government getting involved in the housing market and the start of what we know mortgages to be today.

History of FHA Loans

FHA loans are only available through an FHA-approved lender, meaning that you do not apply directly through the FHA. FHA loans are for a consumer base that may have a lower credit score, who may have trouble getting a loan through other lenders, and that can provide proof of steady income and employment.

Comparing Conventional vs FHA Loans

An FHA loan requires a smaller down payment, and unlike conventional loans, even 100% of the down payment can be a gift. There are also down payment assistance programs for FHA. Because FHA is geared toward those who may not be able to get a conventional loan, even individuals who have had financial troubles such as bankruptcy or foreclosures can be considered. Generally, the more time that has passed since you have gone through bankruptcy, the more favorable your chances are.

Prequalify to an FHA Loan in Just 5 Minutes!

FHA Loans For Bad Credit

FHA loans are the best mortgage loan program for borrowers with bad credit. HUD has very lenient FHA Guidelines on FHA home loans. FHA loans for bad credit benefit borrowers with outstanding collection accounts, charged-off accounts, those who need manual underwriting, homebuyers with credit scores down to 500 FICO, borrowers with late payments, and borrowers who are in an active Chapter 13 Bankruptcy repayment plan.

Because the individuals who borrow through an FHA tend to fall into the higher risk category for loans, you will need to pay for mortgage insurance. Additionally, you can also apply with another individual and that individual does not need to actually live in the home. It is important to note that you will be unable to receive an FHA loan if you have delinquent federal debt or judgments, as this is a federally insured loan.

What Mortgage Insurance Premium on FHA Loans

Lenders are able to offer FHA loans with a low down payment at competitive rates to borrowers at competitive rates due to the government guarantee from HUD. The way HUD pays lenders in the event of any loss by FHA loan borrowers, the FHA mortgage insurance is there to cover the loss from the default. This is how the FHA mortgage loan program works.

When using the FHA program, you will be required to have mortgage insurance. An FHA Mortgage insurance premium (MIP) is insurance to cover your loan should you default on the loan. This is to protect the lender. Normally, you will need to pay a premium at closing, and then through the life of the loan.

What Is The Upfront FHA Mortgage Insurance Premium

The upfront payment can be rolled into the loan amount, and the annual fees are included in the monthly payment. How long a home buyer has to pay the insurance depends on the loan terms. For example, if you put less than 10% down on the loan, you will need to pay it back for the life of the loan. If you put down 10% or more, you can stop paying after 11 years. The good news is that if a person’s financial situation improves, they can pay down the mortgage or refinance to get rid of the PMI.

Learn More About FHA Mortgage Insurance Premium.

FHA Loan Minimum Credit Score Requirement

HUD requires a credit score of at least 580 to qualify for the 3.5% down payment FHA loan option. This is lower than the 620 and up score that most lenders require for conventional loans. Potential buyers need to keep in mind that although the FHA might allow a 580 credit score, an FHA lender might not.

They still might require a higher score. Lenders do not have to lower their requirements. This is why you must shop around for the appropriate lender and still take measures to improve your credit score prior to applying.

How To Boost Your Credit Score Before Applying For a Mortgage

Maximizing your credit scores is very important. Lenders will price out your mortgage loan application based on your credit scores. The higher the credit score, the lower your rate. The team at Gustan Cho Associates are experts in helping borrowers boost their record scores. HUD, the parent of HUD, also offers counseling and credit classes for those who wish to improve their credit score.

How To Boost Your Credit Scores To Qualify For an FHA Loan

Remember to review your credit report for errors, or possible identity theft. There are many ways to boost and maximize your credit scores. These issues are correctable but take months to remedy. Additionally, a low credit score will not automatically disqualify you from an FHA loan.

It is important to find a loan officer that can help you find the right lender. The FHA is looking for a history of reliable payments. If you have a history of reliable payments, they will sometimes overlook a lower credit score.

FHA Debt-To-Income Ratio Requirements

An FHA lender will also need to check your Debt to Income Ratio (DTI). In order to qualify, you will generally need to have a DTI of 43% or less. This can vary a bit, depending on your overall credit score. The maximum DTI is 57% but again, this can vary.

FHA Loan Limits

Under the FHA, there are loan limits calculated by federal law. These are determined by location, and type of property and are updated annually. FHA has a national floor and ceiling on the loan amounts, depending on where you live. For example, if you live in a high-cost area, the ceiling will be higher. To determine your area’s limits, you can check the FHA loan limits site at the Federal Housing Authority website.

What Are The Types of FHA Loans?

There are several different types of FHA loans. The most popular type of FHA loan is an FHA 203 (b) Loan, basically the standard single-family home loan. This type of loan is the loan that everyone thinks of when they hear about FHA loans. The FHA does not dictate the insurance rates, but they are set by the lender. These loans are mostly for the property that people will be actually living in.

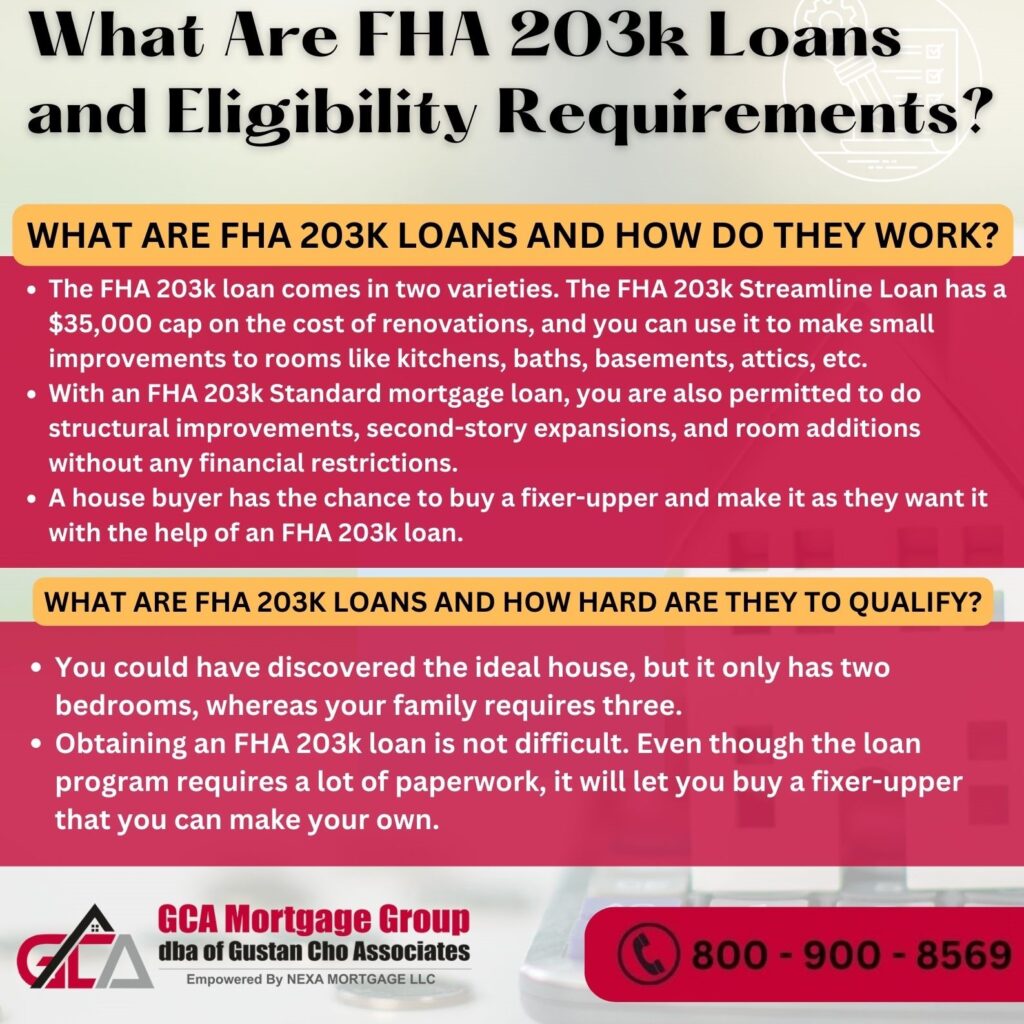

What Is an FHA 203k Loan?

The 203 (k) loan, also known as the FHA Rehab Loan, allows borrowers to take out money for the purchase of a home and allows for extra money to renovate the home as well. This type of money is not meant for “flipping” houses. It is meant for individuals who buy a property that needs repairs that they would otherwise have trouble getting financing to fix. Once work is complete, an inspection is required to ensure it was done.

What Is An FHA 245(a) Loan?

The 245 (a) Loan, the Graduated Payment Mortgage, allows for a smaller initial monthly payment that increases as time goes on. Again, this loan can not be used for investment purposes or “flipping” homes. This option is meant for buyers who have limited income but are projecting that their earnings will increase with time. ‘

The increased amount of the payment that occurs as time goes on is paid on the loan principal and helps shorten the mortgage terms. This option would be great for someone, for example, who is just starting out with a new career or expects promotions as time goes on.

What Is The FHA Energy Efficient Mortgage

The FHA Energy Efficient Mortgage is for you if you want to install upgrades to a home that will lower energy bills. This is ideal for individuals who would have trouble securing another loan to make these upgrades. These upgrades can include things like solar panels and energy-efficient lights. The concept behind this is that it ultimately lowers the buyer’s utility bills, freeing up money for mortgage payments. This allows borrowers to potentially qualify for a larger mortgage.

FHA Reverse Mortgage Loans

Another type of FHA loan is the Reverse Mortgage loan or the Home Equity Conversion Mortgage. This loan is for only senior citizens, aged 62 years or older, and allows them to borrow against the home equity that they have. Senior citizens may do this for a number of reasons. Perhaps they need to pay for healthcare expenses or to supplement income. It is considered tax-free income.

The basis is that the lender will actually pay the homeowner but the title to the home remains with the owner. When the homeowner moves/sells the home, or passes away, the loan is paid back from the estate. This can be done by heirs buying or selling the home or turning the estate over to the lender.

FHA Streamline Streamline Refinance

A homeowner can also refinance with the FHA Streamline refinancing program. FHA Streamline Refinancing is only available if you have an existing FHA-insured mortgage. The issue with this type of refinancing is that the cash takeout is limited to $500. This would not work for someone hoping to take out large amounts of cash for refinancing.

Talk to Us To Learn What Type of FHA Loan Best Fits You.

How Do You Apply For an FHA Loan?

Now that you know a bit about FHA Loans, how do you apply? After checking your credit score and correcting any issues that you can, your first step would be to shop around for a lender that is FHA-approved. When you are doing this, you need to check the approved credit score for the lenders. Remember that all FHA lenders do not allow the minimum 580 credit score. It is up to them to set the credit score minimum.

Are All FHA Lenders The Same?

Not all mortgage lenders have the same guidelines on FHA loans. Most HUD-approved lenders have lender overlays. Overlays are additional lending requirements that are higher than the HUD minimum agency guidelines on FHA loans. If HUD requires a 500 credit score on FHA loans, the individual requires a 600 credit score or even a 620 to 640. The higher credit score requirement is what you call a lender overlays on credit scores.

How Do I Get The Best FHA Mortgage Rates

After you have found the lender that you wish to work with, you submit the application. It is acceptable and preferable to get quotes from different lenders to ensure that you can get the best possible deal. If you are worried about multiple credit inquiries lowering your credit score, it normally will not affect your credit as long as the inquiries are all done at around the same time and within a 30-45 day period.

What Is The Mortgage Process for FHA Loans

You will then be required to submit your supporting documents, as you would with any mortgage loan application. FHA loan applications typically require the same documents as a conventional mortgage, including tax returns, bank statements, recent pay stubs, and W2s. The home inspection and appraisal are where things get a bit more involved as there are different guidelines for an FHA loan. The home inspection and appraisal must be completed by an FHA HUD (Housing and Urban Development) Inspector.

HUD Home Appraisal Requirements on FHA Loans

The home appraisal must meet HUD guidelines. The appraisal is determining your home’s current market value. The home inspection is optional and it is not required by the lender. It is highly recommended homebuyers have a home inspection done. Home inspections will detail what is wrong with the house if any.

What Happens During an FHA Home Appraisal?

The home inspector will comb every bit of the home for any defects, the longevity of sections of the home, and the longevity of high-ticket items such as HVAC, well and septic, roof, appliances, and other sections of the home. FHA appraisal addresses the home’s need to be habitable, not have hazards living in the home, and safety. The results are then sent directly to the lender. The FHA inspector is looking for issues that affect the safety of the property, or the health of the people who live there.

What Things Do FHA Home Appraisers Look For?

Examples of issues they look for are missing handrails, roofing issues, nonfunctioning water heaters, pest infestation, sewage disposal issues, or leaky plumbing. The inspector also looks to see if the home’s location is near excessive noise or hazardous waste dumping grounds. If a home does not meet the FHA property guidelines, the lender will not approve the loan. As a rule, The FHA looks for “unsafe, unsound, and unsanitary conditions.

What Happens If The House Fails The FHA Appraisal?

If the FHA appraiser does find issues with the house, it is up to the seller to repair the issues to make the home available for this type of lender. Normally, if a seller has agreed to accept an FHA loan, they would already be aware of this. An appraiser or licensed inspector needs to return to the property for a follow-up inspection after a licensed tradesperson has completed the repairs. This means that unless you or someone you know is licensed in whatever type of repairs are needed, you will be hiring someone.

How Long Does It Take To Close an FHA Loan?

Many homebuyers are under the assumption it takes longer to close on an FHA loan versus a conventional loan. This is not true. Gustan Cho Associates can close on an FHA loan in 30 days or less. The amount of time it takes to close on an FHA loan is about the same length of time it takes to close on a conventional loan.

Although it may seem as though getting an FHA loan comes with stipulations and frustrations such as mandatory PMI and FHA appraisals, it is important to remember that it serves a purpose for individuals who would otherwise be unable to secure home financing. FHA home appraisals is not too much different than an appraisal for a conventional loan.

Frequently Asked Questions (FAQs)

- 1. Who qualifies for an FHA loan?

FHA loans are available to many borrowers, including first-time homebuyers, repeat buyers, and individuals with lower credit scores. Eligibility requirements typically include a minimum credit score, a stable income, and a down payment. - 2. What credit score is necessary as a minimum for an FHA loan?

The lowest acceptable credit score for an FHA loan can fluctuate but is typically less stringent than the requirement for conventional mortgages. In many cases, a credit score of 580 or higher is sufficient to qualify for an FHA loan. However, some lenders may accept scores as low as 500 with a higher down payment. - 3. How much is the down payment for an FHA loan?

One of the benefits of FHA loans is their demand for a reduced down payment in contrast to conventional mortgages. Usually, the minimum down payment amounts to 3.5% of the property’s purchase price. Nonetheless, borrowers with credit scores below 580 might need to provide a more substantial down payment. - 4. Can FHA loans be used for refinancing existing mortgages?

Indeed, FHA loans can be employed for the purpose of refinancing current mortgages. FHA offers various refinancing options, including cash-out and streamlined refinances, which can help borrowers reduce their monthly expenses or tap into the equity in their residences. - 5. Are there income limits for FHA loans?

There are no designated income thresholds for FHA loans. However, borrowers must have a steady income source and a debt-to-income ratio that aligns with the lender’s criteria. FHA loan approval hinges on your capacity to repay the loan. - 6. What types of properties can I purchase with an FHA loan?

FHA loans are versatile and can be used to purchase various residential properties, including single-family homes, multi-unit properties (up to four units), condominiums, and manufactured homes. However, the property must meet certain FHA requirements to qualify for financing. - 7. Can I use an FHA loan for investment properties or second homes?

FHA loans are primarily designed for properties intended for owner occupancy and cannot be utilized for investment properties or second homes. Borrowers must certify their intention to live in the property they purchase with an FHA loan. - 8. Is mortgage insurance required for FHA loans?

Yes, FHA loans necessitate mortgage insurance, comprising both an initial premium and an annual premium. The initial premium can be rolled into the loan principal, and the annual premium is paid monthly as part of your mortgage payment. Mortgage insurance is a key component that permits lenders to provide loans with reduced down payment requirements and greater flexibility in credit criteria. - 9. How do I apply for an FHA loan?

When considering an FHA loan, you may reach out to an FHA-approved lender, which could be a bank, credit union, or mortgage company. The lender will evaluate your eligibility, scrutinize your financial documents, and lead you through the application process. Prior to submitting your application, it’s vital to assemble the required documentation, which includes evidence of income, employment history, and credit details. - 10. Can I refinance an existing FHA loan into another FHA loan?

Yes, it’s possible to refinance an existing FHA loan into another FHA loan through various FHA refinance programs, such as the FHA Streamline Refinance. These programs are designed to help borrowers capitalize on more favorable interest rates or diminish their monthly installments without extensive documentation or credit checks. - 11. Are FHA loans assumable?

Yes, FHA loans are assumable, implying that an eligible purchaser can assume the current FHA loan and its terms when purchasing a home. Assumably can be a valuable feature when interest rates are rising because it allows the new buyer to inherit the more favorable interest rate of the initial loan.

Here at Gustan Cho Associates, our Loan Officers are expert when it comes to FHA Loans. Contact us by calling 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. We are available even during weekends and holidays!