Non-QM Loans For Self-Employed Borrower Guidelines

This Article Is About Non-QM loans for Self-Employed Mortgage Borrower Guidelines. Non-QM loans for self-employed mortgage loans are now available.

Self-employed borrowers had a difficult time qualifying for home loans. This is due to the write-offs they can utilize as self-employed borrowers.

Lenders go by adjusted gross income after all unreimbursed expense deductions. This often disqualified many business owners or non-W2 wage earners. Non-QM loans for self-employed mortgages are often referred to as non-QM loans or bank statement loans for self-employed borrowers. In the following paragraphs, we will cover non-QM loans for self-employed borrowers’ guidelines.

Qualified Income With Non-QM Loans For Self-Employed Mortgage Loans

Qualified Income Non-QM Loans for self-employed mortgage loans are calculated using bank statement deposits. Non-QM self-employed mortgage loans are often more difficult than regular W2 wage-earner mortgages with traditional income. Qualified income is important because mortgage underwriters need to determine a borrower’s ability to repay.

Ability To Repay Mortgage With Non-Traditional Income

Mortgage lenders now offer non-QM loans for self-employed borrowers without traditional income. Besides bank statement mortgage loans, there are other non-QM mortgage loans for self-employed borrowers. Days of no-doc and state-income mortgage loans are now back. No-doc loans, DSCR loans,

Profit and Loss Statement Only mortgage loans, no-ratio mortgages, and 1099 income-only mortgages, and dozens of other non-QM loans for self-employed borrowers are not back offered at Gustan Cho Associates. Mortgage underwriters will use non-traditional income to calculate qualified income with non-QM loans for self-employed borrowers. What this means is mortgage underwriters need to determine borrowers’ ability to earn stable and continuous income to qualify for a mortgage.

The actual income a borrower makes is often difficult to decipher. This is because intelligent accountants are experts in using the IRS Tax Loopholes to minimize tax liabilities by minimizing taxable income with write-offs.

Launch of Bank Statement Loans For Self-Employed Borrowers

Due to this practice, Gustan Cho Associates launched bank statement loans for self-employed borrowers. These loans are portfolio loans and are often referred to as non-qualified loans.

There are no income tax returns required. Mortgage underwriters will take either 12 or 24 months of bank statement deposits. The monthly average will be the qualified income. There are no set Non-QM loans for self-employed mortgage guidelines.

Each case is unique, and underwriters can be open to making exceptions for each borrower. If the mortgage underwriter believes borrowers can repay, the mortgage will get approved.

Mortgages For Self-Employed Borrowers

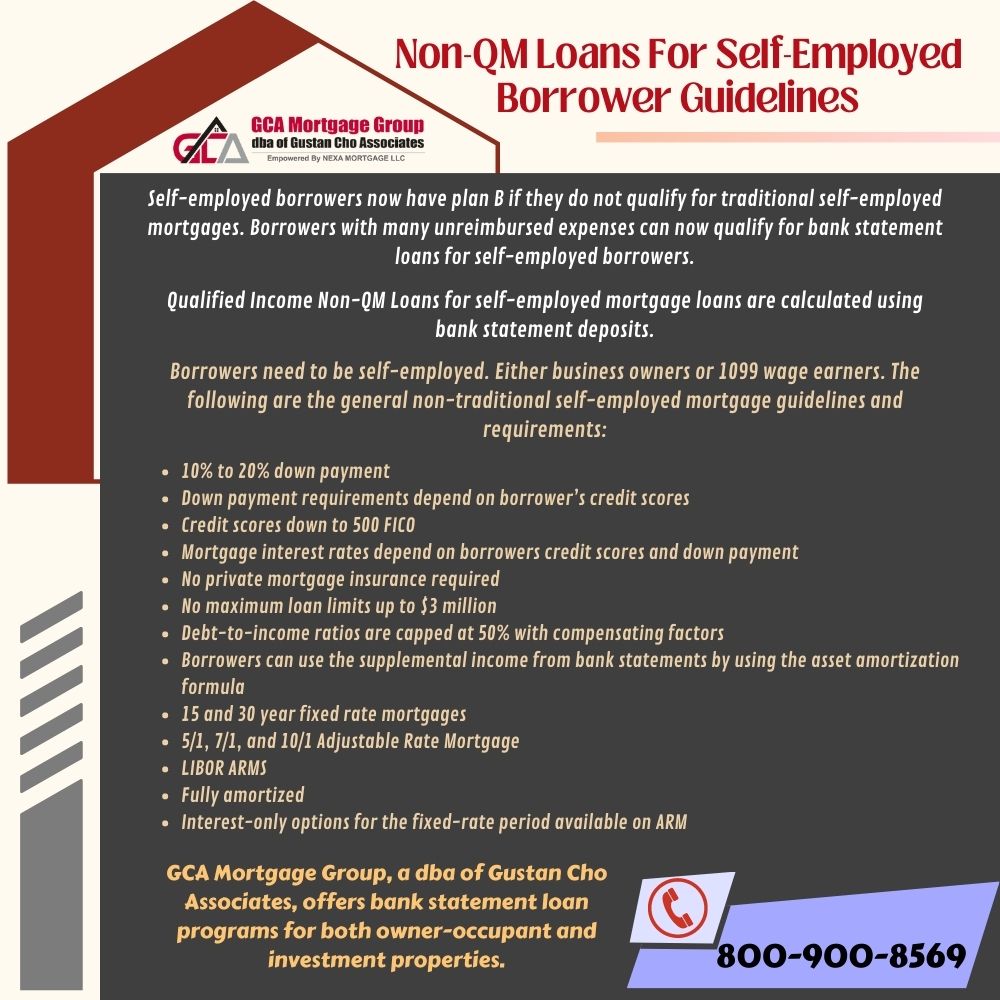

Self-employed borrowers now have plan B if they do not qualify for traditional self-employed mortgages. Borrowers with many unreimbursed expenses can now qualify for bank statement loans for self-employed borrowers.

No income tax returns are required with this loan program. This loan program has been structured and designed for self-employed borrowers when income tax returns are an issue when qualifying for traditional mortgages. Borrowers can use either personal or business bank statements to qualify.

Besides bank statement loans, there are other mortgage loan options for self-employed borrowers at Gustan Cho Associates. We offer no-income verification with limited to no documentation mortgage loans for self-employed borrowers.

Self-Employed Guidelines and Requirements

Borrowers need to be self-employed. Either business owners or 1099 wage earners. The following are the general non-traditional self-employed mortgage guidelines and requirements:

- 10% to 20% down payment

- Down payment requirements depend on borrower’s credit scores

- Credit scores down to 500 FICO

- Mortgage interest rates depend on borrowers credit scores and down payment

- No private mortgage insurance required

- No maximum loan limits up to $3 million

- Debt-to-income ratios are capped at 50% with compensating factors

- Borrowers can use the supplemental income from bank statements by using the asset amortization formula

- 15 and 30 year fixed rate mortgages

- 5/1, 7/1, and 10/1 Adjustable Rate Mortgage

- LIBOR ARMS

- Fully amortized

- Interest-only options for the fixed-rate period available on ARM

Types of Non-QM Loans For Self-Employed Borrowers

Gustan Cho Associates, a dba of Gustan Cho Associates, offers bank statement loan programs for both owner-occupant and investment properties. Contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The Team at Gustan Cho Associates dba of Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Over 80% of our borrowers at Gustan Cho Associates are borrowers who could not qualify at other mortgage companies either because they got a last-minute mortgage loan denial or because the lender did not have the mortgage loan program best suited for the borrower.

Gustan Cho Associates are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. We have a national reputation for having hundreds of non-QM loans for self-employed borrowers, including no-doc mortgage loans, DSCR loans, and profit-and-loss statement-only mortgages.