Non-QM Loans

If you find yourself looking for a Mortgage, there are two different types you are likely to come across. These types are qualified mortgage loans and non-qualified mortgage loans. In this guide, we will be covering the topic of non-qualified mortgage loans, more commonly known as non-QM loans. Not getting a suitable mortgage loan is not a big deal.

Some professions are disadvantaged due to the guidelines of said eligible mortgage loans. Non-qualified mortgage loans, also referred to as non-prime loans and/or non-QM loans, are still safe options. In the following sections, we will be covering and discussing what are non-QM loans and how they work. We will also cover the types of non-QM and alternative mortgage loan options for borrowers and the eligibility requirements of non-QM loans.

Are Non-QM Loans Regulated Like Qualified Mortgages?

The CFPB, consumer financial protection bureau, enforces all mortgage rules and regulators when it comes to protecting consumers on owner-occupant homes. Homebuyers of owner-occupant homes are protected by the CFPB and state regulators due to the strict mortgage regulations. Commercial properties and commercial loans are normally not regulated.

There are protections for the borrower, with fewer guidelines and documentation requirements to get the loan. In an ideal world, you could always get a qualified mortgage loan with all its protections and policies. But life is far from perfect. As we will be pointing out in this guide on non-QM loans, a non-qualified mortgage loan is still a safe option that allows you to proceed in obtaining a home.

What Are Non-QM Loans?

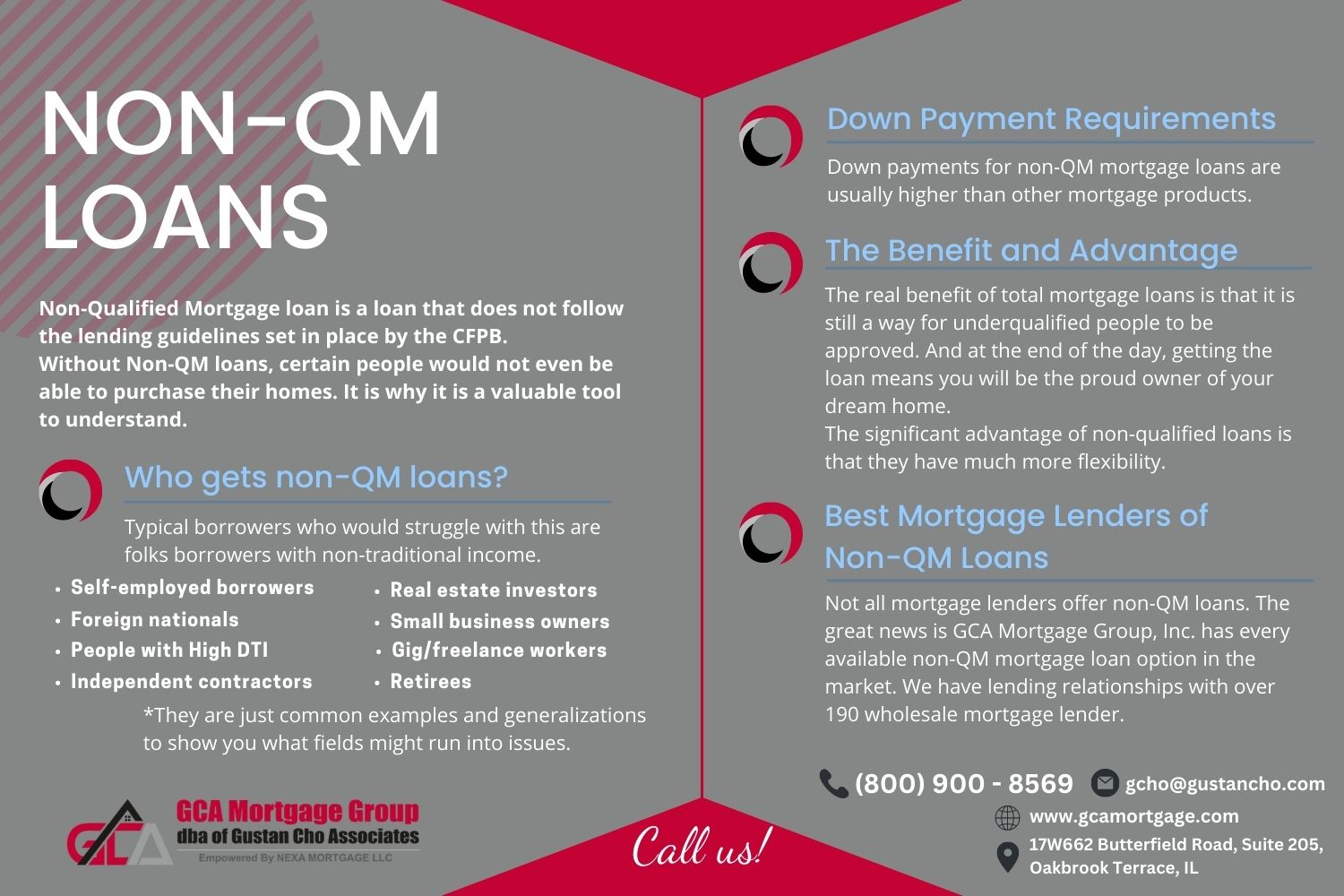

Simply put, a non-qualified mortgage loan is a loan that does not follow the lending guidelines set in place by the CFPB. Consumer Financial Protection Bureau is essentially the federal agency that ensures you have proper protection and treatment from banks and lenders. Now, this might not seem like something you would want, but going against the protections of a company that protects you in the deal seems like a bad idea.

However, due to the strictness of said guidelines, you might not qualify for a mortgage loan. In this example, you would have a non-qualified mortgage loan instead of a qualified one.

Without non-QM loans, certain people would not even be able to purchase their homes. It is why it is a valuable tool to understand. Even though you might want to be protected by these guidelines, just the existence of them might not allow you to use said guidelines in your home purchase transactions. Click here to get apply for Non-Qm Loans by fill up a form

Who gets non-QM loans?

We have covered that those who do not fit the guidelines of the CFPB need a non-qualified mortgage loan. But what are these guidelines, and who would not include these definitions? The guidelines for having a qualified mortgage loan follow one simple rule. That rule is your ability to repay. If you can show financial records showing that you should be able to repay the loan, you will likely end up with a qualified loan.

The requirements for the ability to repay the loan and likely to continue is by the underwriter reviewing the borrower’s credit and income documentation. Typical borrowers who would struggle with this are folks borrowers with non-traditional income, such as borrowers with less than perfect or less-than-stellar credit, Self-employed borrowers, Real estate investors, Foreign nationals, Small business owners, People with a high DTI ratio, Gig/freelance workers, and Independent contractors and Retirees. These borrowers typically run into issues with a credit score or the income they show. Of course, the people that need a non-qualified loan are not limited to the situations listed above. They are just common examples and generalizations to show you what fields might run into issues.

The Difference Between QM-Loans and Non-QM Loans

As covered before, it is significantly easier to receive a Non-qualified loan, possibly the only option for people that fall into specific categories. But once you have either loan, what is the actual difference in practice between the two loan options? The significant advantage of non-qualified loans is that they have much more flexibility.

What Are The Rates and Terms on Non-QM Loans?

You can have negative amortization: Amortization means paying off a loan with regular predetermined payments to reduce the amount of the mortgage loan balance. Negative amortization is when the borrower does not make the minimum monthly payments to lower the outstanding mortgage loan balance. Furthermore, your mortgage loan balance goes up even though you make the minimum monthly payment. The mortgage borrower’s minimum principal and interest payments do not cover the minimum due for the loan balance to be reduced. This cannot be very clear, so let’s see an example. If the monthly mortgage payment is for one-thousand dollars and you can only afford to pay eight hundred dollars, then two hundred dollars would be added to the loan’s principal amount. And although this is not ideal, it can save you from missing a payment.

Non-QM advantages include terms extending for more than thirty years and interest-only payments. The negative factors of taking a non-qualified loan. These drawbacks include High-Interest rates, costs, and fees. Non-QM loans usually come with higher mortgage rates and cost dit self-employed wage earners or foreign nationals. Get qualify for a Non-Qm loans

Best Mortgage Lenders of Non-QM Loans

Difficult to find: Not all mortgage lenders offer non-QM loans. Finding a mortgage lender who has every available non-QM loan product may be harder to find. You can look around online and do your research before working with one. Greater risk of default: Non-QM loans such as interest-only mortgages, where you’re required to pay only interest on the loan over a certain period, may increase your risk of defaulting. The great news is Gustan Cho Associates has every available non-QM mortgage loan option in the market. We have lending relationships with over 190 wholesale mortgage lenders.

Down Payment Requirements on Non-QM Loans

Having higher down payments: Down payments for non-QM mortgage loans are usually higher than other mortgage products. Lenders require a sizable down payment to lower their lending risk if they cannot pay. This is reasonable, though, because by taking this loan, it is established that you do not have significant enough financial documentation to be trusted to pay back the loan as much as you would be in a qualified loan.

The Benefit of Non-QM Loans In a Booming Housing Market

Qualified mortgage loans and non-qualified mortgage loans both have their distinct advantages and disadvantages. You will likely have a safer and cheaper experience with a suitable mortgage loan. But the real benefit of total mortgage loans is that it is still a way for underqualified people to be approved. And at the end of the day, getting the loan means you will be the proud owner of your dream home. So if, for whatever reason, you can not get the ideal qualified mortgage loan, the total mortgage loan is always a safe fallback option to get a mortgage and thus own a home.

Frequently Asked Questions (FAQs)

- What are Non-QM Loans?

Non-Qualified Mortgage or Non-QM loans are mortgage products that do not meet the standards set by government-sponsored entities such as Fannie Mae or Freddie Mac. They are designed for borrowers who may not qualify for traditional mortgages due to unique financial circumstances. - Who are Non-QM Loans Suitable For?

Non-QM loans are ideal for borrowers with non-traditional income sources, self-employed individuals, lower credit scores, or individuals seeking financing for unconventional property types. - What Types of Properties Can Non-QM Loans Be Used For?

Non-QM loans can finance various properties, including investment properties, vacation homes, condos, and properties requiring renovation or unconventional use. - What Are the Key Features of Non-QM Loans?

Non-QM loans typically offer flexible underwriting criteria, including alternative documentation requirements, higher debt-to-income ratios, and leniency towards credit issues such as previous bankruptcies or foreclosures. - What Documentation Is Required for Non-QM Loans?

While documentation requirements may vary among lenders, borrowers may need to provide alternative forms of income verification, such as bank statements, profit and loss statements, or verification from accountants or business managers. - How Do Non-QM Loans Differ from Traditional Mortgages?

Non-QM loans offer more flexibility regarding borrower eligibility, underwriting criteria, and loan terms than traditional mortgages. They cater to borrowers who need to fit within the strict guidelines of conventional loan programs. - What Are the Benefits of Non-QM Loans?

Non-QM loans provide an alternative financing option for borrowers who are not qualified for traditional mortgages. They offer greater flexibility regarding credit history, income verification, and property types, allowing borrowers to access homeownership or investment opportunities. - Are Non-QM Loans Riskier Than Traditional Mortgages?

Non-QM loans may carry slightly higher risk due to the relaxed underwriting standards and potentially higher interest rates. However, when managed responsibly, they can be a valuable tool for borrowers with unique financial situations. - How Do I Qualify for a Non-QM Loan?

To qualify for a Non-QM loan, borrowers must demonstrate their ability to repay it based on alternative income documentation, maintain a reasonable debt-to-income ratio, and have a satisfactory credit history. - Can Non-QM Loans Be Refinanced?

Yes, non-QM loans can be refinanced similarly to traditional mortgages. Borrowers may choose to refinance to secure a lower interest rate, adjust the loan term, or access equity in the property.

If you have other questions you can contact us at GCA Mortgage Group by calling 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!

Talk to our expert for apply for Non-Qm loan