Using Hard Money Loans To Buy Investment Properties

In this blog, we will cover using hard money loans to buy investment properties. Hard money loans are only for non-owner-occupant primary properties. Residential mortgage rules and regulations prohibit hard money loans on residential mortgage lending due to the SAFE Act of 2008 and predatory lending laws.

Asset-Based Mortgage Loans For Real Estate Investors

Why do Real Estate Investors Prefer To Use Hard Money Loans Versus Traditional Loans?

Hard Money Loans are not necessarily for real estate investors with bad credit. Hard money loans are used by sophisticated investors with great credit and income. Why is that?

Hard money lenders can normally close a real estate loan in 30 days or less. There is no stress and red tape during the hard money loan mortgage process.

Mortgage Lending Process on Hard Money Loans

You do not need environmental reports, multiple surveys, two appraisals, engineering reports, income tax returns, financial statements, and other personal financial statements and information.

Hard money loans are asset and collateral based. The high interest is worth every penny for investors who want no stress and a quick fast easy closing.

Timeline From Application To Closing on Hard Money Loans

What Are Hard Money Loans?

There are limited to no lending regulations on investment properties. Regulators and federal law consider real estate investors as sophisticated investors. Therefore, residential lending regulations normally do not apply. In the following paragraphs, we will cover hard money loans and how hard money loans work.

Traditional Versus Hard Money Loans?

Why would any real estate investors use hard money loans versus traditional commercial loans to buy real estate? Hard money loans are high-interest quick cash loans 0ffered by private money investors.

Do Lenders of Hard Money Loans Go Off Credit Score?

Hard money investors mainly are concerned with the borrower’s assets and collateral versus their income and credit.

The ability to repay is more based on if they do not pay, the investor will forfeit the property.

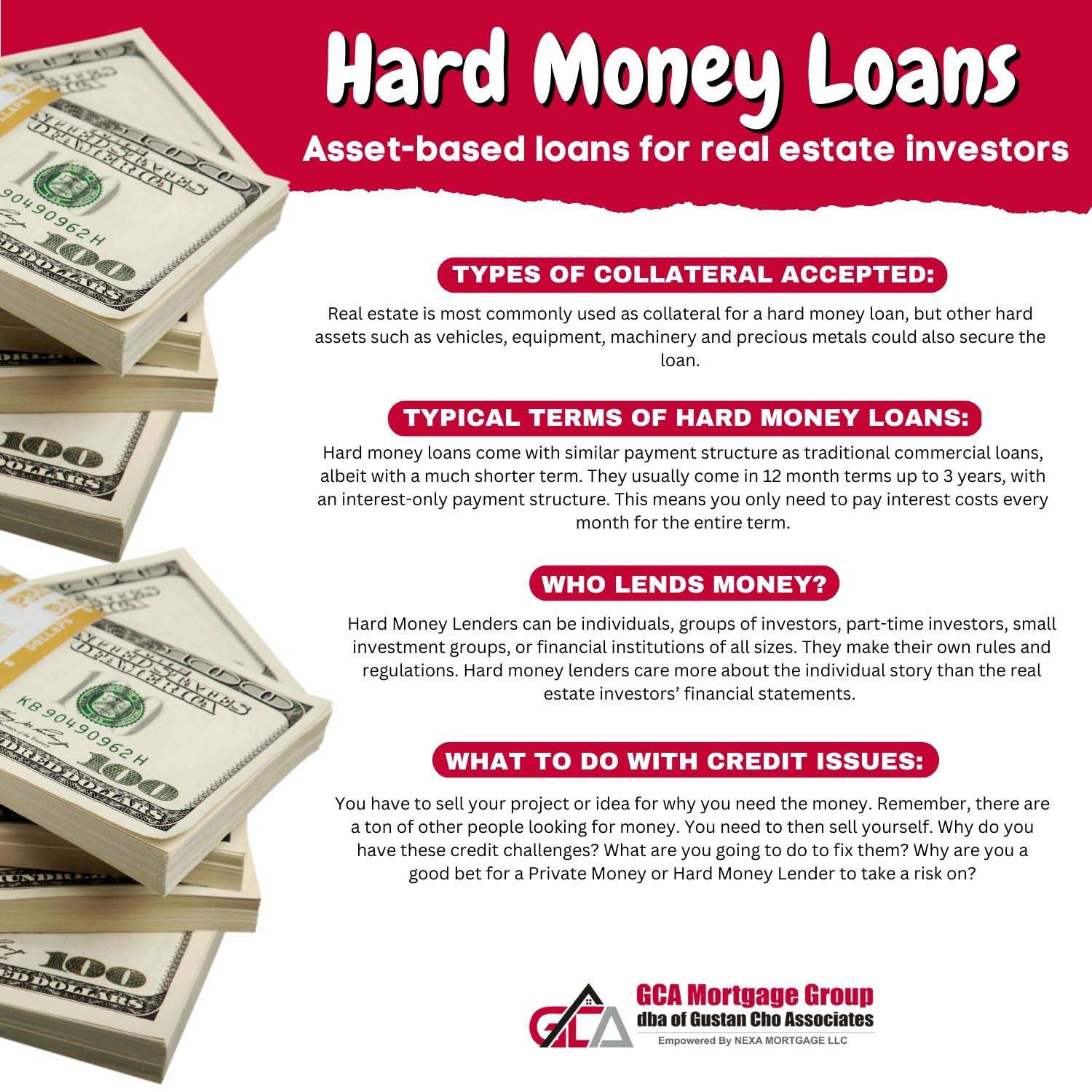

What Type of Collateral Do Hard Money Lenders Require?

Hard money lenders offer hard money loans with large down payments, high costs and fees, and high-interest rates.

Still, many real estate investors would pay high interest and fees to be able to purchase investment properties with hard money loans versus not being able to have the opportunity to buy.

Capitalizing with Hard Money Loans

Do real estate investors need hard money loans? Hard money lending is a huge industry. Many real estate investors will not have the opportunity to be able to buy investment properties without having money loans. Many investors would not be able to invest in real estate without hard money lenders.

Why Would You Use a Hard Money Lender Versus a Traditional Bank?

Hard money lenders are more interested in collateral and assets versus income and credit. Hard money loans are not just for investors with bad credit or investors who cannot show income.

Hard money loans are for investors who are willing to pay the higher interest and costs of the loan because it is much quicker to close on hard money versus traditional investment mortgage loans.

What Are Typical Terms of Hard Money Lenders?

Real estate is hot again throughout the United States. Since the 2008 Real Estate and Mortgage Meltdown and property, investors are back purchasing properties, rehabbing them, and reselling them at a handsome profit.

Why Are Hard Money Loans So Popular?

With tough mortgage rules and regulations with conforming loans, many real estate investors are turning to hard money loans. Traditional loans take an average of 60 days to close on investment properties.

The average timeframe for Fannie Mae and Freddie Mac investment conventional loans take over 45 days to close. Many property investors are turning to Hard Money Loans due to fast turn times of less than two weeks. Closing with hard money loans can take as fast as less than a week.

Hard Money Loans For Bad Credit

How did I get Cash out of my Investment Property while I was getting my Credit Fixed? This is a story a client told me recently. In the paraphrased words of Bob the Borrower:

Who Lends Money on Hard Money Loans?

Hard Money Lenders can be individuals, groups of investors, part-time investors, small investment groups, or financial institutions of all sizes. They make their own rules and regulations. Hard money lenders care more about the individual story than the real estate investors’ financial statements. Once you develop a relationship with a hard money lender, there are many instances they will lend you on a handshake.

Lender Three of Hard Money Loans

Lender number 3 asked about all my credit issues after Bob told him about the 2 flats in Tampa, Florida he could buy for $62,000 and sell for $150,000 after he put $15,000 into it. Why did he now ask him about my credit? He was interested in the deal. Bob had a house worth $180,000 that he owed $15,000 on. Then he had a clear plan, a good deal in place, and Bob appeared to Hard Money Lender 3 to know what the heck he was doing.

Hard Money Loans With Bad Credit

Borrower Bob had credit challenges, but he learned that he has to present an opportunity to a Private Money Lender that makes sense, and helps them both make money.

Can I Get Approved For Hard Money Loans With Poor Credit?

First, you have to sell your project or idea for why you need the money. Remember, there are a ton of other people looking for money. You need to then sell yourself.

Why do you have these credit challenges? What are you going to do to fix them? Why are you a good bet for a Private Money or Hard Money Lender to take a risk on? If you are a real estate investor in need of hard money loans for an investment property, contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

Advantages of Utilizing Hard Money Loans for Real Estate Investments

1. Quick Approval and Funding

- Speedy Process: Hard money loans are known for their rapid approval and funding process, often taking just a few days compared to weeks or months for traditional loans.

- Competitive Advantage: This speed can be crucial in competitive real estate markets where timing is needed to secure a desirable property.

2. Less Stringent Credit Requirements

- Credit Score Flexibility: Hard money lenders focus more on the property’s value than the borrower’s credit score, making it accessible for those with less-than-perfect credit.

- Alternative Qualification: Investors struggling to qualify for traditional loans due to past credit issues can still obtain financing.

3. Greater Flexibility in Terms and Conditions

- Customized Terms: Hard money loans often come with more flexible terms that can be customized to meet the unique requirements of the borrower and the project.

- Negotiable Terms: Borrowers and lenders can negotiate mutually beneficial terms, often impossible with traditional loans.

4. Focus on Property Value

- Asset-Based Lending: The primary concern for hard money lenders is the value of the property being used as collateral. If the property has substantial value, it is easier to secure funding.

- Opportunity for Investment: Investors can finance properties that might not qualify for traditional loans, such as those needing significant repairs or renovations.

5. Ability to Finance Properties Needing Renovation

- Rehab Projects: Hard money loans are ideal for fix-and-flip projects because they can cover the cost of both the purchase and the renovation of the property.

- Increased Property Value: By financing renovations, investors can increase the property’s value and achieve higher returns upon resale.

6. Short-Term Financing Solution

- Bridge Loans: Hard money loans can act as bridge loans, providing short-term financing until a more permanent solution is found.

- Transitional Financing: Investors can use these loans to transition between properties or to secure a property while arranging long-term financing.

7. Opportunity to Build a Track Record

- Investor Credibility: Successful repayment and project completion can help investors build a track record with lenders, making it easier to obtain future financing.

- Business Growth: Establishing a good relationship with hard money lenders can open additional funding opportunities for larger or multiple projects.

8. Potential for Higher Returns

- Leverage Opportunities: Investors can leverage hard money loans to finance multiple projects simultaneously, potentially increasing their overall returns.

- Quick Turnaround: The ability to quickly purchase, renovate, and sell properties can lead to faster and potentially higher profits.

9. No Prepayment Penalties (in many cases)

- Flexible Repayment: Certain hard money loans lack prepayment penalties, enabling borrowers to settle the loan ahead of schedule without incurring additional fees.

- Cost Savings: Early repayment can save on interest costs and increase profitability.

10. Access to Properties in Need of Repair

- Investment Opportunities: Investors can purchase distressed properties that traditional lenders may deem too risky.

- Market Niche: This access allows investors to enter a niche market and capitalize on properties others might overlook.

11. Simplified Application Process

- Less Paperwork: The application process for hard money loans is generally less cumbersome and requires fewer documents than traditional loans.

- Efficiency: This streamlined process allows investors to focus on their projects rather than being bogged down by extensive paperwork.

Frequently Asked Questions (FAQs)

1. What is a hard money loan?

A hard money loan is a type of loan secured by real property. It is typically issued by private investors or companies and is often used for real estate transactions.

2. How does a hard money loan differ from a traditional mortgage?

Hard money loans are asset-based and focus more on the property’s value than the borrower’s creditworthiness. They usually have higher interest rates, shorter terms, and faster approval processes than traditional mortgages.

3. What are the typical terms of a hard money loan?

Hard money loans generally have terms ranging from 6 months to 3 years, with interest rates between 8% and 15%. They often require a down payment of 20% to 30% of the property’s value.

4. What properties can be purchased with a hard money loan?

Hard money loans can be used to buy various properties, including single-family homes, multi-family units, commercial properties, and land for development.

5. What are the benefits of using a hard money loan for investment properties?

- Speed: Hard money loans can be eligible and funded quickly, often within a few days.

- Flexibility: These loans can be customized to fit the investor’s needs.

- Less stringent requirements: They are less dependent on the borrower’s credit score and more focused on the property’s value.

6. What are the risks associated with hard money loans?

- Higher interest rates: They usually have higher rates than traditional loans.

- Shorter terms: The short repayment period can be challenging for some investors.

- Potential for property loss: If the borrower defaults, the lender can take control of the property.

7. Who should consider using a hard money loan?

Real estate investors who need quick financing, have poor credit, or want to finance a property that doesn’t qualify for traditional loans might consider hard money loans.

8. How can I qualify for a hard money loan?

Qualification is primarily based on the property’s value as collateral. Lenders will also consider the borrower’s equity in the property, the property’s condition, and the investor’s experience.

9. How do I find a hard money lender?

Hard money lenders can be found through online searches, real estate investment groups, networking with other investors, and contacting mortgage brokers specializing in investment properties.

10. What is the process for obtaining a hard money loan?

- Application: Submit an application with details about the property and your investment plans.

- Property evaluation: The lender will appraise the property’s value.

- Loan terms: If approved, the lender will present the loan terms, including interest rate, fees, and repayment schedule.

- Funding: Once you agree to the terms, the loan can be funded, often within a few days.

11. Can hard money loans be used for property renovations?

Yes, many hard money loans are designed to finance property purchases and renovations, making them popular with fix-and-flip investors.

12. What fees are associated with hard money loans?

Common fees include origination fees (usually 1% to 3% of the loan amount), appraisal fees, and closing costs. Some lenders may also charge prepayment penalties.

13. Are hard money loans regulated?

Hard money loans are less regulated than traditional mortgages. However, they must comply with state usury laws, and reputable lenders adhere to ethical lending practices.

14. Can I refinance a hard money loan with a traditional mortgage?

Many investors use hard money loans as a short-term solution and later refinance with a traditional mortgage once the property is stabilized or their credit situation improves.

15. What should I look for in a hard money lender?

Look for a lender with a good reputation, transparent terms, reasonable interest rates, and experience in financing the type of property you are investing in.