Mortgage Loans For Recent College Graduates

In this blog, we will cover and discuss mortgage loans for recent college graduates. If you have recently graduated from college and have no employment history, you might assume that you are unable to secure a home mortgage loan. This may have been true in the past. Student debt and lack of work history was a problem. Full-time school can be counted as two years of work experience required by mortgage lenders.

Can I Get a Mortgage If I Just Graduated College?

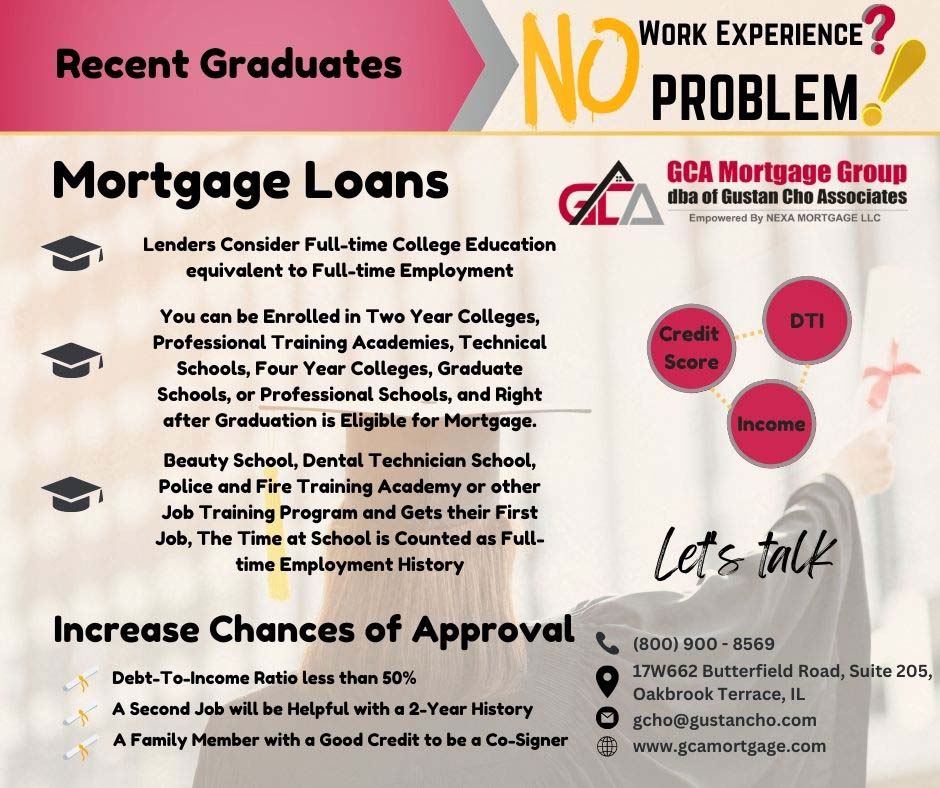

A frequently asked question we get often at Gustan Cho Associates is can I get a mortgage if I just graduated college. YES, you can. You can qualify for a mortgage if you just graduated from college, trade school, or even graduate school with no previous work experience. Your full-time tenure at school counts the same as full-time work experience. The team at Gustan Cho Associates are experts in mortgage loans for recent college graduates.

Can Full-Time Students Get Mortgage Loans For Recent College Graduates?

You can be enrolled in two-year colleges, professional training academies, technical schools, four-year colleges, graduate schools, or professional schools, and right after graduation is eligible for mortgage loans for recent college graduates. If a person was enrolled in a full-time trade school or academy such as a beauty school, dental technician school, police, and fire training academy, or other job training program and gets their first job, the time at school is counted as full-time employment history. Connect With Our Loan Officer for Mortgage Loans

Can I Get Buy House After Graduating From College With No Work Experience?

As a college student or graduate, you need to look at what affects the approval process of acquiring a mortgage. You may not have much credit history as a student or recent graduate, and this is an important factor in getting a mortgage. Lenders consider full-time college education equivalent to full-time employment. Gustan Cho Associates can help get mortgage loans for recent college graduates. In this blog, we will cover and discuss qualifying for mortgage loans for recent college graduates.

Can I Repay My New Mortgage Payment?

When you apply for a mortgage loan, the lender will look at your credit score, debt-to-income ratio, and income. You will want to get pre-approved for a loan, which will help you know what amount you will be approved for. If there is an issue getting you approved.

It is important to know your budget when you are out shopping for a home.

Mortgage lenders want to see the past two years of employment history from loan applicants Mortgages lenders want to determine the likelihood of your employment is likely to continue for the next three years in order to qualify for mortgage loans.

How Much House Can I Afford?

In the preapproval process, the lender will check your income and see if there is more than 50% going towards debt. Your credit score should be 620 or above for conventional loans. Your debt-to-income ratio should not exceed 50%. You will also need to show that you have money for a down payment, which will be 20% down, or you will need to pay mortgage insurance.

What Is The Minimum Credit Score I Need To Get a Home Mortgage

Most lenders want to see a credit score of 620 or better for conventional loans. If you choose to go with a loan from the FHA, the minimum can be as low as 580. If you have had a delinquent or missed payment on your student loans, this will hurt your credit score. If you have had late payments over 30 days and any of your loans are in collection status, it will appear on your report. Get Home mortgage with low credit scores

Understanding Your Debt-to-Income Ratio as a College Graduate

Navigating the area of personal finance can be difficult for a recent college graduate, particularly when managing debt and understanding its effects on financial well-being. One crucial metric that lenders use to assess your financial stability is the debt-to-income (DTI) ratio. Here’s a comprehensive guide to understanding your DTI ratio and its significance.

What is the Debt-to-Income Ratio?

The debt-to-income ratio measures your monthly debt payments relative to your gross income. It is represented as a percentage and assists lenders in determining your ability to handle monthly payments and repay borrowed funds.

How to Calculate the Debt-to-Income (DTI) Ratio

To calculate, follow these steps:

- Add Up Your Monthly Debt Payments:

- Include all monthly debts such as student loans, auto loans, credit card payments, and other financial obligations.

- Identify Your GMI:

- Your total earnings before taxes and other deductions. Include your salary, wages, bonuses, and any other sources of earnings.

- Divide Your Total Monthly Debt by Your GMI:

- Times the result by 100 to get a percentage.

Why Your DTI Ratio Matters?

Lenders view your DTI ratio as crucial when assessing your mortgage application. It helps them assess your risk level and determine your ability to handle additional debt. Here’s why it matters:

- Loan Approval:

- Lenders use your DTI ratio to decide whether to approve your loan application. A lower DTI ratio indicates a good balance between debt and income, making you a less risky borrower.

- Interest Rates:

- A lower DTI ratio can qualify you for good interest rates on loans and credit products. Lenders view borrowers with lower DTI ratios as more likely to repay their loans on time.

- Borrowing Capacity:

- Understanding your DTI ratio helps you know how much additional debt you can manage. This is particularly important when planning significant purchases, such as a home or car.

Ideal DTI Ratio for College Graduates

For recent college graduates, maintaining a healthy DTI ratio is essential. Most lenders favor a Debt-to-Income Ratio of 36% or less, with a max of 28% of that debt allocated to housing expenses (like rent or mortgage payments). However, different types of loans have varying requirements:

- Conventional Loans: Generally prefer a DTI ratio of 36% or lower.

- FHA Loans: You can accept DTI ratios up to 43%, but having a lower ratio can improve your chances of approval.

- VA Loans: Usually allow DTI ratios up to 41%, though some lenders may be more flexible.

Tips for Managing Your DTI Ratio

- Create a Budget:

Monitor your earnings and expenditures to ensure you live within your means and can make adjustments as necessary. - Pay Down Debt:

Prioritize paying off high-interest debt, like balances in your credit card, to lower your overall debt burden. - Increase Your Income:

Look for opportunities to increase income through side jobs, freelance work, or career advancements. - Avoid New Debt:

Once you’ve reduced your obligations, be cautious about taking on new debt, especially large purchases. - Refinance Loans:

Consider refinancing high-interest loans to secure lower interest rates, which can lower your monthly payments. It will also enhance your DTI ratio.

What Can You Do To Increase Approval Chances?

You can look over your credit score and report. You need to determine if there are any issues with your report and work on making all your payments on time. This applies to all your payments and not just your student loans. Work on increasing your income.

A second job will be helpful to earn extra cash, although it will need to be a regular income and not just a fleeting job that ends in a couple of months. Normally, lenders look at two-year history.

If you know someone who has good credit and additional assets, you could ask a family member to be a co-signer. The issue with this is that the co-signer is ultimately responsible for any of your missed payments, as they will actually have to make the payments.

Does Student Loan Debt Affect Buying a Home?

Although the fact that having student loans will not necessarily hurt your chances of acquiring a mortgage loan, if you have a high debt-to-income ratio, it will. Conventional loans have a limit on your debt-to-income ratio set at 50%. If you choose a government-backed loan, these are often higher.

VA Loan Requirements for Student Loans

Eligible active duty and retired members of the U.S. Military with a certificate of eligibility (COE) can qualify for VA loans. There is no down payment required. Lenders offer 100% financing with no mortgage insurance required at competitive mortgage rates. There is a one-time VA funding fee that can be rolled into the back of the mortgage loan.

VA Guidelines on Student Loans

Student loans that have been deferred for longer than 12 months are exempt from debt-to-income ratio calculations on VA loans. If you are on an income-based repayment plan on student loans, you can use the monthly IBR payment number in debt-to-income calculations. There are no minimum credit score requirements on VA loans.

Mortgage Loans For Recent College Graduates With High DTI

VA loans do not have a maximum debt-to-income ratio cap as long as you get an approve/eligible per automated underwriting system approval. The VA offers mortgage options for those who are military veterans. The VA doesn’t actually give out loans but insures them for lenders. With the VA, you can get a mortgage with a debt-to-income ratio of up to 60% and a credit score of 620.

FHA Guidelines on Mortgage Loans For Recent College Graduates

The Federal Housing Administration insures loans made by lenders, which, again, makes lenders feel more comfortable giving out loans to those who might not qualify for a conventional loan.

The Debt to Income ratio for FHA loans is up 46.9% front-end and 56.9% back-end debt to income ratio.

To qualify for a 3.5% down payment home purchase FHA loan, you need a 580 FICO. FHA loans are one of the most popular mortgage loans for recent college graduates. HUD, the parent of FHA, allows you to use two years of college as employment history.

The Loan Process For Mortgage Loans For Recent College Graduates

The lender will need to see your college transcripts. This is a significant advantage as most college graduates did not have steady or full-time employment while going through college. The student would need to have employment in the field of study, and this can be short-term, as long as it follows what you graduated for. An example of this is if you went to school for your law degree. You have since graduated and have worked with a law firm for a short time. The lender would look at your transcripts and count that as work experience.

Fannie Mae Guidelines for Mortgage Loans For Recent College Graduates

Fannie Mae guidelines on mortgage loans for recent college graduates with student loan debts are lenient. However, student loans that are not deferred longer than 12 months are still used for debt-to-income ratio calculations. The actual payment based on an IBR payment that reports on the credit reports can be used for debt-to-income ratio calculations.

Fannie Mae Mortgage Loans For Recent College Graduates on Income-Based Repayment With Zero Monthly Payment

If the borrower has a zero IBR payment, the zero will be used as the monthly payment on the debt-to-income ratio calculations. Fannie Mae and Freddie Mac require mortgage underwriters to take 0.50% of the outstanding student loan balance on deferred student loans as a hypothetical debt used for debt-to-income ratio calculations.

Mortgage Loans For Recent College Graduates With Student Loan Debts

Another way to work through the debt-to-income issue with student loans is if your parents have made your student loan payments for you. If they have sent the payments directly to the lender or have deposited the exact amount into your checking account, this could be sufficient as long as it’s been for a year. Each mortgage lender has different guidelines, so it would be important to find one that would work for you. Speak With Our Loan Officer for Mortgage Loans

DPA Mortgage Loans For Recent College Graduates

Down payment assistance mortgage loans for recent college graduates are available throughout the United States. Down payment assistance programs do not have a uniform standard for all states. Each DPA mortgage loan for recent college graduates is administered by local, county, or state agencies. Therefore, we cannot tell you the specific lender overlays on down payment assistance mortgage loan programs. It is worthwhile to check your state and determine if they have programs for graduates who want to purchase homes within the university’s area. These programs can help with down payment assistance and might offer lower interest rates.

Not All Lenders Have The Same Mortgage Guidelines

Not all mortgage lenders have the same lending requirements on FHA, VA, USDA, and conventional loans. For example, HUD minimum credit score requirement to qualify for a 3.5% down payment home purchase FHA loan is 580 FICO. However, most lenders will require a 620 FICO. Lenders can have higher mortgage requirements, called lender overlays, which are above and beyond the HUD minimum agency guidelines. Gustan Cho Associates has no lender overlays on government-backed and conventional loans.

How To Get Approved For Mortgage Loans For Recent College Graduates

Ultimately, having student loan debt will not disqualify you from obtaining a mortgage loan. The borrower needs to review their financial situation and look at their credit score. You should review your debt-to-income ratio and make adjustments to it as needed. Equally as important is to find a mortgage company that can work with you and is knowledgeable about student loan debt. Get approved for mortgage loans for recent college graduates

Frequently Asked Questions (FAQs)

- Can recent college graduates qualify for a mortgage loan?

Yes, recent college graduates can qualify for a mortgage loan. Lenders evaluate factors such as income, credit score, and employment history. While graduates may have a short employment history, a consistent income, and a strong credit score can help secure a loan. - What types of mortgage loans can be offered to recent graduates?

Several types of mortgage loans are available, including:

Conventional Loans: Generally require a strong credit score and a larger down payment but provide competitive interest rates.

FHA Loans: Backed by the FHA, these loans require a lower credit score and a small down payment.

VA Loans: These are available to veterans and their families, offering low or no down payment options.

USDA Loans: For rural and suburban homebuyers with low to moderate incomes, often with no down payment required. - What is the credit score needed for a mortgage?

The minimum credit score varies by lender and loan type:

Conventional Loans: It usually requires a minimum credit score of 620.

FHA Loans: A minimum score of 580 with a 3.5% down payment or as low as 500 with a 10% down payment is needed.

VA and USDA Loans usually require a minimum score of 620, though some lenders may accept lower scores. - What impact does student loan debt have on mortgage approval?

Student loan debt can impact your debt-to-income (DTI) ratio, a critical factor in mortgage approval. Lenders typically prefer a DTI ratio of 43% or lower. Managing student loan payments effectively and demonstrating consistent repayment can improve your chances. - Can gift money be used for a down payment?

Yes, gift money from family or friends can be used for a down payment. Lenders usually need a gift letter stating that the money is a gift, not a loan. Each lender may have specific guidelines regarding gift funds. - How important is employment history for recent graduates?

Employment history is important, but recent graduates can still qualify if they have a steady job. Some lenders consider part-time work or internships in the field of study as part of the employment history. Providing an offer letter or proof of stable income can also be beneficial. - Are there special mortgage programs for recent graduates?

Some lenders and organizations offer special programs for recent graduates:

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible: Offer low down payment options and consider non-traditional income sources.

State and Local Programs: Many states and municipalities offer first-time homebuyer programs, including down payment assistance and favorable loan terms. - What documentation is needed for a mortgage application?

Typical documentation includes:

Proof of Income: Pay stubs, offer letters, or tax returns.

Credit Report: To assess credit history and score.

Proof of Employment: Employment verification letter or your employer’s contact details.

Bank Statements: To verify assets and savings for the down payment.

Identification: Government-issued ID such as a driver’s license or passport. - How much of a down payment is required?

The required down payment varies by loan type:

Conventional Loans: Usually 5% to 20% of the home’s purchase price.

FHA Loans: As low as 3.5% of the purchase price.

VA Loans: Often, no down payment is required.

USDA Loans: Often, no down payment is required. - What is mortgage insurance, and when is it necessary?

Mortgage insurance safeguards the lender in case you default on the loan. It is typically required for:

Conventional Loans: When the down payment is below 20%.

FHA Loans: Required for all FHA loans.

USDA Loans: Typically required.

VA Loans: A funding fee is required instead of mortgage insurance.

Do Student Loans Make It Hard To Get a Mortgage?

Deferred student loans can definitely make getting a mortgage difficult if you have a high balance on your student loans and a high debt-to-income ratio. However, you can try to get your student loan on an income-based repayment plan. We can now use IBR payments for your student loan monthly payments to lower your debt-to-income ratio so you can qualify. This includes if your IBR payment is zero.

So many people have student loan debt now, and there are many individuals who have the knowledge to assist borrowers with the process.

If you need to get qualified for a mortgage with a lender with no overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and on holidays.