Getting Denied For a Mortgage After Conditional Approval

In this blog, we will discuss getting denied for a mortgage after conditional approval. Can borrowers get denied for a mortgage after conditional approval? There is no guarantee in the mortgage world that a deal will close until it has been closed and funded. There is no reason why borrowers cannot close on their pre-approvals.

Gustan Cho Associates, empowered by NEXA Mortgage, LLC are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. We have a lending network of 210 wholesale lending partners with hundreds of mortgage loan options for owner-occupant, second homes, and investment properties. If there is a mortgage loan product in today’s marketplace, you can be rest assured Gustan Cho Associates has it to offer our borrowers.

Hasty Pre-Approvals Is Number One Reason For Stress

Loan Officers issuing pre-approvals without properly qualifying borrowers is the main reason for stress during the mortgage process. When borrowers first contact a loan originator for pre-approval, they are instructed to complete a 4-page 1003. This is called the official mortgage application.

How To Get Pre-Approved For a Mortgage?

The loan originator will then run credit and review and process the following:

- credit scores

- credit disputes

- review credit history to see if borrowers have had any late payments in the past 12 months

- any unsatisfied judgments

- review collection accounts and derogatory credit items

Importance of Automated Underwriting System

The mortgage loan originator will run the application through an Automated Underwriting System. The Desktop Underwriter DU is Fannie Mae’s version of the Automated Underwriting System.

There are two different types of automated underwriting systems (AUS). Fannie Mae’s version which is called the Desktop Underwriter or DU and Freddie Mac’s version which is called the Loan Prospector or often referred to as LP. Both systems have algorithms pertaining to each mortgage loan program’s agency mortgage guidelines.

Freddie Mac’s version of the Automated Underwriting System is the Loan Prospector LP. The automated underwriting system will analyze all the information on the mortgage loan application. AUS will also credit report and credit score if the mortgage loan applicant qualifies.

Automated Findings of The Automated Underwriting System

If everything is in check, AUS will render an approve/eligible per automated findings. Mortgage lenders like myself have no mortgage lender overlays. We go off automated findings. As long as the mortgage loan applicant can meet all the conditions from the automated findings, borrowers will get approved and closed.

What Is A Conditional Loan Approval?

Conditional approval is when the mortgage loan underwriter has reviewed all of the mortgage documents. This is including the following:

- Mortgage Application

- Credit Scores

- Credit Report

- Two years of tax returns

- Two years W-2s

- Recent bank statements

- Verified borrower’s employment

- Letters of Explanations

- Bankruptcy and/or housing event docs

- Divorce decree if applicable

Conditional Loan Approval Issued By Underwriters

Conditional approval is when a mortgage underwriter feels comfortable issuing a full mortgage loan approval once all the conditions are met. Conditions are updated information or more information underwriters need to issue a clear to close. Borrowers can get denied for a mortgage after conditional approval if they cannot meet conditions.

What Are Mortgage Conditions on Conditional Approval?

Mortgage conditions on a conditional approval are items borrowers need to provide for the mortgage underwriter to issue a clear to close. A clear to close is when the mortgage underwriter certifies that the mortgage lender is ready to close and fund the mortgage loan. Examples of mortgage conditions are the following:

- updated bank statements

- letter of explanation to mortgage underwriters

- verification of rent

- pages missing

- clarification on file

- other items that the mortgage processor has not submitted

Again, once all conditions have been submitted to the mortgage processor, the file will be submitted to an underwriter for clearance for a clear to close.

Denied For a Mortgage After Conditional Approval Due To Delays In Submitting Conditions

Unfortunately, there are cases where a mortgage underwriter has overlooked some conditions when the initial conditional loan approval has been issued. Sometimes, a mortgage processor submits final conditions for a clear to close, and the underwriter can come back with more added conditions.

Whatever conditions the underwriter gets back with, they need to be submitted even though they are added conditions and have not been requested. Mortgage underwriters can always come back with more conditions.

This can get quite frustrating. To get a clear to close, everyone is in the hands of the mortgage underwriter. This is because the underwriter has the final say on issuing the clear to close.

Can I Get Denied For Mortgage After Conditional Approval?

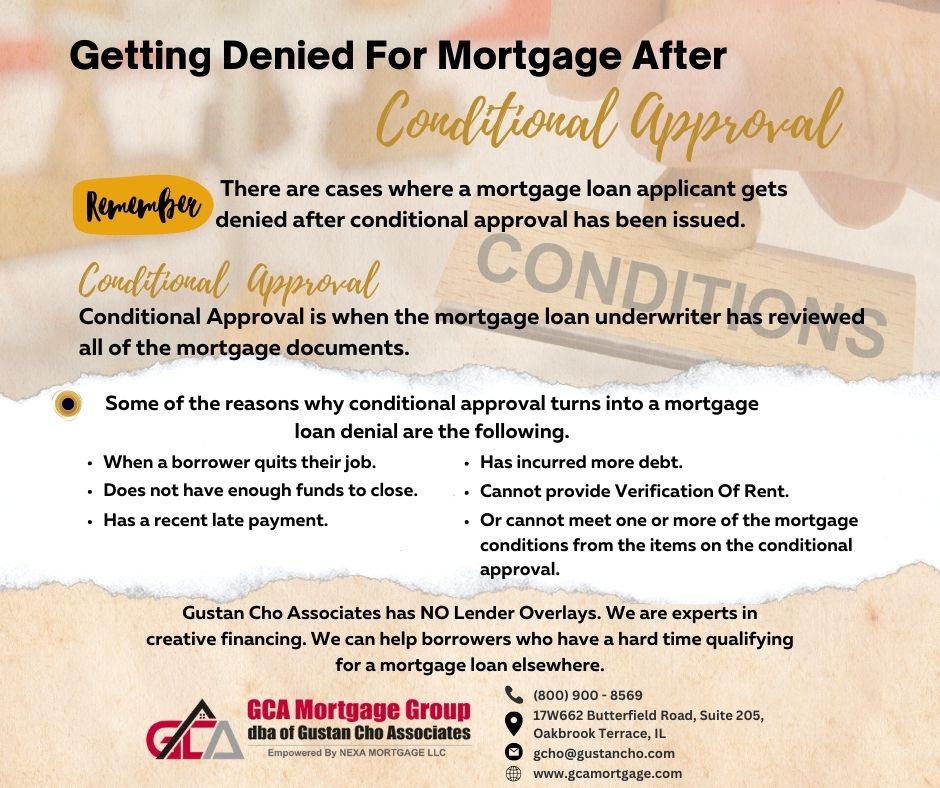

Unfortunately, there are cases where a mortgage loan applicant gets denied after conditional approval has been issued. Some of the reasons why conditional approval turns into a mortgage loan denial are the following:

- when a borrower quits their job

- does not have enough funds to close

- has a recent late payment

- has incurred more debt

- cannot verify rent

- or cannot meet one or more of the mortgage conditions from the items on the conditional approval

Can I Re-Apply For a Mortgage If Denied?

Over 75% of our borrowers are folks who could not qualify from another lender or have gotten denied at the last minute due to their overlays. Or they were denied at the last minute due to not being properly qualified. Gustan Cho Associates has no lender overlays. We are experts in creative financing. We can help borrowers who have difficulty qualifying for a mortgage loan elsewhere.

Frequently Asked Questions (FAQs)

1. What does conditional approval mean?

Conditional approval means that the lender has reviewed your application and decided that you meet the initial requirements for the loan, pending certain conditions. These conditions often include additional documentation, verifications, or other requirements that must be satisfied before final approval is granted.

2. Why might a mortgage get denied after conditional approval?

A mortgage can get denied after conditional approval for several reasons, such as:

*Failure to provide required documentation

*Significant changes in your financial situation, such as job loss or reduced income

*Issues with the property appraisal

*Unresolved credit issues

*Discoveries during the underwriting process that affect your eligibility

3. What are common conditions attached to conditional approval?

Common conditions may include:

*Proof of income and employment verification

*Updated bank statements and asset verification

*Evidence of resolved credit disputes or collections

*A satisfactory home appraisal report

*Title search results

4. How can I avoid getting denied after conditional approval?

To avoid getting denied, you should:

*Promptly provide all requested documentation

*Avoid making significant financial changes, such as large purchases or opening new credit accounts

*Maintain your employment and income levels

*Communicate any potential issues with your lender as soon as possible

*Ensure the property meets appraisal and title requirements

5. What should I do if I am denied after conditional approval?

If you are denied after conditional approval, you should:

*Ask the lender for an explanation of the denial

*Review and address the specific reasons for the denial

*Consider improving your financial situation or credit score

*Seek advice from a mortgage professional to explore alternative options or loan programs

6. Can I reapply for a mortgage with the same lender after being denied?

Yes, you can reapply with the same lender after addressing the reasons for the denial. However, it might be beneficial to wait until your financial situation has improved or consider applying with a different lender.

7. Will getting denied affect my credit score?

Getting denied for a mortgage does not directly affect your credit score. However, the hard inquiries made by the lender during the application process can have a minor impact. Credit scoring models typically treat multiple Credit scoring models that consider multiple inquiries made within a short timeframe as a single inquiry.

8. What are some alternative mortgage options if I get denied?

Alternative options might include:

*Applying for a different loan type, such as an FHA or VA loan

*Seeking a co-signer or guarantor

*Improving your credit score and reapplying later

*Exploring non-QM (non-qualified mortgage) loans

*Considering lenders specializing in less-than-perfect credit scenarios

9. How long should I wait before reapplying after a mortgage denial?

The waiting period before reapplying depends on the reason for the denial. If it’s due to minor issues like missing documents, you can reapply as soon as they are resolved. For more significant issues like credit problems or financial instability, it might be advisable to wait several months to a year while you improve your financial situation.

10. Can pre-approval guarantee final mortgage approval?

No, pre-approval or even conditional approval does not guarantee final mortgage approval. Final approval is contingent upon satisfying all the lender’s conditions, passing the underwriting process, and maintaining your financial situation up to the closing date.

11. Is it common to get denied after conditional approval?

While not extremely common, it does happen. The underwriting process can uncover issues that weren’t initially apparent, and changes in your financial situation can also lead to denial. Being proactive and responsive to your lender’s requests can help minimize the risk.

12. How can I better prepare for the mortgage application process to avoid denial?

To better prepare:

*Maintain a stable income and employment history

*Keep your credit score high by managing debts and paying bills on time

*Save for a larger down payment to strengthen your application

*Avoid significant financial changes during the application process

*Gather and organize all necessary documentation in advance

The minimum credit score to qualify for a 3.5% down payment FHA loan is 580. VA home loans have no minimum credit score requirements or debt-to-income ratio caps. We follow Fannie Mae and Freddie Mac’s automated findings. We have zero overlays on FHA loans, VA loans, USDA loans, and Conventional loans.

To get a fast pre-approval, click GET PRE-APPROVED NOW or email us at gcho@gustancho.com or call us at 262-716-8151. Or Text us for a faster response. Our support and licensed personnel are available seven days a week, holidays included.