Understanding VA Home Mortgages For Veteran Homebuyers

VA home mortgages are one of the most powerful benefits available to U.S. military veterans, active-duty service members, and qualifying surviving spouses. If you’ve served our country, you may be eligible for a VA loan, a mortgage backed by the U.S. Department of Veterans Affairs that offers zero down payment, no mortgage insurance, and flexible credit guidelines. In this updated 2025 guide, we’ll walk you through everything you need to know about understanding VA home mortgages for veteran homebuyers, including how they work, who qualifies, and why VA loans are one of the best options for buying or refinancing a home.

What Are VA Home Mortgages?

VA home mortgages are loan programs designed to help veterans, active military, and eligible spouses achieve homeownership. Unlike traditional loans, VA loans are guaranteed by the federal government, which makes them less risky for lenders and more affordable for borrowers.

VA Home Mortgages Built for Those Who’ve Served

We proudly help veterans buy homes with trusted VA-backed financing.

Understanding VA Home Mortgages

VA loans were created and put in place by Congress to reward the men and women of the United States Armed Service for their service in serving in our military. Active and retired members of the U.S. Military with a valid certificate of eligibility (COE) are eligible for a VA loan.

Benefits of VA Home Mortgages:

- No Down Payment Required

One of the biggest incentives of VA loans is you can buy a home with zero down. No need to save for a significant lump sum. You can keep your savings for emergencies, repairs, or furniture. - No Private Mortgage Insurance (PMI)

VA loans don’t require monthly mortgage insurance even with no down payment. This can save you hundreds each month. Lower monthly payments = higher home affordability. - Competitive Interest Rates

Compared to conventional loans, VA loans usually come with more competitive interest rates. Because the government guarantees the loan, lenders take on less risk. That means better rates for you potentially saving thousands over the life of your loan. - Flexible Credit Requirements

If you’ve had credit problems in the past, VA loans offer more lenient guidelines.. You may still qualify with lower credit scores, past bankruptcies, or foreclosures. There’s no minimum credit score set by the VA (but individual lenders may have overlays). - Limited Closing Costs

The VA limits the closing costs veterans can be charged. Some costs are not allowed to be paid by the borrower. Sellers can give up to 4% of the loan amount toward your closing costs or prepaid expenses. - Streamlined Refinance Options

Already have a VA loan? The VA IRRRL allows you to refinance without a new appraisal or full underwriting. Fast and easy refinance. Great way to lower your monthly payment or switch from ARM to fixed-rate loan. - Options for Renovation and Construction

VA loans can also be used for VA Renovation Loans. Finance both the home and repairs with one loan. And VA Construction Loans. Build a brand-new home with the same zero-down benefit. - Assumable Loans

VA loans are assumable, which means a approved buyer can take over your loan if you sell your home. When rates rise, this is a decisive advantage, making your home more attractive to buyers. - Multiple Uses Allowed

VA loans aren’t one-time-use only. You can use it again once your previous VA loan is paid off or entitlement is restored. Sometimes, you can even have two VA loans simultaneously (with partial entitlement). - Protection Against Foreclosure

The VA offers assistance and guidance to help veterans avoid foreclosure. They can work with your lender on your behalf. Additional tools are available for financial hardship situations.

Veterans: Unlock Your VA Home Loan Benefits Today

Zero down, no PMI, and competitive rates—VA loans are built for you.

Who Qualifies for a VA Home Mortgage?

To be eligible for a VA home mortgage, you must meet at least one of the following:

- Served 90 consecutive days during wartime

- Served 181 days during peacetime

- Fulfilled a 6-year commitment in the Guard or Reserve forces

- Be the eligible spouse of a fallen service member, either from active duty or a service-related disability

You will need a Certificate of Eligibility (COE) from the VA, a valid DD-214 (for veterans), and a proof of service (for active-duty members). Understanding VA home mortgages for veteran homebuyers begins with verifying eligibility. Once you’re eligible, you can move forward with getting pre-approved and finding a home.

Credit Score Requirements for VA Home Mortgages

One of the most attractive features of VA home mortgages is the flexible credit guidelines. There is no official minimum score from the VA, but most lenders require a minimum credit score of 580, and some lenders approve VA loans with scores as low as 500, depending on other factors. When understanding VA home mortgages, it’s important to know that credit score flexibility makes them ideal for buyers who may not be eligible for conventional financing.

VA Loan Down Payment and Loan Limits

No Down Payment Required! With VA home mortgages, you can buy a home with 0% down, one of the few loan programs that allow full financing. There are no official VA loan limits in 2025 for eligible borrowers with full entitlement. If you’ve used part of your VA entitlement or still own a home with a VA loan, limits may apply based on your county’s conforming loan limit. Understanding VA home mortgages for veteran homebuyers means knowing that you can purchase a home with no down payment, even in high-cost areas, depending on your entitlement.

Do VA Loans Require Mortgage Insurance?

No! Unlike FHA or conventional loans, VA home mortgages do not require monthly mortgage insurance (PMI). Instead, VA loans have a one-time VA Funding Fee, which helps support the program.

VA Funding Fee (2025):

| Loan Type | First-Time Use | Subsequent Use |

|---|---|---|

| No Down Payment | 2.15% | 3.3% |

| 5% Down Payment | 1.5% | 1.5% |

| 10% Down Payment | 1.25% | 1.25% |

Exemptions: Veterans with a service-connected disability or certain surviving spouses do not have to pay the VA funding fee.

Income, DTI, and Residual Income Guidelines

Debt-to-Income Ratio (DTI):

VA loans do not have a hard cap on DTI, but most lenders prefer below 50%. DTI over 50% may be allowed with strong residual income and compensating factors

Residual Income:

VA loans have unique residual income requirements, which ensure borrowers have enough income left over after expenses. Residual income is a major factor in VA underwriting. It’s often more important than your credit score or DTI.

| Region | Family of 4 | Minimum Residual |

|---|---|---|

| Northeast | $1,025 | |

| Midwest/South | $1,003 | |

| West | $1,117 |

What Types of Properties Can You Buy?

You can use VA home mortgages to buy single-family homes, condos (must be VA-approved), townhomes, multi-unit properties (2–4 units) – if you live in one unit. manufactured homes – if they meet VA guidelines, and new construction including VA One-Time Close loans. It is important to remember that you must occupy the property as your primary residence. Vacation and investment properties do not qualify for VA loan financing.

Can You Refinance a VA Loan?

Yes! VA offers two powerful refinance options:

- VA Interest Rate Reduction Refinance Loan (IRRRL)

– For existing VA loan holders

– No appraisal or income verification required

– Lower your rate quickly and easily - VA Cash-Out Refinance

– Refinance up to 100% of your home’s value

– Pay off debt or take cash out for home improvements

VA home mortgages offer low-cost, flexible refinance solutions.

VA Loan Process in 2025: Step-by-Step

- Check your eligibility and request your COE

- Get pre-approved with a VA-approved lender

- Find a home and make an offer

- VA appraisal and underwriting review

- Close on your loan and move in!

Working with an experienced lender makes all the difference when navigating the VA home mortgage process.

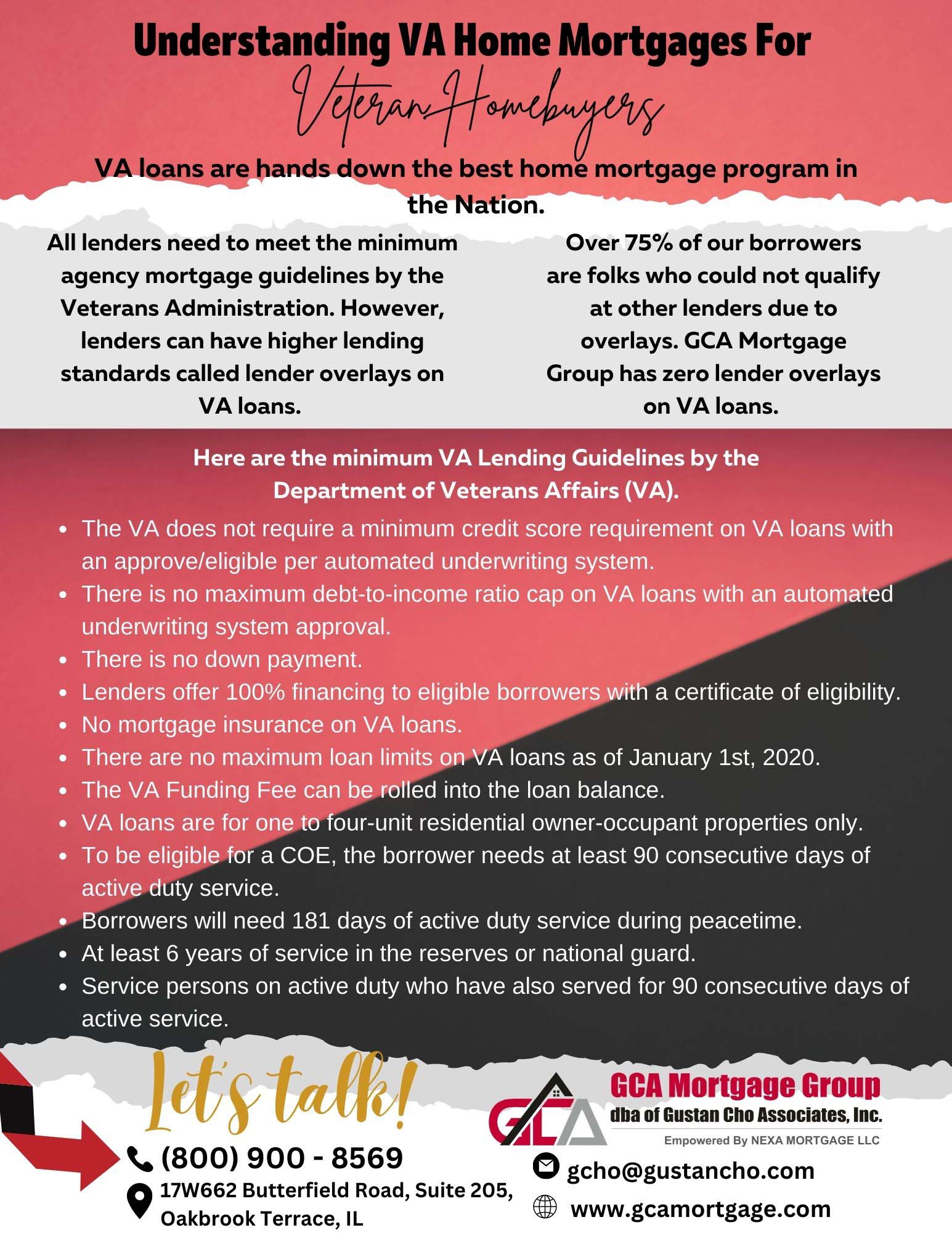

What Are Lender Overlays on VA Loans?

Understanding VA home mortgages lender overlays is important. All lenders need to meet the minimum agency mortgage guidelines by the Veterans Administration. However, lenders can have higher lending standards called lender overlays on VA loans. Therefore, not all lenders have the same lending requirements on VA loans. This is why Understanding VA Home Mortgages and how overlays work is important. This holds especially true for borrowers with less-than-perfect credit or prior bad credit. Just because you do not qualify for a VA loan with one lender does not mean that you will not qualify with a different lender.

Confused About Lender Overlays on Your VA Loan?

Contact us today to learn how these additional requirements affect your eligibility and how we can help you get approved.

Best VA Mortgage Loans With No Lender Overlays

Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on VA loans. Over 75% of our borrowers are folks who could not qualify at other lenders due to overlays. Gustan Cho Associates has zero lender overlays on VA loans. We just go off the automated underwriting system (AUS) findings and do not have another layer of lender overlays

Qualifying For a VA Home Mortgage After Bankruptcy And Foreclosure

Homebuyers can qualify for a VA home mortgage after bankruptcy, foreclosure, a deed in lieu of foreclosure, or a short sale. The waiting period after bankruptcy, foreclosure, a deed in lieu of foreclosure, or a short sale is two years. Established credit and no late payments after bankruptcy and/or housing event is frowned upon by lenders and is difficult to get approve/eligible per AUS.

VA Loans While In Chapter 13 Bankruptcy

Homebuyers in an active Chapter 13 repayment plan are eligible to qualify for VA loans with Trustee approval with a manual underwrite. Chapter 13 bankruptcy does not have to be discharged. There is no waiting period after the Chapter 13 Bankruptcy discharge date. However, if the Chapter 13 discharge date has not been seasoned for two years, the file is downgraded to a manual underwrite.

Frequently Asked Questions (FAQs): Understanding VA Home Mortgages For Veteran Homebuyers

1. What is a VA home mortgage?

Understanding VA home mortgages is essential. A VA home mortgage is a loan program the Department of Veterans Affairs provides to assist veterans, active-duty service members, and qualified surviving spouses in buying, building, or improving a home. These loans often come with good terms, such as no down fees and no private mortgage insurance.

2. Who is eligible for a VA home mortgage?

Eligibility for a VA home mortgage is typically extended to Veterans, Active-duty service members, Members of the National Guard or Reserves, and Eligible surviving spouses Eligibility is determined based on the length and type of service and discharge status.

3. What are the benefits of a VA home mortgage?

Key benefits of a VA home mortgage include:

- No down payment is required in most cases

- No private mortgage insurance (PMI) required

- Competitive interest rates

- Limited closing costs

- Lenient credit requirements compared to conventional loans

- The capacity to finance the VA funding fee

4. What is the VA funding fee?

VA funding fee is a single payment made to the Department of Veterans Affairs to cover the expenses of the VA loan program. The fee can be added to the loan total amount and varies based on factors such as the loan amount, type of loan, and whether the borrower has used a VA loan.

5. Can the VA funding fee be waived?

The VA funding fee can be exempted for certain veterans, particularly those receiving VA disability compensation. Surviving spouses of veterans who passed away in service or due to a service-related disability may also be eligible for a waiver.

6. What types of properties can be purchased with a VA home mortgage?

VA home loans can be utilized to buy single-family homes, condominiums and townhomes (VA-approved), manufactured homes and lots, multi-family properties (up to four units) if the veteran wanted to occupy one of the units, and new construction homes.

7. Can I utilize a VA loan more than once?

Understanding VA home mortgages utilization is crucial. You can use a VA loan multiple times if you have remaining entitlement and meet the eligibility requirements. Your entitlement can be restored after paying off a previous VA loan or selling the property.

8. Understanding VA home mortgages: How do I apply?

Understanding VA home mortgages application is crucial. Here’s how:

- Get a Certificate of Eligibility from the VA, verifying your loan Eligibility.

- Choose a VA-approved lender and complete their loan application process.

- Provide the lender with the necessary documentation, such as your COE, income verification, and credit information.

- The lender will process your application and guide you through the steps to closing.

9. What credit score is needed for VA home mortgages?

It does not set a minimum credit score needed, but most lenders prefer a credit score of at least 620. However, some lenders may accept lower scores based on other compensating factors.

10. How does the appraisal process work for VA home mortgages?

Understanding VA home mortgages appraisal process is important. The VA requires an inspection to ensure the property meets minimum property requirements (MPRs) and is safe, structurally sound, and sanitary. A VA-approved appraiser will assess the property and provide a report to the lender. The appraisal helps identify the home’s fair market value and any necessary repairs.

Final Thoughts: Why VA Loans Are a Top Choice in 2025

If you’re a veteran, active-duty service member, or surviving spouse, understanding VA home mortgages can help you take advantage of one of the best mortgage programs available in 2025. No down payment required. No mortgage insurance. Flexible credit and DTI guidelines. Competitive interest rates. Available across all 50 states.

Ready to Get Pre-Approved for a VA Loan?

If you’re still having a hard time understanding VA home mortgages or you’re a Homebuyer who need to qualify for a VA loan with a five-star national mortgage company licensed in multiple states with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

Have Questions About VA Loan Overlays?

Reach out now to get clarity on how overlays impact your VA loan and how we can help you get the financing you need.