Mortgage After Bankruptcy

In this guide on Gustan Cho Associates, we will cover qualifying for a Mortgage after Bankruptcy. Homebuyers have many options in qualifying for a mortgage after bankruptcy. You can qualify for a mortgage after bankruptcy with FHA, VA, USDA, and Conventional loans. Gustan Cho Associates allows non-traditional and non-QM loans one day out of bankruptcy with a 20% to 30% down payment.

Borrowers can qualify for a traditional and non-QM mortgage after bankruptcy. Traditional mortgages require mandatory waiting period requirements after bankruptcy. Non-QM loans do not require mandatory waiting period after bankruptcy.

Oftentimes, many people think that getting a mortgage after bankruptcy is difficult. Bankruptcy is not a bad thing. Bankruptcy is a federal law that gives people a second chance to restart their financial life. There are dozens of reasons for people to file for bankruptcy.

Reason Why People File Bankruptcy

People can file bankruptcy due to a loss of job, business, divorce, medical issues, accident, or economic turmoil beyond their control, like the coronavirus outbreak in February 2020. This guide on the mortgage after bankruptcy will guide you on how to qualify for a mortgage after bankruptcy. We will discuss the mortgage options available to homebuyers after bankruptcy.

How Difficult Is It To Get a Mortgage After Bankruptcy

Getting a mortgage after bankruptcy is not a cakewalk, but yet is not difficult either. You may even think it’s impossible, but it is not. The team at Gustan Cho Associates has helped thousands of people qualify for a mortgage after bankruptcy.

Homebuyers do not have to hire expensive credit repair companies after bankruptcy for credit repair. Whatever a credit repair company does, you can do it yourself at no cost.

A prior bankruptcy will not impact getting a high mortgage rate. Bankruptcy has no bearing on mortgage rates. However, your credit scores do. It is best recommended you start rebuilding your credit after bankruptcy. The team at Gustan Cho Associates has helped thousands of borrowers get their credit scores to over 700 FICO one year after Chapter 7 Bankruptcy’s discharge.

Mortgage After Chapter 7 Bankruptcy

In this paragraph, we will cover what bankruptcy is. We will discuss two types of bankruptcy, Chapter 7 and Chapter 13 Bankruptcy.

Chapter 7 is the most common for individuals. This is liquidation or straight bankruptcy. Usually, people will file Chapter 7 if they do not have the finances to pay their debts.

When you file Chapter 7, you will “sell” almost all your assets to settle your debts to creditors. This allows you to start a clean slate, releasing you from all your obligation. You may be able to keep some of the assets, depending on your state’s laws.

Mortgage During and After Chapter 13 Bankruptcy

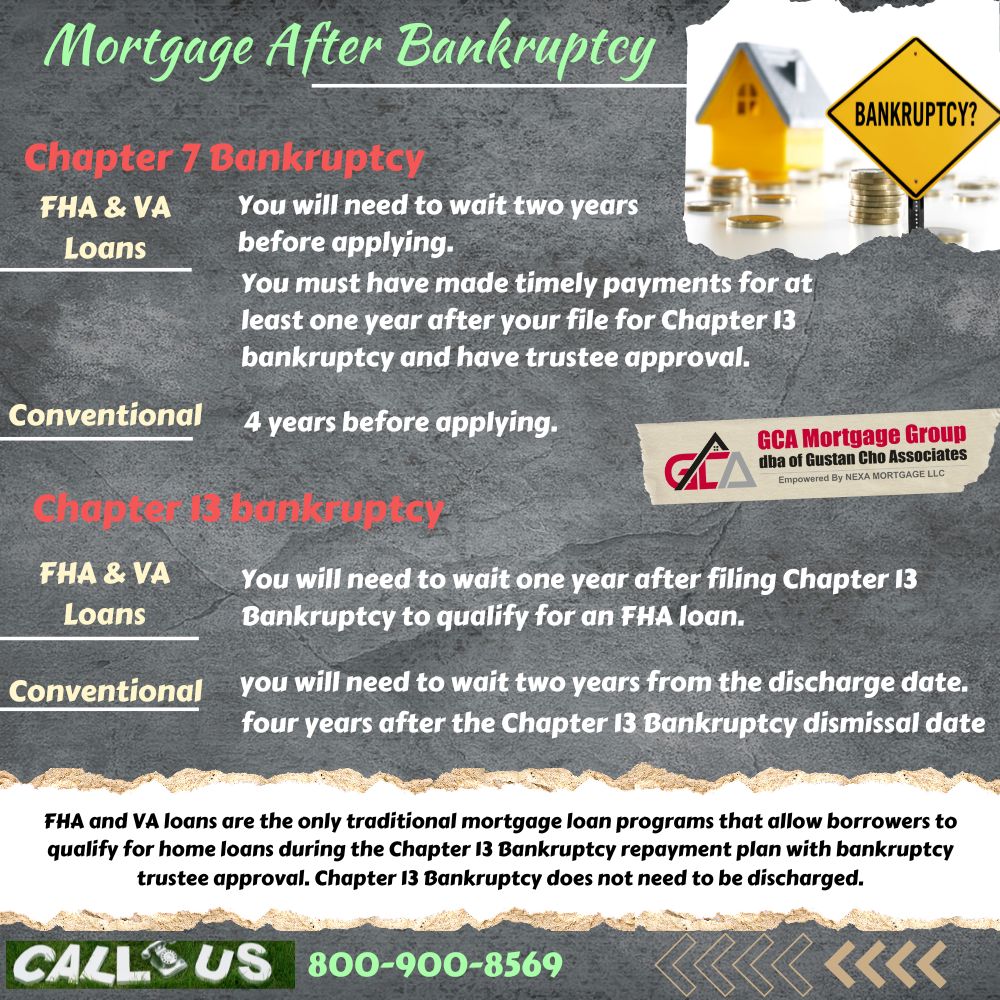

FHA and VA loans are the only traditional mortgage loan programs that allow borrowers to qualify for home loans during the Chapter 13 Bankruptcy repayment plan with bankruptcy trustee approval. Chapter 13 Bankruptcy does not need to be discharged.

The soonest you can qualify for an FHA and VA loan during Chapter 13 Bankruptcy repayment plan is after making 12 timely payments into the repayment plan. It needs to be a manual underwrite. The FHA and VA manual underwriting mortgage process is exactly the same.

Chapter 13 Bankruptcy is a repayment plan for debts. This is instead of surrendering all their property. Once the payment plan has been completed, the debts are discharged.

How To Get a Mortgage After Bankruptcy

This section will cover how to get a mortgage after bankruptcy. You can get a mortgage after bankruptcy. It will take time and patience to get a mortgage after bankruptcy.

Filing bankruptcy will lower your credit score. A lower score tells lenders that you are high risk. Chapter 7 bankruptcy will remain on your credit report for ten years from the filing date.

Chapter 13 Bankruptcy will stay on your credit report for seven years. You will not have to wait the full amount of time (10 and 7 years) for the bankruptcy you fall off your credit report, but you will need to wait sometime before applying and trying to get a loan.

Mortgage After Bankruptcy With Extenuating Circumstances

There are reasons why bankruptcy might have been out of your control. If this is the case, a lender might consider you earlier than they typically would after bankruptcy. These are difficult to get approved. These would be the non-reoccurring event that results in a significant and sudden loss of income. It would also need to be a prolonged loss of income. Examples of extenuating circumstances are:

Loss of a Job

The loss of a job would need to be out of your control. This means that you would not have been fired for a valid reason. An example of an acceptable reason would be a company shutdown or mass layoff.

Death of a Primary Wage Earner

Unfortunately, losing a primary wage earner in the home could qualify you for an extenuating circumstance.

Serious Illness

If you have experienced a severe illness that has resulted in the loss of employment, this might qualify you.

Divorce

Divorce is not considered an extenuating circumstance, although there have been exceptions based on facts at the time of the divorce. To determine if you have any extenuating circumstances, it is recommended that you speak to a professional. You need to provide documentation of this circumstance, and they can talk you through what is acceptable.

Waiting Period Requirements on Mortgage After Bankruptcy

Below are examples of mortgages, and how long you need to wait to apply for a mortgage is based on each type.

USDA Mortgage after Bankruptcy

For Chapter 7 Bankruptcy, you must wait three years before applying. In Chapter 13, you will need to wait one year.

USDA loans are insured by the US Department of Agriculture and are only for individuals who are buying homes in rural qualifying areas. This is for low-income individuals, and their income can’t be more than 115% of the median income for the area.

This loan type does not have a minimum credit score or a minimum down payment. However, it could vary depending on the lender.

FHA Mortgage After Bankruptcy

Chapter 7 Bankruptcy, you will need to wait two years before applying. You can qualify for an FHA loan one year after filing Chapter 13 Bankruptcy. You will need to wait one year after filing Chapter 13 Bankruptcy to qualify for an FHA loan. If you have extenuating circumstances that contributed to your Chapter 7 bankruptcy.

HUD will allow one year into the Chapter 13 Bankruptcy repayment plan with trustee approval. An FHA loan is a loan insured by the Federal Housing Administration.

Because HUD, the parent of FHA, insures it, It is often accompanied by more flexible requirements. You will need a 580 credit score to qualify for a 3.5% down payment FHA loan. Unless you can put 10% down with credit scores under 580 FICO and down to 500 credit scores. If you can put 10% down, a credit score between 500-579 is permitted.

Conventional Loan Guidelines on Mortgage After Bankruptcy

For Chapter 7 Bankruptcy, you must wait four years before applying. The waiting period is only two years if you have had extenuating circumstances. In Chapter 13 bankruptcy, you will need to wait two years from the discharge date. You must wait four years after the Chapter 13 Bankruptcy dismissal date to qualify for a conventional loan.

If there are extenuating circumstances, you can apply after two years. A conventional, non-government loan that follows guidelines by Fannie Mae and Freddie Mac will require you to meet the waiting period and reestablish your credit.

Your credit score will need to be a minimum of 620, and a 3% down payment will be required for first-time homebuyers. 5% down payment on a conventional loan if you have owned a property in the past three years. Apply For a Mortgage: Click Here

VA Loans Mortgage After Bankruptcy Guidelines

For Chapter 7 Bankruptcy, you must wait two years before applying. If you are in a Chapter 13 Bankruptcy repayment plan, there is a one-year waiting period after you have filed to qualify for a VA loan. You must have made timely payments for at least one year after your file for Chapter 13 bankruptcy and have trustee approval.

There is no waiting period after the Chapter 13 Bankruptcy discharge date. The Veterans Administration offers loans to its qualifying service people. These loans are more flexible with their terms and more forgiving with credit history. After meeting the required waiting period, you can apply.

The VA does not have minimum credit score requirements or a minimum down payment requirement. However, these are often set by the lenders who offer VA loans, so it is essential to look around to see where you can get the best rate with your financial history.

Non-QM Loans

For Non-QM Loans, there is NO WAITING Period! Without non-QM loans, many people would not even be able to purchase their homes. Many different situations apply for a QM loan, so many different kinds of QM loans exist. A Non-Qualified Mortgage (Non-QM) is a mortgage that falls outside of federal guidelines for a qualified mortgage and is an alternative financing mortgage program.

Non-QM Mortgage Lending Requirements

This home loan type is not required to meet the Consumer Financial Protection Bureau (CFPB) standard requirements. The Consumer Financial Protection Bureau helps consumers by making sure banks, lenders, and other financial companies treat them fairly. The CFPB also offers tools for individuals to learn about mortgages and how to protect themselves.

Non-Qualified Versus Qualified Mortgages

Because the CFPB does not protect these non-QM loans, these mortgages are high risk for lenders. Due to the higher risk, they do not have the same assurance that the loans will not default or will be paid. However, because these loans do not follow the rules, lenders can be more relaxed and flexible with the borrowers in terms of income, credit, and other risks that they usually would not be able to be flexible with. A non-QM loan is often more expensive.

Mortgage Rates on Non-QM Loans

A non-QM mortgage rate will depend on the borrower’s credit score, the amount of the down payment, and the length of time since the bankruptcy event. People can usually secure a Non-QM loan after bankruptcy if they can pay the downpayment and meet the other requirements. These loans include interest-only payments, balloon payments, or longer loan terms than 30 years.

How To Find Non-QM Mortgage Lenders

It is crucial to find a mortgage broker who can assist you in finding a lender specializing in Non-QM loans. Although not all lending institutions offer Non-QM Loans, many are out there.

Some agencies specialize in low to moderate-income buyers and even bankruptcy and foreclosures. This allows for a higher DTI or lower credit score than a qualified loan.

You need to shop around and look at all options. Look at local banks, mortgage brokers, and online lenders. You want to check your interest rate and the size of your needed loan in relation to the property value and attempt to get preapproved. In the following sections, we will cover tips to get back on track after bankruptcy.

CREDIT CREDIT CREDIT!

There is no more critical way to ensure that you will be eligible for a mortgage than working on your credit. Of course, your credit will have taken a nose dive after bankruptcy. However, you need to remember that you have control over mending it! The more time that has passed since you filed for bankruptcy, the better it is. The most recent credit history is the most important.

How To Prepare For a Mortgage For The Best Rates

You will need to check your credit report. This means more than just knowing your credit score; you will need to look through the report. There are three major credit bureaus. These are Equifax, Experian, and TransUnion. If there are errors on your report, you can dispute these errors.

You report them to Credit Reporting Bureau. Incorrect instances on your credit report do happen, which can signal identity theft or even mistakes. Correcting issues can take time, but it is worth it. You need to ensure that you pay your bills on time. This is one of the most significant factors in improving your credit score.

Late payments have a significant negative influence on your score. Become an authorized user of someone you trust with good credit. This would allow you to make purchases on their credit card, but you would not need to do that to reap the benefits. As long as the credit card remains in good standing, using the card and timely payments can help improve your credit.

How To Rebuild Your Credit To Qualify For a Mortgage After Bankruptcy

After bankruptcy, you will get offers for credit cards. Try to get a secured credit card. This functions much like a regular credit card but requires you to deposit money as a security deposit. The good side is that most secured credit cards report your status to credit bureaus.

If you are making payments on time and using the credit card with restraint, it should positively impact your score. Another card to try to get is a retail card.

These a less strict in requirements but will charge high-interest rates and fees. However, this is still a good option if you can use it only to increase your credit and use it responsibly.

How To Maximize Your Credit For Best Rates on Mortgage After Bankruptcy

This brings us to Credit Card Utilization. Credit bureaus look to see if you are keeping your credit utilization below or about 30%. It’s important to not overspend on credit and leave some of it open.

It would be best if you tried to pay off some of your credit card debt. If you have any old cards left after the bankruptcy, do not close them!

Although, in theory, it seems like this will help you lower your credit score, it can have the opposite effect. Credit history length can account for 15% of your score.

Avoid Credit Inquiries During Mortgage Process

It would be best if you tried to limit new inquiries. An inquiry is made when you apply for a new credit card or credit increase. A soft inquiry will not affect your credit score, and these instances include when you check your credit, an employer checks your credit, or a credit card company preapproves you for offers. Applying for new credit, such as car loans or a new credit card, is considered a hard inquiry. Hard inquiries show up on your credit.

You need to be aware of shortcuts that could be scams. Credit card repair companies often claim they do not follow through. These companies often want money upfront, then promise to remove damaging information from your credit report. Instead, you could go to a credit counseling service that can advise you on your finances.

These are customarily certified counselors trained in consumer debt, credit, and money management. These professionals can assist you in getting back on track and developing a plan to ensure you stay on course after bankruptcy.

In Summary on Qualifying For Mortgage After Bankruptcy

In summary, do not despair if you have experienced a bankruptcy event. Especially if you have gone through a significant extenuating circumstance. There are loan options for you to purchase a home. Keep in mind that bankruptcy is to reset your financial situation. You want to be sure that you have taken steps to rebuild your credit and have a clear budget in place, so you do not end up in the same financial trouble.