FHA Loans With Low Credit Scores Mortgage Guidelines

This blog will cover qualifying for FHA loans with low credit scores and bad credit mortgage guidelines. FHA loans are this country’s most popular loan program and enable hard-working Americans eligible to be homeowners. The minimum down payment required is 3.5%.

Home sellers can contribute up to 6% of homebuyers’ closing costs. A minimum credit score of 580 FICO to qualify for a 3.5% down payment FHA home loan in median-priced counties nationwide.

Borrowers with credit scores down to 500 FICO are eligible for an FHA loan with a 10% down payment. HUD, the parent of FHA, requires a 10% down payment for homebuyers with credit scores under 580. In the following paragraphs, we will discuss qualifying for FHA loans with low and bad credit scores.

For FHA Loans with Outstanding Collections and Charged-Off Accounts?

Outstanding collections and charge-off accounts do not have to be paid off. FHA Loan Limit for single-family homes is $479,500. A down payment can be 100% gifted. Homebuyers with 500 to 579 credit scores can qualify for FHA loans with a 10% down. The debt-to-income ratio caps at 56.9% for borrowers with 620 credit scores or higher: less than 620 FICO, 43% DTI. Gustan Cho Associates specializes in helping borrowers with FHA loans with low credit scores and no overlays.

HUD Minimum Credit Score Guidelines on FHA Loans

HUD guidelines on FHA loans require a 580 credit score to qualify for a 3.5% down payment FHA loan. Borrowers under a 580 FICO and down to a 500 credit score require a 10% down payment. The lowest credit score allowed to qualify for FHA loans is 500 FICO.

For borrowers with under 580 credit scores and down to 500 FICO, a 10% down payment is required.

For borrowers who got an approve/eligible per automated underwriting system (AUS) findings with at least a 580 credit score, the maximum debt-to-income ratio cap is 46.9% front-end and 56.9% back-end. The maximum debt-to-income ratio cap for borrowers under 580 credit scores is 31% front-end and 43% back-end on FHA loans.

FHA Loans With Low Credit Scores and Bad Credit Mortgage Guidelines

How Do Mortgage Underwriters Analyze Borrowers With Bad Credit

Underwriters will review the borrower’s overall credit history and ensure that the borrower has a history of paying their bills. The HUD Guidelines are very lenient, but they want to see borrowers demonstrate financial responsibility. Past performance on timely payments indicates that they will pay their mortgage promptly.

Prequalify for a mortgage in just five minutes.

FHA Loans With No Credit Scores

Mortgage borrowers can qualify for FHA loans with no credit scores or credit tradelines. Credit tradelines are not required to get approved for FHA loans. However, three credit tradelines with at least 12 months of seasoning is a good sign. For borrowers with no credit history, non-traditional credit tradelines can be used. Those without credit tradelines should get three to five secured credit cards to re-establish their credit.

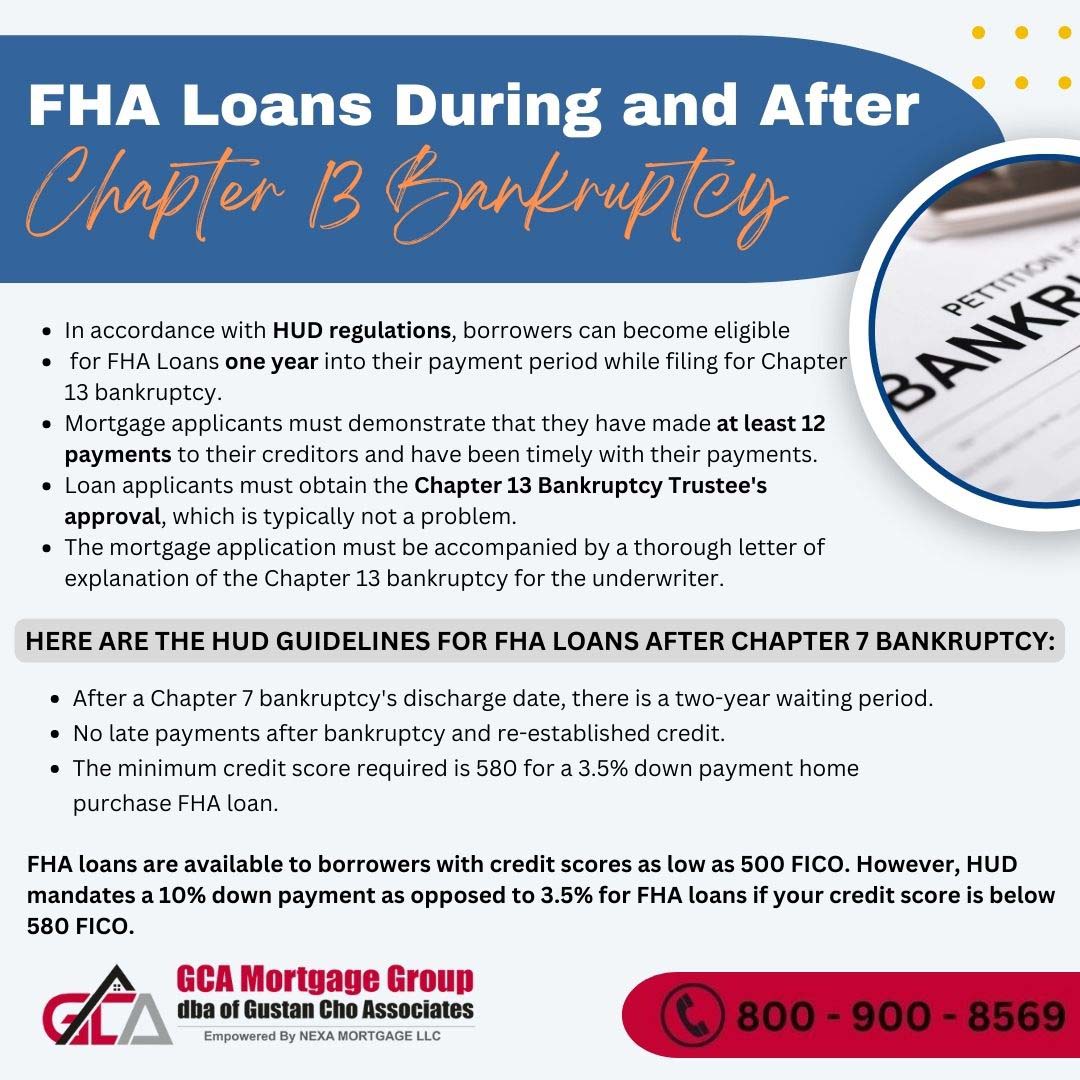

FHA Loans During and After Chapter 13 Bankruptcy

This section will cover FHA guidelines during and after Chapter 13 Bankruptcy. Under HUD guidelines, borrowers can qualify for FHA loans during a Chapter 13 bankruptcy one year into their payment period. Mortgage applicants must show that they have been paying on time and have made at least 12 payments to their creditors. Loan applicants need to get the approval of the Chapter 13 Bankruptcy Trustee, which is not an issue most of the time. A detailed letter of explanation of Chapter 13 bankruptcy is required with the mortgage application for the underwriter.

What Are Compensating Factors That Can Be Used For Manual Underwriting

The following will be compensating factors for borrowers qualifying for FHA during and after Chapter 13 bankruptcy:

- Reserves

- Credit tradelines of on-time payments

- No gift funds and own funds for the down payment

- Proof of job stability

- Other income, such as part-time income, is not used in the qualification

- Low payment shock

- Low debt-to-income ratio

- Larger down payments are compensating factors that show solid credibility for borrowers

All FHA Chapter 13 bankruptcy files need to be manually underwritten. Manual underwrites require verification of rent. Homebuyers who do not have verification of rent because they have been living rent-free with family can be exempt. They would need to have the family member sign a rent-free letter that Gustan Cho Associates has provided

FHA Loans With Low Credit Scores After Chapter 7 Bankruptcy

Here are the HUD Guidelines for FHA Loans After Chapter 7 Bankruptcy:

- There is a two-year waiting period after the discharge date of a Chapter 7 Bankruptcy

- No late payments after bankruptcy and re-established credit

- The minimum credit score required is 580 for a 3.5% down payment home purchase FHA loan.

Homebuyers can qualify for an FHA loan with credit scores down to 500 FICO. However, if your credit scores fall below 580 FICO, HUD requires a 10% down payment versus a 3.5% down payment on FHA loans.

FHA Loans With Recent Late Payments

FHA Loans With Low Credit Scores After Foreclosure

This section will cover FHA loans with low credit scores after foreclosure. Borrowers can qualify for FHA loans three years after the recorded date or sheriff’s sale date after the deed-in-lieu of foreclosure. Borrowers can qualify for FHA loans three years after the short sale date reflected on the HUD-1 Settlement Statement, now the new CD, or Closing Disclosure—no late payments after bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale. One or two late payments after bankruptcy or a housing event are not a deal killer.

FHA Loans With Low Credit Scores and Collections, Judgments, Federal Tax Liens

HUD does not require borrowers to pay outstanding collections and charge-offs to qualify for FHA loans with low credit scores. This section will discuss the HUD guidelines concerning collections, charge-offs, judgments, and federal debts. Collections and charge-offs do not have to be paid.

Medical collections and zero balance non-medical collection accounts are exempt from DTI calculations.

For non-medical outstanding collections with a total balance over $2,000, 5% of the outstanding collection account will be used for DTI calculation purposes. Suppose the 5% of the outstanding collection accounts is too much and will disqualify the borrower. In that case, the borrower can negotiate a written payment agreement with the creditor and use the agreed-upon figure instead of the 5%.

HUD Guidelines on Judgments and Tax Liens

Borrowers can qualify for FHA loans with outstanding judgments and federal debts, such as tax liens. However, a written payment agreement must be in effect, and three months of payments must be made. Homebuyers or homeowners who need to qualify for a mortgage with a mortgage company with no lender overlays on government or conventional loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Get expert mortgage advice now.