VA DTI Mortgage Guidelines on VA Home Loans

In this blog, we will discuss and cover VA DTI mortgage Guidelines. VA DTI mortgage guidelines state there is no maximum debt-to-income ratio cap on VA loans with an approve/eligible per automated underwriting system (AUS). You should get an approve/eligible per automated underwriting system as long you have strong residual income.

You should also get an AUS approval as long as the borrower has timely payments in the past 12 months. If can not get an approve/eligible per the automated underwriting system and get a refer/eligible, you may be able to be eligible for a manual underwrite if you had timely payments in the past 24 months. In the following paragraphs, we will cover VA DTI mortgage guidelines on VA home loans.

Understanding Debt-to-Income (DTI) Ratio for VA Loans

The Debt-to-Income (DTI) ratio is crucial in determining your eligibility for a VA home loan. It measures your monthly debt obligations relative to your gross monthly income. Here’s an in-depth look at the DTI ratio and its importance for VA loans.

What is a Debt-to-Income (DTI) Ratio?

The DTI ratio is represented as a percentage. It is calculated by dividing your monthly liabilities and payments by your gross income. This ratio aids lenders in evaluating your capacity to handle and repay the loan.

Components of the DTI Ratio

- Total Monthly Debt Payments:

- Includes all recurring monthly debts such as:

- Mortgage payments

- Car loans

- Student loans

- Credit card payments

- Personal loans

- Child support or alimony payments

- Includes all recurring monthly debts such as:

- Gross Monthly Income:

- The total income you earn each month before taxes and other deductions.

- Sources of income considered:

- Salary or wages

- Bonuses and commissions

- Self-employment income

- Rental income

- Retirement and pension income

- Disability benefits

Why is the DTI Ratio Important for VA Loans?

The DTI ratio is an important measure of your financial health and capacity to manage additional debt. Lenders use this ratio to check the risk of lending to you. A lower DTI ratio signifies lower risk, which can enhance your likelihood of loan approval.

VA Loan DTI Ratio Guidelines

- Preferred DTI Ratio: The VA prefers a DTI ratio of 41% or lower. Your monthly debt payments should be 41% of your gross monthly income.

- Higher DTI Ratios: While a DTI ratio above 41% may still be acceptable, it requires strong compensating factors such as high residual income, excellent credit scores, or significant cash reserves.

Residual Income and Its Importance

- Residual Income: This is the amount left over after all monthly debts and obligations are paid. The VA uses residual income requirements to ensure borrowers have enough funds to cover basic living expenses.

- Role in Loan Approval: Meeting or exceeding the VA’s residual income guidelines can compensate for a higher DTI ratio, increasing your chances of loan approval.

Improving Your DTI Ratio

- Pay Down Debts: Reduce your existing debts to lower monthly payments.

- Increase Income: Boost your income through additional employment, bonuses, or other sources.

- Avoid New Debt: Do not take on new loans or credit card obligations before applying for a VA loan.

Conclusion

Understanding and managing your DTI ratio is vital when applying for a VA home loan. By keeping your DTI ratio within acceptable limits and ensuring high residual income, you can enhance your eligibility and secure favorable loan terms. Always consult a VA loan specialist for personalized advice and support throughout the application process.

Getting an Approve/Eligible Per AUS With High DTI on VA Loans

As long as you have timely payments in the past 12 months and strong residual income, you can get approve/eligible per an automated underwriting system with a high debt-to-income ratio.

VA manual underwriting guidelines and requirements on maximum debt-to-income ratios are based on underwriter discretion.

Can You Get a VA Loan With a 65% Debt-To-Income Ratio?

Gustan Cho Associates has helped our borrowers get a manual underwriting mortgage loan approval on a VA loan with debt to income ratio as high as 65% DTI.

Again, a 65% DTI VA loan approval on a manual underwrite. The team at Gustan Cho Associates are experts in VA mortgage financing. We receive numerous phone calls every day with questions surrounding VA mortgage guidelines.

What Is Overlays on a VA Loan?

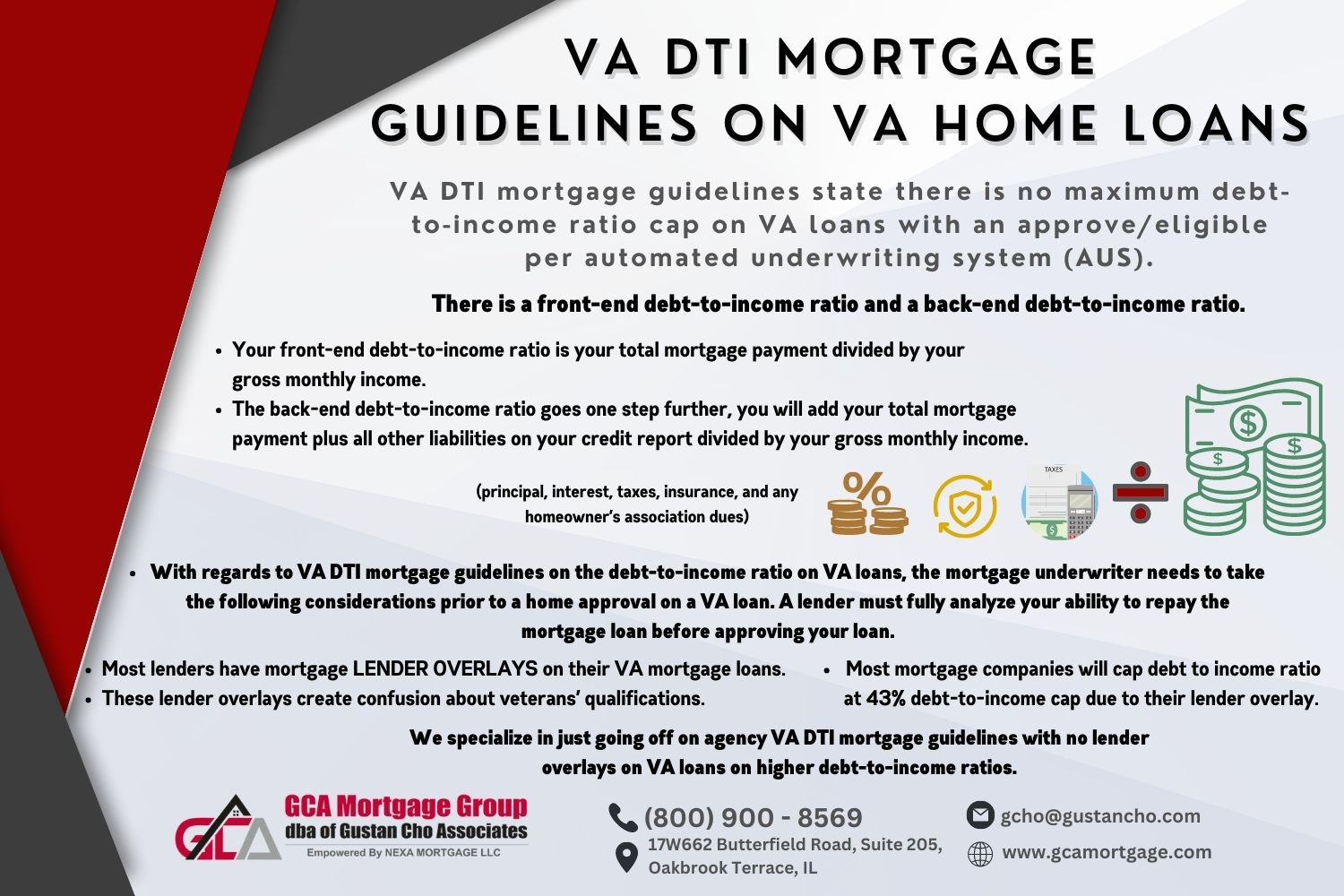

In most situations, utilizing your VA benefits will give you the best terms for buying a home. Our brave veterans deserve a zero-down payment mortgage to help their families achieve homeownership and long-term financial success. Most lenders have mortgage LENDER OVERLAYSon their VA mortgage loans.

These lender overlays create confusion about veterans’ qualifications. In this blog, we will detail VA DTI guidelines on VA loans. We will be covering how your debt-to-income ratio will be calculated for a VA loan. We specialize in just going off on agency VA DTI mortgage guidelines with no lender overlays on VA loans on higher debt-to-income ratios. In this article, we will cover and discuss VA DTI mortgage guidelines on maximum debt-to-income ratios.

What Is Debt-To-Income Ratio in Mortgages?

With regards to VA DTI mortgage guidelines on the debt-to-income ratio on VA loans, the mortgage underwriter needs to take the following considerations prior to a home approval on a VA loan. A lender must fully analyze your ability to repay the mortgage loan before approving your loan.

VA DTI Mortgage Guidelines on Residual Income

The ABILITY TO REPAY ACT was put in place on January 10, 2014. The borrower needs to pass the VA residual income test. Now lenders must verify all of the borrower’s income and liabilities. Make sure the mortgage loan applicant meets all VA DTI mortgage guidelines. It is important to understand that there are two aspects that factor into your debt-to-income ratio.

VA DTI Mortgage Guidelines on Front and Back-End Ratios

There is a front-end debt-to-income ratio and a back-end debt-to-income ratio. Your front-end debt-to-income ratio is your total mortgage (principal, interest, taxes, insurance, and any homeowner’s association dues) payment divided by your gross monthly income.

The back-end debt-to-income ratio goes one step further, you will add your total mortgage payment (principal, interest, taxes, insurance, and any homeowner’s association dues) plus all other liabilities on your credit report divided by your gross monthly income.

VA DTI Mortgage Guidelines Versus Overlays

When doing your own research on VA mortgages, you will find many lenders will tell you your max debt-to-income ratio is 43%. However, this is not the case at Gustan Cho Associates

Most mortgage companies will cap debt to income ratio at 43% debt-to-income cap due to their lender overlay. According to the U.S. Department of Housing and Urban Development (HUD) which oversees VA loans, there is no max income ratio requirement.

VA Residual Income Guidelines For High DTI Borrowers

How Is Qualified Income Calculated By Mortgage Underwriters

How is income calculated for a VA mortgage? When computing income for a VA mortgage, there are certain things that must be taken into account. The lender will use your total gross income This can be easy to calculate if you are an hourly or salary employee but can be much more difficult if you have variable income such as commissions or are self-employed. Please review this blog on How Mortgage Underwriters Calculated Incomein mortgage lending.

VA Student Loan Guidelines

In this section, we will cover student loan debt and VA mortgages: If you have student loan debt, this will be factored into your overall debt-to-income ratio. If your student loans are currently in repayment, the lender must use payment on the credit report.

If your loans are in deferment, the VA has a strict policy on how to calculate that payment. As long as the student loans are deferred for 12 months or longer from the closing date (FUNDING date for refinances), your monthly payment will be calculated using the following equation.

How Mortgage Underwriters Calculate Student Loan Debt on VA Loans

Here is a case scenario:

- Principal balance of student loans * 5% / 12 months = monthly payment counted against your DTI ratio

Example:

- A veteran has two separate student loans

- Student loan #1 is for $25,000 and the payments start in 6 months

- Student loan #2 is for $20,000 and that is deferred for 18 months

- Student loan #1 – $25,000 * 5% = $1,250, $1,250 / 12 months = $104.17

- Student loan #1 will have a $104,17 payment counted against your debt-to-income ratio

- Why would I not you know it’s perfect and is exactly what I want

Student loan #2 – Since this student loan is deferred for more than 12 months after our closing date, a $0 payment will be counted against your debt-to-income ratio.

Qualifying For VA Loans With High DTI

If you are still reading this article and have additional questions on VA DTI mortgage guidelines, contact us at 800-900-8569 or text us for a faster response. You can also email us at gcho@gustancho.com. Most viewers visiting us at Gustan Cho Associates were either told or read some contradicting information surrounding VA DTI mortgage guidelines. This is simply because the majority of lenders have additional lender overlays on their VA mortgage loans. We have seen debt-to-income ratios as high as 65% still get approved for VA mortgage financing.

Please remember, a veteran must pass their residual income thresholds no matter what their debt-to-income ratio may be. For any clarification on VA DTI mortgage guidelines, please call us at 262-716-8151 or text us for a faster response. Or you can email us at gcho@gustancho.com. We are available seven days a week and even on holidays. We look forward to helping you with your mortgage financing.

Frequently Asked Questions (FAQs)

1. What is a Debt-to-Income (DTI) ratio?

A DTI ratio is a percentage that measures your monthly debt payments against your gross monthly income. Lenders use it to evaluate your capacity to handle monthly payments and repay debt.

2. How is the DTI ratio calculated for VA home loans?

To calculate the DTI ratio, divide your monthly debt payments by your gross earnings. Multiply the result by 100 to get a percentage. For example, if your monthly debts are $1,500 and your monthly gross earnings are $5,000, your DTI ratio is 30%.

3. What is the maximum allowable DTI ratio for VA home loans?

The VA does not establish a strict maximum DTI ratio, but lenders generally prefer a DTI ratio of 41% or lower. However, VA loans can be approved with higher DTI ratios if the borrower has strong compensating factors.

4. What are the compensating factors for high DTI ratios?

Compensating factors are favorable elements of your financial profile that can balance out a high DTI ratio. These may include:

- High credit score

- Significant cash reserves

- Stable and reliable income

- Low housing expense compared to previous housing costs

- Residual income that exceeds the VA’s guidelines

5. What is residual income, and why is it important?

Residual income is left over after all monthly debts and obligations are paid. It is a key factor in VA loan approval because it measures the borrower’s ability to cover basic living expenses. The VA has specific residual income requirements based on family size and geographic location.

6. How does the VA residual income requirement affect loan approval?

Meeting or exceeding the VA’s residual income requirements can compensate for a higher DTI ratio. Lenders may be more flexible with your DTI ratio if your residual income is sufficient.

7. Are there exceptions to the DTI guidelines for VA loans?

Yes, exceptions can be made on a case-by-case basis. Borrowers with higher DTI ratios may still qualify for a VA loan if they have strong compensating factors or significant residual income.

8. How can I improve my DTI ratio for a VA loan application?

- Pay down existing debts: Reducing your monthly debt payments will lower your DTI ratio.

- Increase your income: Additional sources of income can help improve your DTI ratio.

- Avoid new debts: Avoid taking on new loans or credit card obligations before filing for a VA loan.

9. What types of income are considered in the DTI calculation for VA loans?

Lenders consider various types of income, including:

-

Employment income

-

Self-employment income

-

Retirement income

-

Disability benefits

-

Rental income

-

Alimony or child support (if it meets certain conditions)

10. Can I still qualify for a VA loan with a high DTI ratio but a strong residual income?

Yes, strong residual income can compensate for a high DTI ratio. To identify your loan repayment ability, lenders will consider your residual income and DTI ratio.

11. What documentation is required to verify my income for a VA loan?

You will need to provide:

- Recent pay stubs

- W-2 forms

- Tax returns (if self-employed)

- Proof of other income (retirement, disability, rental, etc.)

12. Can active-duty military personnel qualify for VA loans with high DTI ratios?

Yes, active-duty military personnel can qualify for VA loans, even with high DTI ratios, if they have strong compensating factors and meet the residual income requirements.