IDHA Down Payment Assistance Mortgage Program

This guide covers the IDHA down payment assistance mortgage program for first-time homebuyers. In today’s rising economy, many Americans need down payment assistance to buy their dream home. Many hard-working. Americans make good incomes and can easily afford a mortgage payment on an average $200,000 Illinois home purchase. However, many do not have the down payment and closing costs.

Today’s high cost of goods and services makes it difficult for any family to save enough down payment and closing costs on a home purchase.

Besides the down payment, all home purchase or refinance transactions come with closing costs. Most closing costs can be covered on purchases with seller’s concessions or lender credit. The Illinois Housing Development Authority (IDHA) now makes the dream of home ownership a reality through the IDHA down payment assistance mortgage program for Illinois homebuyers. This article will discuss and cover IDHA Down Payment Assistance Mortgage for Illinois homebuyers.

IHDA DPA Makes The Dream of Homeownership Become a Reality

The good news is the state of Illinois currently has down payment assistance programs for purchasing a primary residence. Gustan Cho Associates is based in Illinois and is familiar with IDHA Home Loans and national down payment assistance programs. The team at Gustan Cho Associates are experts in IHDA programs. That stands for Illinois Housing Development Authority. This blog will detail each program specifically.

IDHA Down Payment Assistance Programs For First-Time Homebuyers

The four programs that are currently available are the following:

- IHDA Access Forgivable

- IHDA Access Deferred

- IHDA Access Repayable

- 1st Home Illinois

All of these programs besides 1st Home Illinois are new in 2018. The new programs are not limited to first-time home buyers, helping thousands of Illinois residents. Now, that’s going to each program in more detail.

IHDA Access Forgivable Down Payment Assistance Program

IDHA Down Payment Assistance Mortgage offers the IHDA Access Forgivable Program, which will give you up to $6,000 or 4% of the home’s purchase price. This money can be used for the down payment and or closing cost. Illinois residents love this program because it is Forgiven after ten years. That’s right. This is a gift that does not have to be repaid. Two types of down payment assistance programs exist: Forgivable and not forgivable.

The IDHA Access Forgivable is a 30-year fixed mortgage with affordable interest rates offered directly through IHDA. Available for all mortgage programs, including FHA, VA, USDA, and FNMA HFA Preferred.

Available to first-time home buyers and repeat home buyers throughout the entire state of Illinois. A few additional requirements include a minimum credit score of 640. The house can be an existing or new construction home. Illinois home buyers must contribute $1,000 or 1% of the purchase price (whichever is greater) of their own funds. Complete ownership counseling (in-person or online)

IHDA Access Deferred DPA Mortgage Program

With the IDHA Access Deferred Down Payment Assistant Loan Programomeowners do not need to repay until they sell their home, refinance, or pay off the 30-year fixed-rate mortgage.

Available for all mortgage programs, including FHA, VA, USDA, and FNMA HFA Preferred. This program is available to repeat home buyers as well as first-time home buyers. IHDA Access Deferred is available throughout the entire state of Illinois. IHDA Access Deferred has the same requirements as IDHA Access Forgivable.

IHDA Access Deferred DPA Home Purchase Mortgage Program

Homebuyers need to meet certain lending requirements to qualify for IHDA Access Deferred. IHDA Access Deferred requires a minimum credit score of 640. Homebuyers can purchase an existing house, which can be an existing or new construction home. Homebuyers must contribute $1,000 or 1% of the purchase price (whichever is greater) of their own funds. Borrowers need to complete the homeownership counseling (in-person or online).

IHDA Access Repayable DPA Mortgage Program

IDHA Down Payment Assistance Mortgage offers the IHDA Access Repayable loan program. This new down payment assistance program is the most popular. Access Repayable will give you up to $10,000 for the down payment and closing costs.

The IDHA down payment assistance mortgage program is only available to first-time homebuyers. A first-time homebuyer is anyone who has not owned a home within the last three years.

10% of the purchase price (capped at $10,000) is offered as an interest-free loan repaid monthly over a 10-year period. Once again, this program is available for all mortgage programs, including FHA, VA, USDA, and FNMA HFA Preferred. IHDA Access Repayable is available for repeat home buyers and first-time home buyers.

IHDA Access Forgivable and IHDA Access Deferred Home Purchase DPA Program

The requirements are the same as IHDA Access Forgivable and IHDA Access Deferred. A minimum credit score of 640 is required. The subject house can be existing or new construction. Homebuyers must contribute $1,000 or 1% of the purchase price (whichever is greater) of their own funds. Complete ownership counseling (in-person or online)

IDHA Down Payment Assistance 1st Home Illinois

IDHA Down Payment Assistance Mortgage Program offers 1st Home Illinois loan programs. The IDHA down payment assistance mortgage program has been around for years. The popular Illinois down payment assistance mortgage program has helped thousands of borrowers purchase their first home. The IDHA DPA program is also available for all veterans.1st Home Illinois is only available in the following counties;

- Boone

- Cook

- DeKalb

- Fulton

- Kane

- Marion

- McHenry

- St. Clair

- Will

- Winnebago

The 1st Home Illinois DPA program gives you $7,500 for down payment and closing costs and can be used with FHA, VA, USDA, or Conventional financing. 1st Home Illinois Is available to purchase a primary residence with one or two units. Home Buyers cannot use this to purchase a three or four-unit property. The property must be an existing residential dwelling. New construction is not allowed on IDHA down payment assistance mortgage loans.

Eligibility Requirements For IDHA Down Payment Assistance Program

The requirements are once again the same. To qualify and get approved for the IDHA down payment assistance mortgage program, homebuyers need a minimum credit score of 640. House can be existing or new construction. Buyers must contribute $1,000 or 1% of the purchase price (whichever is greater) of their own funds. Complete ownership counseling (in-person or online)

Qualifying For a Mortgage In Illinois With a Lender With No Overlays

Now that you know more about the four programs IHDA offers for purchasing your new home, contact Gustan Cho Associates. Feel free to call or text us for a faster response at 800-900-8569. Or email us at gcho@gustancho.com. In the following paragraphs, we will cover the steps to start the process for the IDHA Down Payment Assistance.

Documents Required For The IDHA Down Payment Assistance Mortgage Program

The documents required for the IDHA down payment assistance mortgage program are similar to documents required on traditional mortgage loans. The first step required for the IDHA down payment assistance mortgage program is the following:

Step 1: Please send the following as soon as you can:

- Last 60 Days Bank Statements – to source down payment

- Last 30 Days Pay Stubs

- Last Two Years, W2’S

- Last Two Years Tax Returns

- Driver’s License

Complete The Online Mortgage Loan Application

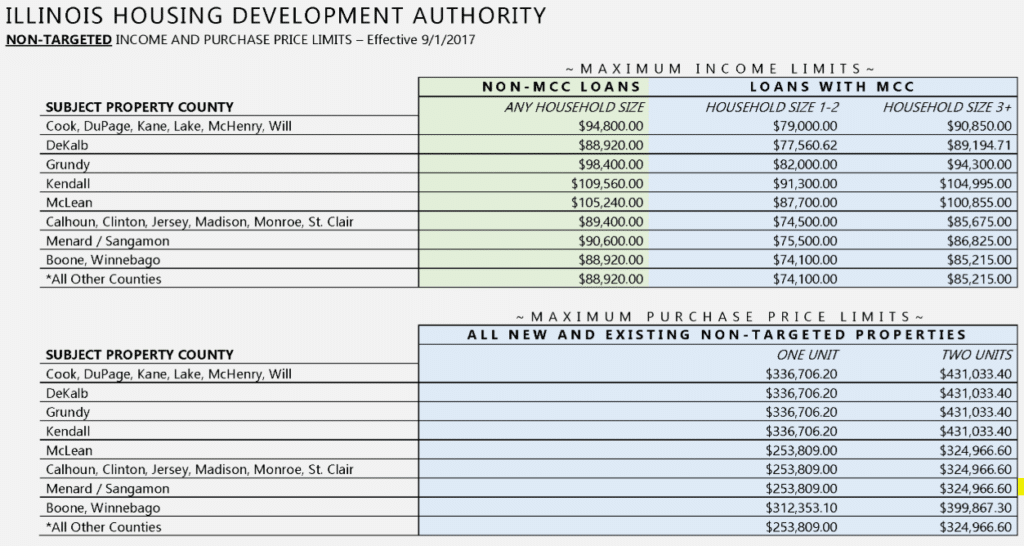

Step 2: Please follow this link at APPLY NOW and complete the online mortgage loan application. Be sure to double-check the income limits and purchase price restrictions directly from the IHDA WEBSITE, as these restrictions are subject to change.