Home Loan After Loan Modification Mortgage Guidelines

This blog will cover qualifying for a home loan after loan modification mortgage guidelines. A loan modification is when the current lender restructures the homeowner’s current mortgage loan to make it affordable for homeowners and avoid foreclosure. There are various ways of modifying a mortgage. The delinquent payments of the mortgage payments homeowners have been delinquent can be added to the back of the mortgage loan balance. This way, the homeowner can afford their housing payments. This will enable homeowners to stay in their homes instead of facing foreclosure. Angie Torres, the National Operations Director at Gustan Cho Associates, said the following about qualifying for a home loan after loan modification:

Loan modifications used to be very popular right after the 2008 Real Estate and Mortgage Collapse. Homeowners with upside-down mortgages lost their jobs or businesses and could not afford their mortgage payments. Lenders often offered loan modifications to homeowners who could prove their financial hardship but would be able to afford their mortgage payments and other monthly expenses.

A homeowner can qualify for another mortgage after a loan modification. However, to qualify for another mortgage after a loan modification, there are mandatory waiting periods to qualify for a mortgage loan after a loan modification. This is dependent on the type of loan program. This article will discuss qualifying for a mortgage after modification for FHA and VA loans.

Understanding Loan Modification:

Definition and Purpose

A loan modification is a change made to the lender’s terms of an existing mortgage. The primary reason for a loan modification is to assist borrowers struggling to make their mortgage payments by adjusting the loan’s terms to make it more manageable. Modifications are often used as an alternative to foreclosure, allowing borrowers to keep their homes while addressing financial hardships.

Common Types of Modifications

- Interest Rate Reduction: Lowering the interest rate on the loan can reduce the monthly payment, making it more affordable for the borrower.

- Term Extension: Extending the loan loan can spread the remaining balance over a longer period, lowering the monthly payment. For example, a 30-year mortgage might be extended to 40 years.

Principal Forbearance: A part of the principal balance is deferred or forgiven, reducing the amount owed on the loan. This can significantly lower monthly payments. However, the deferred amount may need to be repaid when the loan term concludes, or the property is sold.

Eligibility Criteria for Loan Modifications

- Financial Hardship: Borrowers must prove they are facing financial trouble, such as unemployment, medical bills, or other circumstances impacting their ability to make mortgage payments.

- Current Mortgage Status: Some lenders require borrowers to be delinquent on their mortgage payments, while others may offer modifications to current borrowers who are at risk of default.

- Ability to Pay: Borrowers must show sufficient income to make the modified payments. This often involves providing documentation such as pay stubs, tax returns, and bank statements.

- Owner-Occupied Property: Typically, the property must be the borrower’s primary residence. Investment properties and second homes may not qualify for modification programs.

- Loan Type and Investor Guidelines: The type of loan and the investor holding the loan (e.g., Fannie Mae, Freddie Mac, FHA, VA) can influence eligibility and the specific available modification options.

Understanding these key aspects of loan modifications can help borrowers navigate the process and determine if it’s a viable solution for their financial situation.

How Can A Homeowner Qualify For Loan Modification?

Homeowners can have extenuating circumstances such as the following:

- have had periods of unemployment

- loss of business

- medical issues

- divorce

- or other extenuating circumstances

Extenuating Circumstances By Homeowners

Extenuating circumstances often disrupt homeowners’ steady flow of income disrupted. They often fall behind on their mortgage and are on the verge of foreclosure. These homeowners can qualify for a home loan modification. Lenders do not want to foreclose. Alex Carlucci advises the following:

Homeowners who had a sudden change of circumstances, such as a loss of employment, are undergoing a divorce, or have other issues, should contact their lender before defaulting on any mortgage payments. Lenders do not want borrowers’ homes.

. They do not want to foreclose on borrowers’ homes. Lenders want to work with borrowers. Often lenders do understand that extenuating circumstances do happen. Lenders can offer homeowners a mortgage workout plan or loan modification plan.

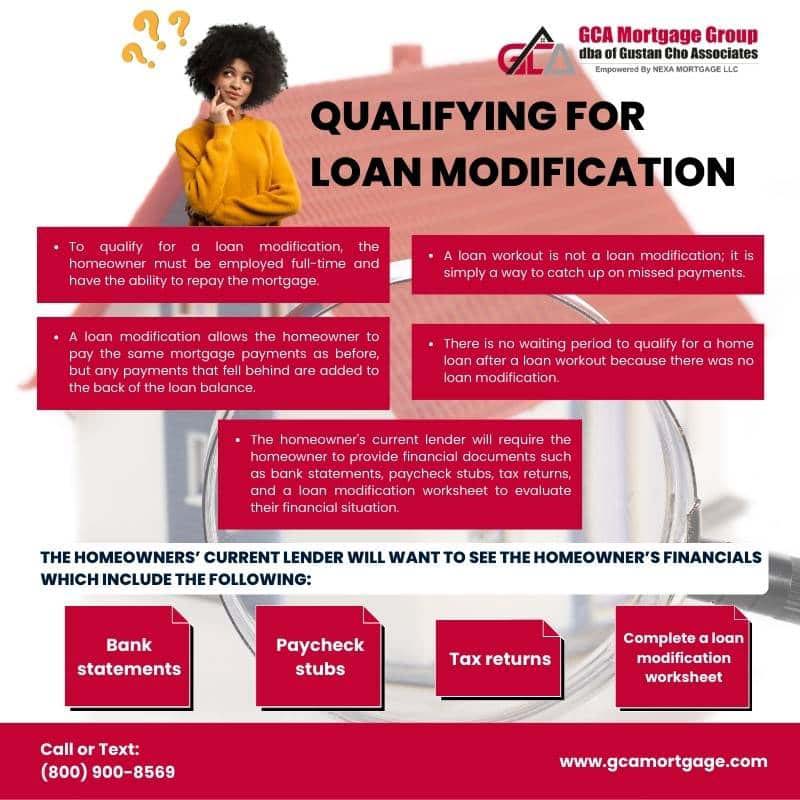

Qualifying For Loan Modification

To qualify for a loan modification, the homeowner needs to be employed full-time with the ability to repay the mortgage. It will often be near impossible to repay the mortgage payments so the homeowner will pay the same payments as before on a loan workout. But the number of payments that fell behind will be added to the back of the loan balance. This is not a loan modification. It is called a loan workout. On a loan workout, there is no waiting period to qualify for a home loan after a loan modification. This is because there was no loan modification. The homeowners’ current lender will want to see the homeowner’s financials which include the following:

- bank statements

- paycheck stubs

- tax returns

- complete a loan modification worksheet

Documents Required To Qualify For Home Loan Modification

Again, to qualify for a loan modification, the homeowner must show they are employed full-time. The lender will then look at the homeowner’s financials, including their income and expenses, and decide on the maximum home expenses the homeowner can afford. Once the lender has determined the maximum housing expenses, the lender will determine whether or not the homeowner can qualify for a loan modification. Dale Elenteny of Gustan Cho Associates issued the following statement on getting a home loan after loan modification:

If the current payments the homeowner is paying are too much, the lender will determine a lower amount of the new payment the homeowner can afford. This can be accomplished by the lender lowering the mortgage rates to a lower rate than the actual rate. Or, the lender may discount the original loan balance, take a loss, and restructure the mortgage loan.

The loan modification process is a process and may take many months. Once a settlement has been reached, the borrower will have their loan modification finalized and start making payments with the new agreed payment.

Qualifying For Government Home Loan After Loan Modification

Homeowners who had a loan modification may decide to sell their home after the mortgage loan modification was done and purchase a new home. Suppose the homeowner who had a prior loan modification done decides to sell their current home and purchase another home with an FHA loan. In that case, there is a mandatory waiting period to qualify for a home loan after loan modification.

To qualify for an FHA home loan after loan modification, there is a one-year waiting period after the loan modification. Proof of 12 months of timely payments to the lender after the modified loan. There cannot be any late payments after the home loan modification.

Lenders want not only to see timely payments on mortgage payments but all of the other monthly debt payments to be paid timely in the past 12 months. VA and USDA loans have the same one-year waiting period to qualify after a loan modification.

Qualifying For Conventional Home Loan After Loan Modification

Qualifying for a conventional home loan after loan modification requires a waiting period of four years after the loan modification if the mortgage loan has been restructured. Fannie Mae and Freddie Mac define a restructured mortgage loan as a home loan in which the lender has changed the original terms and conditions. It has been changed or restructured by the following:

- Either by the lender forgiving part or all of the mortgage loan balance

- or if the lender had to restructure the original debt by modifying the original loan to a new mortgage by reducing the interest rate

- or by reducing the monthly principal and interest payments so the homeowner can afford to pay the payments and stay and keep their home

Restructuring Loan To Make It Affordable

This section will cover examples of restructuring a home loan through loan modification. The lender will forgive a portion of the principal, interest, or a combination of both on the first or second mortgage loan balance. Application of a principal curtailment, except as permitted by policy. Converting any portion of the original mortgage loan debt to a “soft” subordinate mortgage

They are converting any portion of the original mortgage debt from secured to unsecured. Borrowers can qualify for a conventional home loan after modification 48 months have passed since the restructuring of the mortgage loan modification has occurred. Borrowers cannot have any late mortgage payments for the past 24 months.

Frequently Asked Questions (FAQs)

1. How is a loan modification defined?

A loan modification is a change to the lender’s terms of an existing mortgage. It is typically used to help borrowers struggling to make their mortgage payments. Changes can include lowering the interest amount, prolonging the loan term, or lessening the principal balance.

2. Can I get a new mortgage after a loan modification?

Yes, it is possible to get a new mortgage after a loan modification. However, you need to meet specific guidelines and waiting periods, which vary based on the type of loan and the lender’s policies.

3. What are the waiting periods for getting a new mortgage after a loan modification?

The waiting periods can vary:

- Conventional Loans Usually require a waiting period of 2 years from the date of the loan modification.

- FHA Loans generally require a one-year waiting period if the borrower has made 12 months of on-time payments under the modified terms.

- VA Loans: Usually require a waiting period of 1-2 years, depending on the lender’s guidelines.

- USDA Loans: Typically require a 1-3 year waiting period, depending on the circumstances and lender requirements.

4. Will a loan modification affect my credit score?

Yes, a loan modification can impact your credit score. The impact depends on how the modification is reported to the credit bureaus. Initially, your score may drop, but it can recover over time with consistent, on-time payments.

5. What documentation will I need to apply for a new mortgage after a loan modification?

You will generally need:

- Proof of income (pay stubs, tax returns, W-2s)

- Bank statements

- A copy of your loan modification agreement

- Proof of on-time payments under the modification terms

- Employment verification

6. Do I need to meet specific guidelines to qualify for a new mortgage after a loan modification?

Yes, guidelines can include:

- Maintaining a stable income and employment history

- Having a debt-to-income (DTI) ratio within the acceptable range

- Providing a sufficient down payment (amount varies by loan type)

- Ensuring your credit score meets the lender’s minimum requirements

7. Can I refinance my mortgage after a loan modification?

Yes, refinancing is possible after a loan modification. However, you must meet the lender’s criteria, which may include a waiting period similar to that for obtaining a new mortgage.

8. Are there any special programs for borrowers with a loan modification?

Some lenders offer special programs or products for borrowers with a loan modification history, but availability and terms vary widely. It’s important to shop around and consult with a mortgage professional.

9. How can I enhance my possibility of getting approved for a mortgage after a loan modification?

To improve your chances:

- Maintain a consistent payment history

- Improve your credit score by managing debt and making timely payments

- Save for a larger down payment

- Keep thorough records of your financial situation and loan modification agreement

10. What are the risks of getting a new mortgage after a loan modification?

Risks include:

- Potentially higher interest rates due to perceived credit risk

- Stricter lending criteria

- Possibility of not being approved if you don’t meet the guidelines

- Financial strain if new mortgage payments are not sustainable

11. Who should I consult before applying for a new mortgage after a loan modification?

It is advisable to consult with:

- A mortgage agent or loan officer who specializes in lending to clients after a loan modification.

- A financial consultant to ensure you understand the long-term implications

- Credit counseling organizations if you require assistance in enhancing your credit report.

12. What should I disclose to the lender when applying for a new mortgage after a loan modification?

Full disclosure is essential. Inform the lender about your loan modification, provide all required documentation, and be transparent about your financial history and situation.

Borrowers with a prior mortgage loan modification need to apply for a home loan after a loan modification, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Borrowers can also email us at gcho@gustancho.com.