First Time Homebuyer Mortgage Questions On House Purchase

In this article, we will discuss and cover First Time Homebuyer Mortgage Questions On House Purchase. Buying a home for the first time is an exciting milestone. Still, it can also be overwhelming with all the questions and decisions you’ll face. One of the most significant aspects of this process is securing a mortgage. Here, we’ll address some of first-time home buyers’ most common questions about mortgages.

Top First Time Homebuyer Mortgage Questions On House Purchase

Two of the most common first time home buyer mortgage questions are the following:

- How much down payment do I need to purchase a home?

- Besides the down payment, do I need closing costs and how much closing costs do I need?

There are many other first time home buyer mortgage questions besides the top two that I will cover on this article.

How Much Down Payment Do I Need To Purchase A Home?

There are several types of mortgage loan programs. Each of these mortgage loan programs requires a certain amount of down payment. Here are the loan programs available and the down payment requirements for these mortgage loan programs:

- FHA Loans:

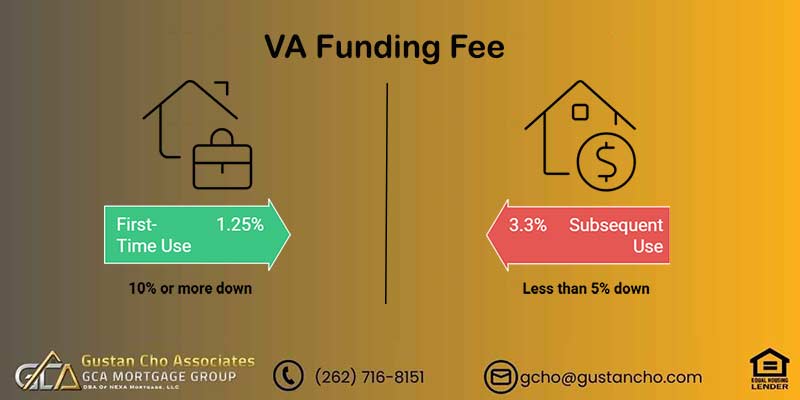

3.5% down payment required - VA Loans:

Does not require any down payment to qualify - USDA:

No down payment is required - Fannie Mae And Freddie Mac:

Fannie Mae and Freddie Mac are Conventional Loans. 3% is required for first time home buyers. A first time home buyer is defined as a home buyer who had no homeownership for the past three years. For non- first time home buyers, borrowers need 5% down payment on a home purchase - Jumbo Mortgages:

Need normally 20% down payment to qualify for Jumbo Loans

Speak With Our Loan Officer for Mortgage Loans

How Much Closing Costs Do I Need On A Home Purchase?

Unlike down payment, closing costs is not a fixed percentage of the purchase price of a home. Here are examples of closing costs:

- Title Charges

- Pre-Paid which are escrows for taxes and homeowners insurance

- Appraisal Fees

- Discount Points and Origination Fees

- One year homeowners insurance

- Attorneys costs

- Appraisal and Home Inspection Fees

- Other third-party closing costs

Sellers Concessions Or Lender Credit For First Time Home Buyer Mortgage Closing Costs

Closing costs can vary depending on city, county, state. Can range anywhere from 2% to 5% or more of the purchase price. The good news is that most buyers do not have to come up with any closing costs on a home purchase. There are two ways that closing costs can be covered by home buyers: Sellers Concessions & Lender Credit.

What Are Sellers Concessions?

All loan programs allow for a home seller to offer a sellers concession to a home buyer via sellers concessions. Sellers concessions can only be used for homebuyers to pay for the buyer’s closing costs. Cannot be used for the down payment. Here are the maximum amount of sellers concessions allowed for the individual mortgage loan programs:

- FHA allows up to 6% sellers concession

- VA Loans allows up to 4% sellers concessions

- USDA Loans allows up to 6% sellers concessions

- Fannie Mae and Freddie Mac allow up to 3% sellers concessions for owner occupant properties and second homes

- 2% sellers concessions for investment properties

Overages With Sellers Concessions

Sellers concessions can only be used for closing costs and not for the down payment. Any overages in sellers concessions cannot be kicked back to the home buyer and need to be returned to the home seller if it is not used. However, most lenders will apply any overages in sellers concessions to buy discount points and buy down the mortgage rates for the borrower

What Are Lender Credit?

In the event if the borrower cannot get sellers concessions towards paying closing costs, lenders can offer lender credit to the borrower:

- Lenders credit is offered by lenders so the borrower does not have to pay any closing costs

- A lender credit can be given to the borrower in lieu of a higher mortgage rate

- Lender credit is offered by lenders so borrowers do not have to come up with outside closing costs

- Lender Credit is not free

Borrowers pay for lender credit by getting a higher mortgage rate.

First Time Homebuyer Mortgage Questions: The Loan Process For First Time Home Buyers

Once renters have decided to become a first time home buyer, here is a list of tasks:

- Consult with a loan officer from a lending institution

- Get pre-approved for a mortgage loan

- If you are not pre-approved with the current lender find out why?

- Consult with other lenders and other loan officers and due your due diligence and see why you do not qualify?

- Is the reason that you do not qualify due to the lender overlays or because you do not meet the federal minimum lending guidelines?

If you already have been shopping at properties with your real estate agent, your real estate agent will refer you to mortgage loan originators and lenders. Realtors will refer a loan officer he or she has worked with before with success and had a smooth mortgage closing process with them. Click here to apply for mortgage loan first time

First Time Homebuyer Mortgage Questions: Referral By Real Estate Agents

Realtors are often selective when referring to loan officers. However, homebuyers should do their own due diligence when hiring a loan officer:

- Real Estate Agents are the go-to people in any home purchase transaction

- Most great realtors will oversee the whole home process

- Real estate agents can be the mediator between buyers and sellers

- Realtors can guide buyers and refer them to a lender and loan officer who had a similar type of case scenario

- Can shop for a lender and loan officer by searching the internet, asking for co-workers, asking family, asking friends for referrals

- Finding the right mortgage lender is one of the most important decisions borrowers will make

- It is not a matter of getting the best rates and terms

- Need to get along with loan officer and the lender needs to be able to do the loan specific to borrowers credit/income

Frequently Asked Questions (FAQs)

- What is a mortgage for first-time home buyers?

It’s a loan designed to help people purchase their first home. These loans often have special benefits, such as lower down payments, reduced interest rates, and assistance programs. - Who qualifies as a first-time home buyer?

Generally, a first-time home buyer has not owned a home in the past three years. However, qualifications can vary by program, so it’s important to check specific criteria for the loan you are considering. - What types of loans are available for first-time home buyers?

– FHA Loans: These loans, guaranteed by the Federal Housing Administration, needed lower down payments and credit scores.

– VA Loans: These loans are accessible to veterans and active-duty military members and usually require no initial fee.

– USDA Loans: Provide no down payment options for home buyers in rural and suburban areas.

– Conventional Loans: Traditional loans may have special programs for first-time buyers with lower down payment qualifications. - How much down payment is needed for a first-time home buyer mortgage?

The down payment requirement varies depending on the type of loan. FHA loans typically require 3.5%, VA and USDA loans may offer no down payment options and conventional loans can require as little as 3-5%. - What is private mortgage insurance?

It’s an insurance that protects the lender if you default on your mortgage. It is usually needed for conventional loans with a down payment of less than 20%. FHA loans require a similar insurance called MIP (Mortgage Insurance Premium). - What are the benefits of being a first-time home buyer?

– Lower Down Payments: Many programs offer reduced down payment requirements.

– Tax Credits: Some programs provide tax credits for first-time buyers.

Assistance Programs: There are various state and local programs offering grants and loans to help with down payments and closing costs. - What is pre-approval, and why is it important?

Pre-approval occurs when a lender evaluates your financial status and decides how much they will lend you. It is essential because it shows sellers that you are a committed buyer and can afford the home you want to buy. - How do I get pre-approved for a mortgage?

To get pre-approved, you need to submit an application to a lender along with documents such as proof of earnings, tax returns, and credit reports. The lender will evaluate your financial record and credit score to determine your eligibility. - What should I consider when choosing a lender?

– Interest Rates: Shop around and assess rates from various lenders to ensure the best deal.

– Loan Terms: Consider the loan term and the monthly payment amounts.

– Customer Service: Choose a lender with good reviews and responsive customer service.

– Fees: Be aware of all loan fees, including origination fees, closing costs, and PMI. - What are closing costs, and how much should I expect to pay?

Closing costs are fees for finalizing your mortgage, including appraisal, title insurance, and attorney fees. They usually range from 2% to 5% of the entire loan amount. - Can I use gift money for my down payment?

Many loan programs permit you to use gift money from family or friends for your down payment. You must provide a gift letter stating that the money is a gift, not a loan. - What is a fixed-rate vs. adjustable-rate mortgage?

Fixed-Rate Mortgage: The interest charge remains unchanged for the entire loan term, offering stable and predictable payments.

Adjustable-Rate Mortgage (ARM): The interest charge can change periodically, so your monthly payments can go up or down. - How does my credit score impact my mortgage eligibility?

Your credit score is a major factor in identifying your eligibility for a mortgage. Higher scores can lead to better interest rates and loan terms. In comparison, lower scores limit your options or require higher interest rates. - Are there special programs for first-time home buyers with low income?

Yes, there are various federal, state, and local programs aimed at assisting low-income first-time home buyers. These programs may offer reduced down payments, lower interest rates, or grants to help with the purchase. - What is a home inspection, and why is it important?

A home inspection examines the property to identify any issues or necessary repairs. It’s important because it helps you understand the home’s condition and can prevent unexpected costs after purchase. - How long does the mortgage approval process take?

The mortgage approval process typically takes 30 to 45 days but can differ depending on the lender and your financial situation.

For more information about first time homebuyer mortgage questions on purchase and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.