Things To Avoid During Mortgage Process

Getting a mortgage is a big step toward owning a home, but it requires following some strict guidelines along the way. One wrong move during the process could delay or even cancel your approval. At Gustan Cho Associates, we’ve helped thousands of homebuyers successfully navigate the mortgage process even with less-than-perfect credit. This guide covers the most common things to avoid during mortgage process so you can get to the closing table faster and stress-free.

Things To Avoid During Mortgage Process

We will discuss tips on things to avoid during mortgage process to avoid a last-minute mortgage loan denial. Alex Carlucci of Gustan Cho Associates said the following:

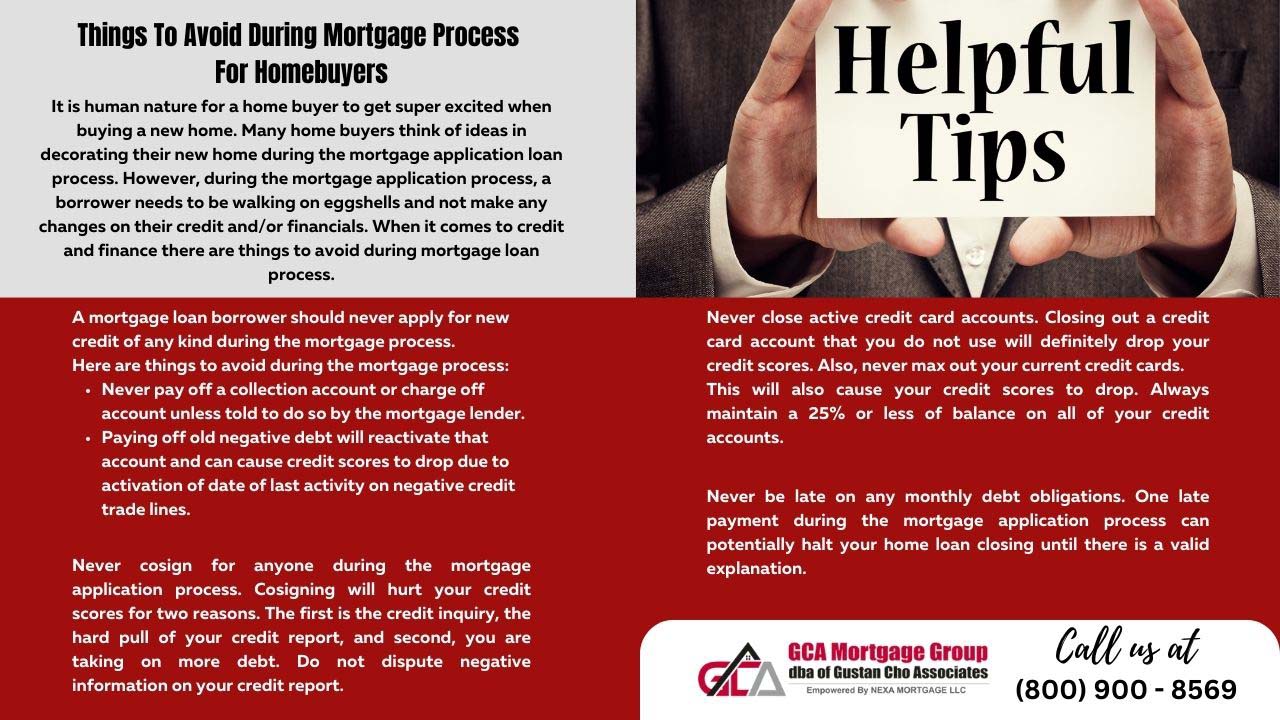

It is human nature for a home buyer to get super excited when buying a new home. Many home buyers think of ideas for decorating their new homes during the mortgage application loan process.

During the mortgage application process, a borrower must walk on eggshells and not make any changes to their credit and financials. When it comes to credit and finance, there are things to avoid during mortgage process. In the following paragraphs, we will cover things to avoid during mortgage process so there are no delays with the home closing and to avoid any chance of a last-minute mortgage loan denial.

Avoid Mistakes During the Mortgage Process

Contact us today to learn about the top things to avoid to ensure a smooth approval process.

What are The Things To Avoid During Mortgage Process?

When a mortgage loan borrower completes their 1003 mortgage application, the mortgage loan officer pulls a credit check. The Loan Officer will review two years’ tax returns, W2s, and paycheck stubs. The LO will run the credit report and mortgage application through an Automated Underwriting System. Once the AUS yields approve/eligible, a pre-approval is issued. Dale Elenteny of Gustan Cho Associates, said the following:

If the mortgage borrower meets all the guidelines, the AUS will render an approve/eligible per AUS. Hard credit inquiries will cause a drop in credit scores. Charging large ticket items such as appliances and new furniture will affect debt-to-income ratios.

Large purchases on a credit card will increase the credit debt and the DTI. Credit card balances over a 20% credit utilization ratio will cause a drop in credit scores. More monthly payments will increase debt to income ratio, potentially disqualifying borrowers for a home loan.

Avoid New Credit Top: Things To Avoid During Mortgage Process

A mortgage loan borrower should never apply for new credit during the mortgage process. Never pay off a collection account or charge off the account unless told by the mortgage lender. Paying off old negative debt will reactivate that account and can cause credit scores to drop due to activation of the date of last activity on negative credit trade lines.

Don’t Close Credit Accounts: Things To Avoid During Mortgage Process!

One of the things to avoid during mortgage process is close active credit card accounts. Closing out a credit card account you do not use will drop your credit scores. Also, never max out your current credit cards. This will also cause your credit scores to drop. Always maintain a 25% or less balance on your credit accounts.

Things To Avoid During Mortgage Process For Homebuyers

Avoiding Life Changes That Can Impact Mortgage Approval

Changing marital status during the process can alter financial stability and affect mortgage approval. Like getting married, divorced, or separated. Adding or removing someone from the mortgage application can also affect the approval. The implications of changing applicants during the process, including potential impacts on credit scores, income verification, and overall loan approval. Cosigning for someone else’s loan can increase your debt-to-income ratio and jeopardize your mortgage approval.

Maintaining Credit Stability

- Importance of Timely Bill Payments: Late payments can negatively affect your credit rating and potentially lead to higher interest amounts or loan denial.

- Risks of Lowering Your Credit Score During the Process: Understanding how certain financial behaviors, such as increasing credit card balances or missing payments, can decrease your credit score and jeopardize mortgage approval.

- The Impact of Credit Inquiries on Mortgage Approval: How multiple credit inquiries, especially new credit applications, can lower your credit rating and raise concerns with lenders, potentially affecting your loan terms or approval status.

Managing Bank Accounts Wisely

Avoid large unexplained deposits or transfers. Unexplained funds can lead to delays or denials. It is important to document the source of any large deposits. Keeping consistent bank activity to avoid red flags. Maintaining stable and predictable banking activity helps reassure lenders and avoid unnecessary complications. The risks associated with switching banks mid-process, including potential delays in verifying assets and income can create confusion for lenders.

Keeping Communication Open with Your Lender

- Consulting Your Lender Before Making Significant Financial Decisions: Why it’s crucial to discuss any major financial moves, like large purchases or debt payoffs, with your lender to avoid impacting your mortgage approval.

- Reporting Any Changes in Your Financial Situation Immediately: It is important to promptly inform your lender about any income, employment, or debt changes to ensure your loan application remains accurate and up-to-date.

- The Importance of Meeting Deadlines and Attending Scheduled Appointments: Staying on top of timelines and appointments helps keep the mortgage process on track, preventing delays and potential issues with loan approval.

Make Your Mortgage Process Easy—Avoid These Pitfalls!

Contact us today to find out what to avoid and how we can help you through the entire process.

Frequently Asked Questions (FAQs)

1. Why Should I Avoid Making Large Purchases During the Mortgage Process?

Large purchases, especially on credit, can alter your debt-to-income ratio (DTI) and affect your loan approval. Lenders reassess your financial situation before closing; any significant changes could lead to delays or mortgage denial.

2. Is It Safe to Change Jobs While in the Middle of the Mortgage Process?

It’s generally not advisable to change jobs during the mortgage process. This is one of the things to avoid during mortgage process. Lenders prefer stability, and a job change can complicate the verification of your income. If a job change is unavoidable, ensure it’s in the same field with equal or higher pay. Be prepared to provide additional documentation.

3. Can I Open New Lines of Credit While My Mortgage Is Being Processed?

One of the things to avoid during mortgage process is opening new lines of credit, such as a credit card or auto loan, can negatively impact your credit score and DTI ratio. Even a minor drop in your credit score or an increase in debt could lead to a higher interest rate or loan denial.

4. Should I Close Any Existing Credit Accounts During the Mortgage Process?

It’s best to keep any credit accounts open during the mortgage process. Closing accounts can negatively affect your credit utilization ratio and credit history, which could lower your credit score.

5. What Are the Risks of Making Late Payments on Bills During the Mortgage Process?

Late fees can hurt your credit score and damage your chances of mortgage approval. Lenders look for responsible financial behavior; late payment could be a red flag, potentially resulting in a higher interest rate or denial.

6. Is It Okay to Make Large Deposits into My Bank Account During the Mortgage Process?

Large deposits can raise red flags for lenders, as they may question the source of the funds. All large deposits must be documented and explained. It’s best to only make large deposits if necessary and always keep clear records of where the funds are coming from.

7. Why Should I Avoid Switching Banks During the Mortgage Process?

Switching banks can make the process easier, as lenders must re-verify your financial information. It’s best to keep your finances stable until after the mortgage closes.

8. Can I Cosign for Someone Else’s Loan During My Mortgage Process?

One of the things to avoid during mortgage process is cosigning for another person’s loan will increase your financial liabilities and could affect your DTI ratio. This added debt can impact your mortgage approval or increase interest rates.

9. Is It Important to Avoid Major Life Changes During the Mortgage Process?

Major life changes, such as getting married, divorced, or having a baby are things to avoid during mortgage process. These can affect your financial situation and mortgage process. Any significant change should be communicated to your lender, which may impact your loan approval.

10. Should I Avoid Moving Large Amounts of Money Between Accounts?

One of the things to avoid during mortgage process is moving large sums of money between accounts can be problematic. Lenders need a clear and consistent picture of their finances, and unexplained transfers could raise concerns or delay the process.

Don’t Co-Sign for Others!

Never cosign for anyone during the mortgage application process. Cosigning will hurt your credit scores for two reasons. The first is the credit inquiry, the hard pull of your credit report, and the second, you are taking on more debt. Do not enroll in any credit monitoring services as well, the less activity there is on your credit profile, the better. Any activities on your credit during the mortgage application process will alert the underwriter as a red flag. This will scrutinize your mortgage application process, and letters of explanation will be required, which might delay your home loan closing.

If you have further questions about things to avoid during mortgage process, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Our loan experts are available 24/7.

Ready to Avoid Pitfalls in Your Mortgage Process?

Contact us today to get advice on the key things to avoid and secure your home loan faster.