No Waiting Period After Foreclosure With NON-QM Loans

This blog will cover no waiting period after foreclosure with non-QM loans. Prior homeowners who went through a foreclosure, a deed-in-lieu of foreclosure, or a short sale can have a second chance to realize the American Dream of Home Ownership become a reality through non-QM loans. Non-QM loans are alternative financing mortgage options for real estate. Non-QM loans are available for primary, second, and investment properties.

The down payment and mortgage rates on non-QM mortgages depend on the borrower’s credit scores and financial strength.

The higher the credit scores, the lower the rates and down payment requirements. Home prices have increased yearly for several years with no signs of a slowdown. Due to non-QM loans, homebuyers no longer need to wait the mandatory waiting period after foreclosure with government and conventional loans. There is no waiting period after foreclosure with non-QM loans.

Will a Foreclosure Affect My Spouse, Who is Not on The Mortgage Note But Is on the Title?

Many married couples seeking a home loan with bad credit are confused about the mandatory waiting period after foreclosure to qualify for FHA home loans. Married borrowers with one spouse on the mortgage note but both on the title with a recently foreclosed home can qualify for a mortgage loan with no waiting period after foreclosure. Only one borrower needs to be on the new loan. Both can be on the title.

Married couples can qualify for conforming traditional loans if the foreclosure or housing event is only in one of the spouse’s name but not with the other spouse. The spouse who does not have the mortgage note on their name may be eligible for a conforming traditional loan.

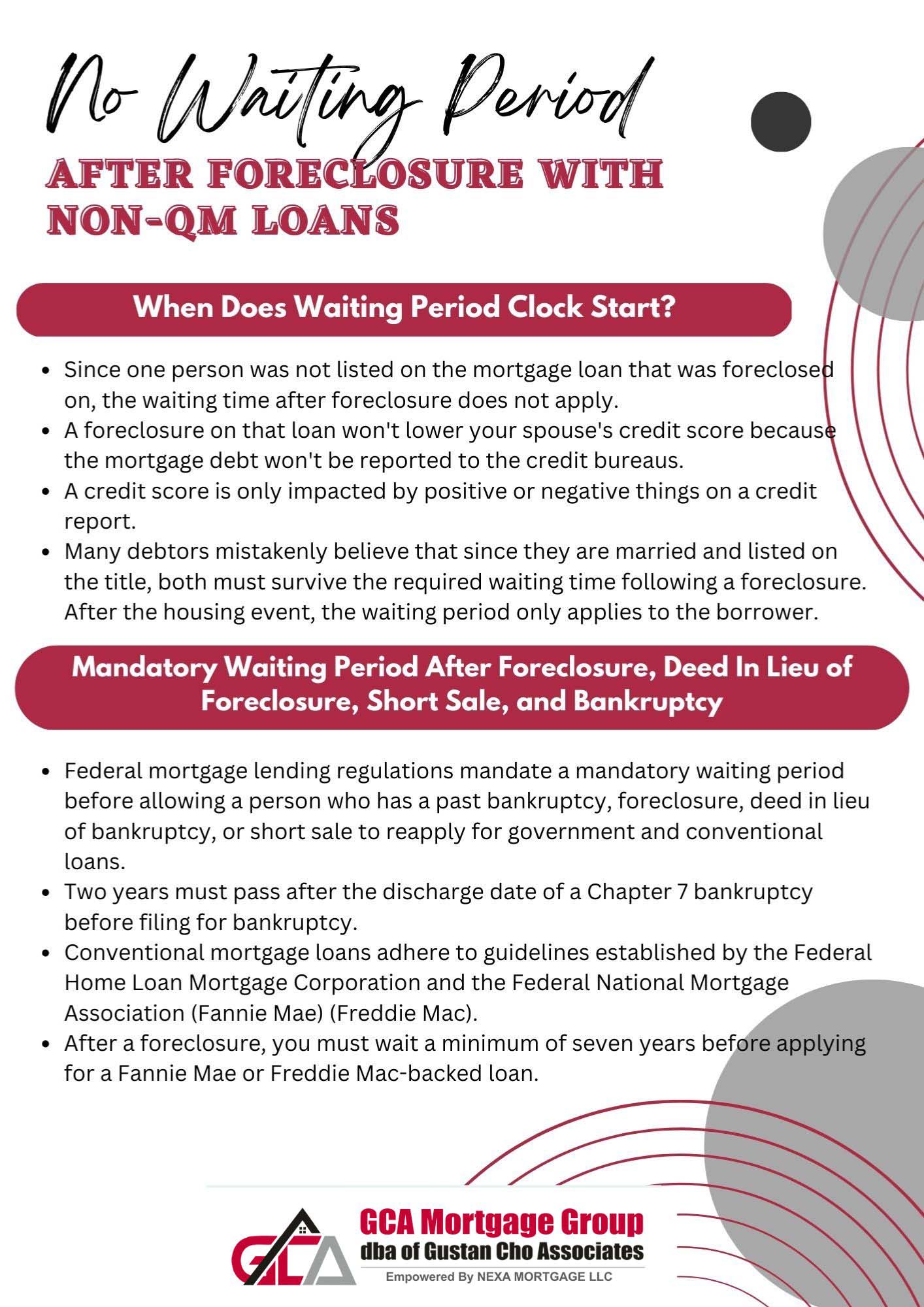

When Does Waiting Period Clock Start?

The waiting period after foreclosure does not apply since one person was not on the mortgage loan that was foreclosed on. A couple can currently live in a home being foreclosed on and still qualify for FHA insured mortgage loan as long as they are not on the mortgage note, and their spouse is.

Many borrowers think that because they are married and on the title, both must pass the mandatory waiting period after a foreclosure. Only the person on the mortgage knows how the waiting period applies after the housing event. A married couple can have one spouse on the mortgage note, and both can be on the title.

It is recommended to have one spouse on the note if they qualify alone. Many married couples want every asset jointly. This can be done with a home with just one spouse on the note, but you can put both spouses on the title. The liability is the person on the mortgage note.

Mandatory Waiting Period After Foreclosure, Deed-In-Lieu of Foreclosure, Short Sale, and Bankruptcy

For those with prior bankruptcy, foreclosure, deed-in-lieu of bankruptcy, or short sale, federal mortgage lending guidelines require a mandatory waiting period to re-qualify for government and conventional loans. For bankruptcy, there is a mandatory waiting period of two years from the discharge date of Chapter 7 bankruptcy.

Non-QM loans are portfolio loans. They are called non-conforming loans. Therefore, there are no agency mortgage guidelines that need to be followed. Non-QM wholesale lenders are the investors who set non-QM mortgage guidelines.

There is a three-year mandatory waiting period after the housing event for a foreclosure, deed-in-lieu of foreclosure, or short sale. As mentioned in the earlier paragraph, for those who are married and are not on the mortgage note but are on title, there is no waiting period after a foreclosure or housing event. It only applies to the person who is on the mortgage note.

Non-QM Loans With No Waiting Period After Foreclosure

Homebuyers with a prior Chapter 7 Bankruptcy discharge can qualify for non-QM loans one day out of foreclosure and bankruptcy. However, the longer the foreclosure has been seasoned, the lower the down payment requirement. Most non-QM wholesale mortgage lenders prefer borrowers to be one year out of foreclosure.

If you had a bankruptcy, most wholesale non-QM mortgage lenders prefer to lend to borrowers with one year out of the Chapter 13 Bankruptcy discharged date. There is no waiting period after bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale.

To qualify for non-QM loans one day out of bankruptcy or foreclosure, a 20% down payment is required. Non-QM mortgage lenders require a minimum credit score of 500 FICO. The down payment requirements depend on the borrower’s credit score. For example, borrowers with credit scores higher than 720 FICO can qualify for non-QM loans with a 10% down payment on a home purchase. The minimum credit score is 500 FICO on non-QM loans.

Mortgage After Foreclosure & Other Housing Events

Many folks had a prior foreclosure years ago. However, the foreclosure has just recently gotten recorded. Mandatory waiting period requirements exist to qualify for government or conventional loans after a housing event. Unfortunately, the waiting period clock does not start until the recorded date of foreclosure, deed-in-lieu of foreclosure, or short sale date.

There is no waiting period requirements on non-QM loans one day out of foreclosure. However, to qualify for non-QM loans one day out of foreclosure, deed-in-lieu of foreclosure, or short sale, you need a 20% to 30% down payment on a home purchase.

Until the launch of non-QM loans one day out of foreclosure, many homebuyers could not buy homes. Many potential homebuyers got priced out of the housing market due to the waiting period. The housing market became a raging Bull housing market with home prices skyrocketing to historic levels. Now, homebuyers can qualify for a home using non-QM loans with no waiting period after foreclosure.

Who Benefits With Non-QM Loans?

Many qualified homebuyers cannot qualify for a traditional government and conventional loan due to not being able to meet the waiting period after a housing event. Gustan Cho Associates now offers NON-QM loans. There is no waiting period after bankruptcy, foreclosure, and other housing events. Alex Carlucci is one of the top mortgage loan originators of non-QM loans in the nation. Here is what Alex had to say about the benefits of non-QM mortgage loans:

Non-QM mortgage loans benefit self-employed borrowers or borrowers with non-traditional income. NO income verification, no income tax returns, and no verification of employment is required on non-QM loans.

To qualify, borrowers need a 10% to 20% down payment. To qualify for a 10% down payment non-QM loans, the borrower must have at least a 680 middle credit score. The minimum credit score to qualify for non-QM loans is 500 FICO. Gustan Cho Associates has over a dozen wholesale non-QM lenders.

Frequently Asked Questions (FAQs)

- What are Non-QM Loans? Non-QM Loans are mortgage that falls outside the criteria created by the Consumer Financial Protection Bureau (CFPB) for qualified mortgages. These loans are often more flexible but may have different eligibility requirements.

- Is there a waiting period after foreclosure for traditional mortgages? Yes, conventional mortgages typically have waiting periods of 3-7 years after a foreclosure before you can qualify for a new loan.

- What does “No Waiting Period After Foreclosure” mean with Non-QM Loans? Some Non-QM Loan programs allow borrowers to apply for a mortgage immediately after a foreclosure without the usual waiting period.

- Who might benefit from No Waiting Period Non-QM Loans? Borrowers who recently experienced a foreclosure but are otherwise financially stable may benefit from these loans.

- Are credit scores and income still important for no-waiting period non-QM loans? Lenders may continue to evaluate your credit score and income when approving Non-QM Loans, even if there’s no waiting period.

- Which kinds of properties are eligible for financing through No Waiting Period Non-QM Loans? Non-QM Loans are applicable for a variety of property types, including primary residences, investment properties, and second homes.

- Do No Waiting Period Non-QM Loans have higher interest rates? Interest rates on Non-QM Loans can vary but may be slightly higher than those for traditional mortgages due to the increased risk.

- Are these loans available nationwide? Availability may vary by lender and location, so it’s essential to check with lenders specializing in non-QM loans.

- Can I refinance with a no-waiting period non-QM loan after a foreclosure? Some Non-QM Loan programs may offer refinancing options for borrowers who recently experienced a foreclosure.

- What documentation is needed for a No Waiting Period Non-QM Loan? Borrowers typically need to provide standard financial documentation, such as proof of income, employment history, and credit history. However, requirements may vary among lenders.

- Are there penalties for prepaying no-waiting period non-QM loans? Some non-QM loans may have prepayment penalties, so it’s important to understand the terms and conditions before signing.

- What are the risks associated with No Waiting Period Non-QM Loans? It’s important for borrowers to be aware that these loans may come with elevated interest rates, which could result in increased total expenses. It is essential to evaluate your capacity to comfortably repay the loan.

Best Mortgage Lenders For Bad Credit

Homebuyers who need to qualify for a mortgage with a national mortgage company licensed in 48 states with no overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates has ZERO OVERLAYS on FHA, VA, USDA, and Conventional loans. Gustan Cho Associates, a dba of NEXA Mortgage LLC, is licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands.

Gustan Cho Associates are mortgage brokers licensed in 48 states with over 210 wholesale mortgage lenders. Gustan Cho Associates is a dba of NEXA Mortgage and correspondent lenders with AXEN Mortgage, LLC.

The team at Gustan Cho Associates are experts on non-QM loans and bank statement loans for self-employed borrowers. You can contact us at Gustan Cho Associates by calling us at (800) 900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays! No other mortgage broker is connected with over 210 wholesale mortgage lending partners.

Get Pre-approved in Just 5 minutes. Click Here!