Home Loan With Overtime Income and Other Income

This article will cover qualifying for a home loan with overtime income and other income. Homebuyers can qualify for a home loan with overtime income and other non-traditional income if certain conditions are met.

Borrowers can qualify for a mortgage with overtime income and other income. However, lenders want a two-year history of borrowers making other income. Lenders also want to see a likelihood of income continuation for the next three years.

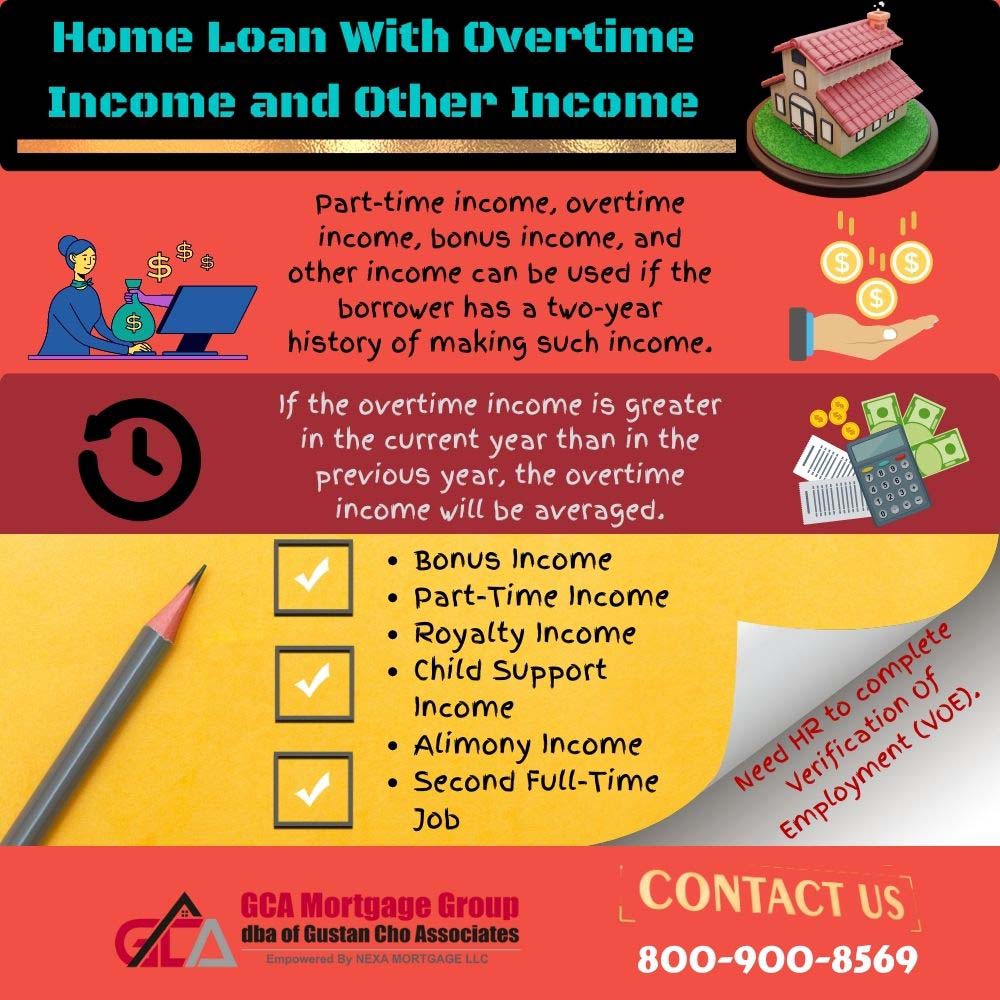

Part-time income, overtime income, bonus income, and other income can be used if the borrower has a two-year history of making such income. These other incomes cannot be irregular or declining income. Mortgage underwriters have underwriter discretion on other nontraditional income. Most underwriters will automatically disqualify other income if the borrower has declining income.

The Importance of Qualified Income When Qualifying For a Mortgage

Credit Scores and Income are the top two qualification requirements for any home loan.

Borrowers with higher debt-to-income ratios may need other income, such as overtime income, to qualify for a home loan. HUD, the parent of FHA, allows borrowers to have a maximum debt-to-income ratio of up to 46.9% front end and 56.9% DTI back. This holds true as long as they have credit scores over 620.

Borrowers with under 620 credit scores normally get their debt-to-income ratio capped at 31% front end and 43% back end to get an approved/eligible per Automated Underwriting System unless they have strong compensating factors. Borrowers with high debt-to-income ratios and need to purchase higher-priced homes may need more income or pay outstanding debts. This is so they can qualify and meet the debt-to-income ratio on the loan program they are applying.

Mortgage underwriters allow borrowers to use other income such as overtime, bonus, part-time, and other income to qualify for a mortgage. However, the income needs to be secured and qualified. Two years’ history of making other income is required.

Debt-To-Income Ratio Requirements on Mortgage Loan Programs

Here are the debt-to-income ratio requirements for loan programs:

FHA loans:

- For borrowers with 620 or higher credit scores, the maximum front-end debt-to-income ratio is capped at 46.9% DTI and 56.9% DTI back end to get an approve/eligible per automated underwriting system approval.

FHA and VA Manual Underwriting Guidelines on Debt-To-Income Ratio

FHA and VA loans are the only two traditional mortgage loans that allow manual underwriting. FHA and VA loans manual underwriting guidelines are the same regarding timely payments in the past 24 months and front-end and back-end debt-to-income ratio caps.

The maximum debt-to-income ratio required to get an approve/eligible per AUS is 31% front end and 43% DTI back end. The file can be manually underwritten if the borrower has higher debt-to-income ratios.

Debt-to-income ratios on manual underwriting are capped at 31% front-end and 43% back-end DTI with zero compensating factors. Debt-to-income ratios on manual underwriting can be as high as 37% front-end and 47% back-end DTI with one compensating factor. Debt-to-income ratios on manual underwriting can be as high as 40% front-end and 50% back-end DTI with two compensating factors.

Fannie Mae Debt-To-Income Guidelines on Conventional Loans

Conventional loans are capped at a 50% debt-to-income ratio. There is no front-end debt-to-income ratio on conventional loans.

VA Guidelines on Debt-To-Income Ratios on VA Loans

VA loans do not have debt-to-income ratio requirements:

- However, to get an approve/eligible per Automated Underwriting System Approval with over 60% DTI on VA loans, the borrower should have strong residual income

Conventional and FHA loans allow non-occupant co-borrowers to be added to the main borrowers.

What Are Lender Overlays?

Most Lenders have overlays on debt-to-income ratios where they cap FHA DTI to 45% to 50% DTI even though HUD is the parent of FHA, allowing up to 56.9% DTI. Overlays are mortgage guidelines above and beyond those of FHA, VA, USDA, Fannie Mae, and Freddie Mac.

Gustan Cho Associates has no lender overlays on government and conventional loans. We go off AUS FINDINGS and have zero lender overlays.

Over 80% of our borrowers are borrowers turned down by other lenders due to lender overlays or because they had a last-minute mortgage loan denial.

Using Overtime Income As Qualified Income For Mortgage

For those borrowers who work overtime regularly can qualify for a home loan with overtime income and can use overtime for extra income when applying for a mortgage loan if they have a history of working overtime for the past two years and the overtime is likely to continue.

Part-Time and Bonus Income can also be used if they have had bonus income for the past two years and it is likely to continue. Qualifying for a home loan with overtime income can be tricky. This is because the mortgage underwriter needs to be convinced that the overtime income is stable and will likely continue for the next three years. Also, overtime income cannot decrease from one year to another when qualifying for a home loan with overtime income. It needs to be the same or greater in the most current year.

To provide proof and verification that the mortgage loan borrower has been receiving overtime and bonus income for the past two years is not hard to prove. The borrower must provide tax returns, W-2s, and payroll records or have the lender request a verification of employment, also known as a VOE, from the employer. One or more of the documents I just mentioned will be ample proof borrower has been receiving regular overtime income or bonus income for the previous two years.

Home Loan With Overtime Income With Likelihood To Continue

Nobody can guarantee that overtime income and bonus income will continue. Proving that overtime income and bonus income will continue can be challenging. However, many mortgage lenders require this, and the only way lenders will accept overtime income is with the following conditions.

Need a two-year history of consistent overtime income. Need HR to complete Verification Of Employment (VOE). VOE must state that overtime will likely continue for the next three years.

Many employers are reluctant to write such letters that overtime is likely to continue for the next three years unless it is a mom-and-pop shop. If overtime or bonus income has been declining year after year, lenders can decide not to use overtime or bonus income. Many professions, such as fields of law enforcement, public safety, firefighters, nurses, physicians, and restaurant workers, have overtime income consistently.

How Do Mortgage Underwriters Calculate Home Loan With Overtime Income

Overtime income is calculated as follows. If the overtime income is greater in the current year than in the previous year, the overtime income will be averaged. If the overtime income is less in the current year than the prior year, then the current lower income will be used and not averaged. Other income, such as the following, can be used:

- Bonus Income

- Part-Time Income

- Royalty Income

- Child Support Income

- Alimony Income

- Second Full-Time Job

How To Use Part-Time Or Other Income For DTI Calculations

For other income to be used in mortgage qualification, the following needs to apply:

- Two-year history of having such income

- Likelihood of three years continuation of such income

- For example, child support income can be used.

- However, if the children are 16 or 17 years old and child support payments stop at 18, the child support income cannot be used to qualify because it will not continue for the next three years.

- Part-Time Income or borrowers with two full-time jobs need two years of seasoning requirement on both jobs to qualify for an income.

Frequently Asked Questions (FAQs)

1. Can overtime income be used to qualify for a home loan?

Yes, overtime income can be used to qualify for a home loan, but it must be consistent and verifiable. Lenders typically require a two-year history of receiving overtime pay, and they will average this income over the past two years.

2. What documentation is needed to use overtime income for a mortgage?

To use overtime income, borrowers need to provide:

- Pay stubs showing overtime earnings

- W-2 forms from the past two years

- A letter from the employer confirming the likelihood of continued overtime income

3. How do lenders calculate overtime income for mortgage qualification?

Lenders generally average the overtime income over the past two years. They will also look at year-to-date earnings to ensure the income is consistent and likely to continue.

4. Can bonus income be considered when applying for a mortgage?

Yes, bonus income can be considered. Similar to overtime income, it must be consistent and verifiable. Lenders typically require a two-year history of receiving bonuses and will average this income over the past two years.

5. What other types of income can be used to qualify for a home loan?

Other types of income that can be used include:

- Part-time job income

- Self-employment income

- Rental income

- Alimony or child support (if it will continue for at least three years)

- Investment Income

- Social Security or pension income

6. Are there any specific guidelines for using part-time job income?

Yes, part-time job income can be used if the borrower has held the part-time job for at least two years. The income must be stable and likely to continue.

7. How do lenders verify self-employment income?

Self-employment income is verified using:

- Two years of personal and business tax returns

- A year-to-date profit and loss statement

- Bank statements showing deposits

- A letter from a CPA verifying the business’s existence and income stability

8. Can rental income be used to qualify for a mortgage?

Yes, rental income can be used. Lenders will typically require:

- A lease agreement

- Proof of rental payments received (bank statements)

- Two years of tax returns that document rental earnings

9. How is investment income considered in mortgage qualification?

Income from investments, such as dividends and interest, can be used if it is consistent and expected to continue. Lenders will need two years of tax returns to verify this income.

10. What is the process for using alimony or child support as qualifying income?

Alimony or child support can be used if it will continue for at least three years. Borrowers must provide:

- A copy of the divorce decree or court order

- Proof of receipt of payments (bank statements)

- Evidence of consistent payment history

11. Are Social Security or pension incomes acceptable for mortgage qualification?

Yes, Social Security and pension incomes are acceptable. Borrowers need to provide:

- Award letters

- Proof of receipt of payments (bank statements)

- Documentation showing the income will continue

12. What should borrowers consider when using multiple income sources for a mortgage?

Borrowers should ensure all income sources are well-documented and consistent. Lenders will look for stability and the likelihood that the income will continue. It’s also important to maintain good credit and manage debt-to-income ratios effectively.

Getting Approved For a Mortgage With Overtime Income

Borrowers who need to qualify for a home loan with a mortgage company licensed in 48 states with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text for faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates has a national reputation for being able to do mortgage lenders other lenders cannot do.

Gustan Cho Associates, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states, including Puerto Rico, The U.S. Virgin Islands, and Washington DC with a lending network of 210 wholesale lending partners.

The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. Gustan Cho Associates, a dba of Gustan Cho Associates, is a national five-star mortgage company with no overlays on government and conventional loans. We also offer non-QM loans and alternative financing programs on owner-occupant homes, second homes, investment properties, and commercial loans. We offer non-QM bank statement loans for self-employed borrowers, non-QM Jumbo mortgages, and non-QM mortgages one day out of bankruptcy.