High Debt-To-Income Ratio Mortgage Loans

Many new high debt-to-income ratio mortgage loans have been recently launched and introduced to the market. No-doc loans, DSCR mortgages, profit and loss statement-only mortgage loans, bank statement mortgages, and asset-depletion loans are some non-QM loan programs that do not require income docs and are based on other income/asset factors.

Many borrowers think they will not qualify for a mortgage loan because they have a high debt-to-income ratio. Many lenders have overlays on debt-to-income ratios. Large outstanding student loans are one of the biggest hurdles in not qualifying for a home mortgage due to high debt-to-income ratios. Deferred student loans for longer than 12 months are no longer exempt from debt-to-income ratio calculations unless they are VA loans.

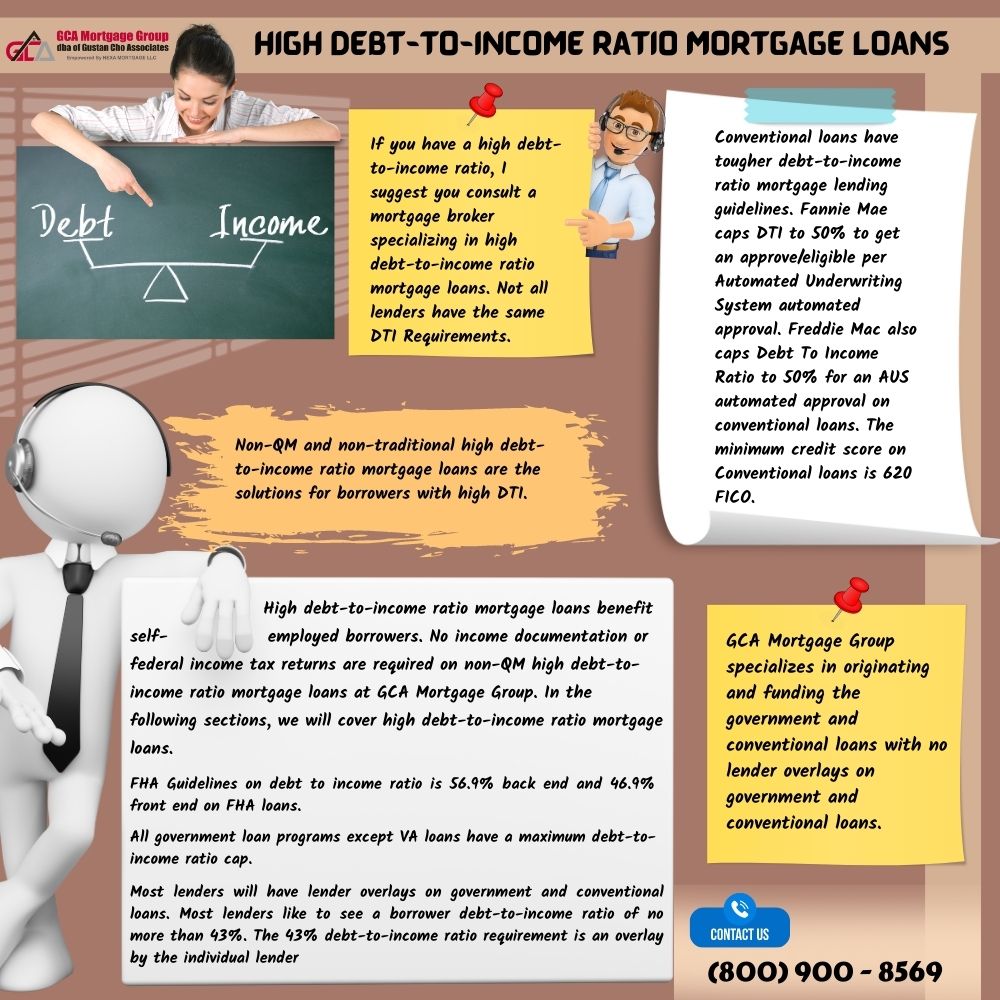

Non-QM and non-traditional high debt-to-income ratio mortgage loans are the solutions for borrowers with high DTI. High debt-to-income ratio mortgage loans benefit self-employed borrowers. No income documentation or federal income tax returns are required on non-QM high debt-to-income ratio mortgage loans at Gustan Cho Associates. In the following sections, we will cover high debt-to-income ratio mortgage loans.

VA Loan Requirements on Deferred Student Loans

VA loans are the only home mortgage program that exempts deferred student loans that are deferred for longer than 12 months. FHA loans are the best home mortgage loan program for a high debt-to-income ratio.

If the borrower has a large outstanding student loan balance, the loan officer may want to switch the borrower to a conventional loan or FHA loan. Fannie Mae, Freddie Mac, and now HUD allow income-based repayment (IBR Payments) on conventional and FHA loans.

HUD, the parent of FHA, now allows income-based repayment. You can have zero IBR payment, and the zero monthly IBR payment will be used as your monthly student loan payment when underwriters calculate your debt-to-income ratios on both FHA and Conventional loans.

Agency Guidelines Versus Lender Overlays

All government and conventional loans need to meet the minimum agency mortgage guidelines. All government loan programs except VA loans have a maximum debt-to-income ratio cap.

Fannie Mae and Freddie Mac Agency Mortgage Guidelines cap debt-to-income ratios at 50% DTI on conventional loans. However, individual lenders can have stricter lending requirements called lender overlays on government and conventional loans.

Individual lenders can have lenders overlays that are lower than the maximum allowed by FHA, VA, USDA, Fannie Mae, and Freddie Mac.

Mortgage Companies With Lender Overlays

Case Scenario Of Lender Overlays: Most lenders will have lender overlays on government and conventional loans. Most lenders like to see a borrower debt-to-income ratio of no more than 43%. The 43% debt-to-income ratio requirement is an overlay by the individual lender and is not HUD Guidelines.

HUD Guidelines On Debt To Income Ratios allows up to 46.9% front-end DTI and 56.9% back-end DTI for borrowers with 620 credit scores or higher.

Gustan Cho Associates specializes in originating and funding the government and conventional loans with no lender overlays on government and conventional loans.

Lenders Specializing In High Debt-To-Income Ratio Mortgage Loans

If you have a high debt-to-income ratio, I suggest you consult a mortgage broker specializing in high debt-to-income ratio mortgage loans. Not all lenders have the same DTI Requirements.

Every lender has different lender overlays on debt-to-income ratio and credit score overlays. Just because one lender has a maximum debt-to-income ratio requirement of 43% doesn’t mean all lenders do.

As mentioned earlier, FHA Guidelines on debt to income ratio is 56.9% back end and 46.9% front end on FHA loans.

DTI Requirements on Conventional Loans

Conventional loans have tougher debt-to-income ratio mortgage lending guidelines. Fannie Mae caps DTI to 50% to get an approve/eligible per Automated Underwriting System automated approval. Freddie Mac also caps Debt To Income Ratio to 50% for an AUS automated approval on conventional loans. The minimum credit score on Conventional loans is 620 FICO.

Another way to solve a high debt-to-income ratio problem is to pay off existing debt and creditors. Paying off available credit card balances to eliminate the monthly payments would be a great start.

A car payment can usually be 300 dollars or more per month. Paying off a car loan can give a lot of buying power. Trading existing high-payment car payments for lower-car payments can help.

Non-Occupant Co-Borrowers Mortgage Guidelines

Borrowers with a high debt-to-income ratio trying to qualify for FHA loans can have non-occupant co-borrowers added to the loan. The Federal Housing Administration allows multiple non-owner-occupied co-borrowers. To qualify for a 3.5% down payment home purchase FHA loan with non-occupant co-borrowers, the non-occupant co-borrowers need to be related to the main borrower by blood, law, or marriage.

FHA Non-Occupant Co-Borrower Requirements Not Related To Borrowers

Non-occupant co-borrowers who are not related to the main borrower by law, blood, or marriage can still become non-occupant co-borrowers, but the main borrower needs to put a 25% down payment versus 3.5%.

Fannie Mae Freddie Mac allows non-occupant co-borrowers on conventional loans. Non-Occupant co-borrowers do not need to be related to the main borrower by law, marriage, or blood.

The only co-borrowers allowed on VA loans are the married spouse of the veteran borrower. Non-occupant co-borrowers are not allowed on VA loans. USDA loans do not allow for non-occupant co-borrowers.

Non-Traditional Income High Debt-To-Income Mortgage Loans

Mortgage lenders have income requirements. Overtime, part-time, and bonus income can be used as additional income. Overtime, part-time, commission and bonuses can be used as other income. This holds only if the borrower has a two-year history of earning such income.

If it is close to 2 years, a letter will be required by the company’s human resources department stating that the borrower will be guaranteed so many hours for the next six to twelve months can be used. Rental income can be used if declared on income tax returns. Depreciation can be added back as income if stated on income tax returns.

Implications of a High DTI Ratio

1. How a High DTI Ratio Affects Mortgage Approval

- Increased Risk for Lenders: A high DTI ratio indicates that an important portion of your income is already committed to debt repayment. Lenders may view this as a higher risk, as you may need more financial flexibility to manage mortgage payments and other expenses.

- Stricter Qualification Standards: Borrowers with high DTI ratios often face more stringent qualification standards. Lenders may need higher credit scores, larger down payments, or additional documentation to mitigate the perceived risk.

- Limited Loan Options: Some loan programs have strict DTI ratio limits. For example, conventional loans typically require a DTI ratio of 43% or lower. Borrowers with higher DTI ratios may need to look for alternative loan options, such as FHA, VA, or non-QM loans, with more flexible DTI requirements.

2. Impact on Interest Rates and Loan Terms

- Higher Interest Rates: Lenders may demand higher interest amounts to compensate for the increased risk associated with a high DTI ratio. This can result in higher monthly mortgage obligations and overall loan costs.

- Less Favorable Loan Terms: Besides higher interest rates, borrowers with high DTI ratios may receive less favorable loan terms. This could include shorter loan terms, higher down payment requirements, or the inability to secure certain types of loans (e.g., adjustable-rate mortgages).

- Increased Private Mortgage Insurance (PMI): If your down payment is less than 20%, lenders may need PMI to protect against default. With a high DTI ratio, the cost of PMI may be higher, adding to your monthly expenses.

3. Financial Risks Associated with a High DTI Ratio

- Increased Financial Strain: Managing high debt levels and a mortgage can strain your finances. Unanticipated expenses, such as medical expenses or car repairs, can become difficult to manage and increase the risk of missing mortgage payments.

- Higher Default Risk: Borrowers with high DTI ratios are at a greater risk of defaulting on their loans if their financial situation changes, such as a job loss or an important reduction in income. Defaulting on a mortgage can have serious impacts, including foreclosure and long-term damage to your credit score.

- Limited Savings and Emergency Funds: High debt payments can leave little room for saving. Withers may struggle to cover unexpected expenses with adequate emergency funds, leading to increased reliance on credit and higher overall debt.

- Impact on Future Borrowing: A high DTI ratio can limit your ability to ensure additional loans or credit. Lenders may hesitate to extend more credit if they see that much of their income is already allocated to existing debts.

Understanding these implications can help borrowers with high DTI ratios make informed decisions and take steps to enhance their financial situation before applying for a mortgage. This might include paying down existing debt, increasing income, or saving for a higher down payment to reduce the DTI ratio and improve loan approval chances.

Frequently Asked Questions (FAQs)

1. What is a Debt-To-Income Ratio?

The DTI compares your monthly debt responsibilities to your monthly gross income. Lenders use it to assess your capability to manage monthly payments and repay debts.

2. What is considered a high DTI ratio?

Most lenders consider a DTI ratio above 43% high. However, some lenders may approve loans for borrowers with a DTI ratio of 50% or more based on other elements like credit score, savings, and overall financial situation.

3. Can I get a mortgage with a high DTI ratio?

Yes, getting a mortgage with a high DTI ratio is possible. Certain loan programs, like FHA loans, are more lenient and have higher DTI ratios. Additionally, some lenders specialize in non-QM (Non-Qualified Mortgage) loans that cater to borrowers with high DTI ratios.

4. What factors do lenders consider when approving high DTI ratio loans?

Lenders will consider several factors, including:

- Credit Score: Higher credit scores can offset the risk associated with a high DTI ratio.

- Down Payment: A greater down payment can make lenders more comfortable with a higher DTI ratio.

- Employment History: Stable and sufficient income can help mitigate the risk.

- Savings and Assets: Substantial savings or liquid assets can demonstrate financial stability.

5. How can I increase my chances of getting approved with a high DTI ratio?

- Improve Your Credit Score: Pay down existing debt and ensure timely payments to boost your credit score.

- Increase Your Down Payment: Save more money for a larger down payment.

- Reduce Debt: Pay off as much existing debt as possible to lower your DTI ratio.

- Stable Income: Demonstrate a stable and reliable income source.

6. What types of loans are available for high DTI ratio borrowers?

- FHA Loans: These loans are more lenient on DTI ratios and require a lower down payment.

- VA Loans: Available to veterans, they often have flexible DTI ratio requirements.

- Non-QM Loans: Non-qualified mortgages are designed for borrowers who do not meet traditional lending standards, including those with high DTI ratios.

- USDA Loans: These loans for rural properties may have flexible DTI requirements.

7. What are the risks of getting a mortgage with a high DTI ratio?

- Financial Strain: High monthly payments can lead to financial stress and limited disposable income.

- Higher Interest Rates: Loans for high DTI ratio borrowers may have higher interest rates.

- Potential for Default: Higher risk of defaulting on the loan if your financial situation changes.

8. Are there any alternatives if I can’t qualify for a high DTI ratio mortgage?

- Co-Signer: Having a co-signer with a better financial profile can help you qualify.

- Loan Programs: Explore different loan programs that may have more flexible requirements.

- Debt Consolidation: Consider consolidating your debts to lower your monthly obligations and improve your DTI ratio.

9. How does a high DTI ratio affect the mortgage approval process?

A high DTI ratio can complicate the approval process as lenders may see it as a higher risk. You may need to provide additional documentation and evidence of financial stability. It might also lengthen the time it takes to get approval.

10. Can refinancing help if I have a high DTI ratio?

Refinancing can be an alternative to lower your monthly obligations and improve your DTI ratio. However, qualifying for refinancing with a high DTI ratio can be challenging, and it may depend on other factors like your credit score and equity in your home.

Mortgage borrowers with a higher debt-to-income ratio and looking for a lender with no lender overlays can call us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.