W2-Income-Only Mortgages

This guide covers qualifying for W2-Income-Only Mortgages. Borrowers who are W-2 wage earners and mortgage underwriters will go off the most recent paycheck stubs reflected on the past 30 days and from the employer’s employment verification. Two years of W2s are required, but there is a lot of leniency with W-2 wage earners. The following paragraphs will discuss W2-income-only mortgages on FHA, VA, and conventional loans.

Case Scenario of W2-Income-Only Mortgages

This section will cover case scenarios on how mortgage underwriters calculate income. Suppose a mortgage loan applicant has worked part-time for a company for the past two years or even less but got promoted to full-time status. In that case, underwriters will use the full-time status income to qualify for the mortgage income debt-to-income qualifications.

If the borrower shows declining income, the most recent lower income will be used. It will be averaged for 12 months to determine monthly gross income in qualifying for a mortgage.

Suppose a mortgage applicant has been working for the same company and got a promotion with a hefty pay increase. In that case, the new payment will be used to calculate income as long as employment verification confirms that. If a mortgage loan applicant moved jobs from one job to another job and the new job offered a high pay increase, the new job’s pay will be used to qualify for income even though the W2s for the past two years were substantially less.

Mortgage Guidelines With Employment Gaps In the Past 2 Years

If a mortgage applicant has had gaps in employment via W-2s, they can qualify for a mortgage as long as they found a new job within six months and the gap in employment was not greater than six months. If the gap in employment were longer than six months, they would have to work in their new job for at least six months to qualify for the new job’s pay. An offer letter requires 30 days of paycheck stubs at the new job before the underwriter issues clear to close.

Overtime Income To Qualify For Home Loan

Overtime income can be used for additional income as long as borrowers consistently document they have been getting overtime income for the past two years. Bonus income can be used in qualifying for a mortgage as long as the borrower can show that they have been receiving bonus income for the past two years. Alimony and child support income can be used if the borrower will likely receive alimony and child support income for the next three years.

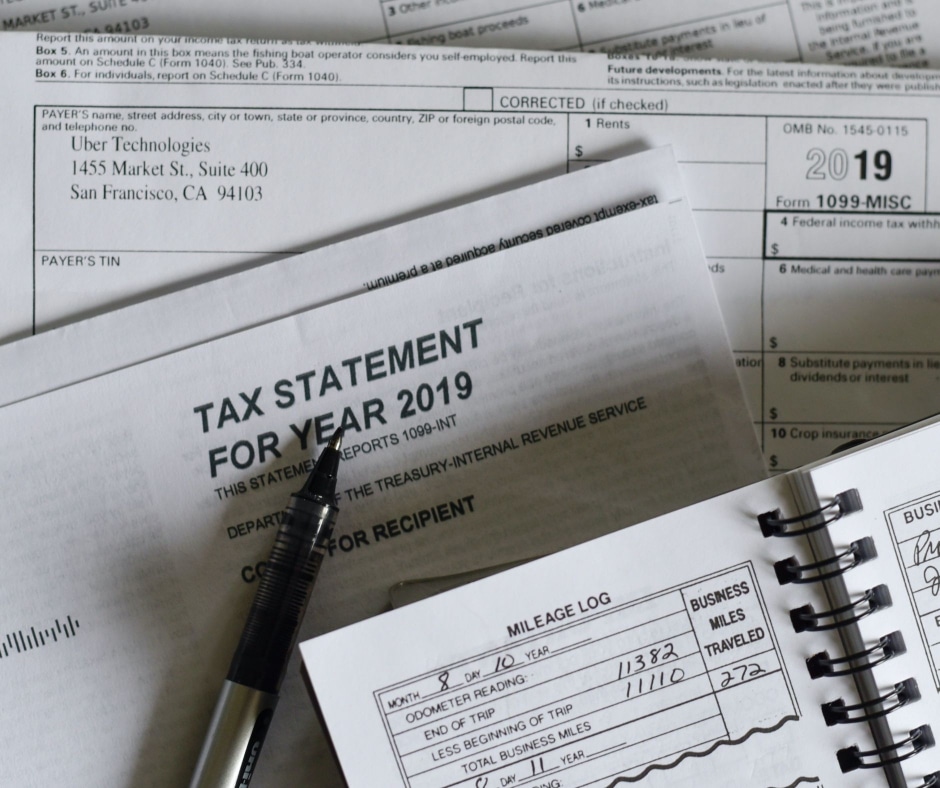

Qualifying For W2-Income-Only Mortgages With No Tax Returns

Homebuyers who are W-2 wage earners can qualify for W2-income-only mortgages with no-income tax returns on the following loan programs:

- FHA loan W2-income-only mortgages

- VA loan W2-income-only mortgages

- Conventional loan W2-income-only mortgages

Tax returns are not required on W2-income-only mortgages. For borrowers who write off a lot of expenses on tax returns, the write-offs from tax returns will negate the W2 income. Many times, due to the write-offs, the chances are borrowers do not qualify for a mortgage loan. Gustan Cho Associates now offers W2-income-only mortgages with no income tax returns required for homebuyers. W2-income-only mortgages are available for FHA, VA, and Conventional loans.

How Does W2-Income-Only Mortgages Work

Borrowers where they can qualify for W2-income-only mortgages with no income tax returns required, W2-income-only mortgages need to be full-time W2 wage earners. This is where no income tax returns are required as long as borrowers are W-2 wage earners.

Only two-year W-2s are required.. However, the borrower needs only W-2 wages and not 1099 wages. If the mortgage loan applicant has both W-2 income, rental properties, and 1099 income, then two years tax returns are required.

As long as the borrower has W-2 income only, then the two years tax returns will not be used. It will not be required to be submitted, and the write-offs from the two years’ tax returns will not be used and counted against borrowers.. We offer W2-Income-Only Mortgage Loans on FHA, VA, and Conventional Loans.

Update on W2-Income-Only Mortgages

Effective immediately, Gustan Cho Associates offers bank statement loans for self-employed borrowers. Tax Returns are not required with our bank statement mortgage loan program for self-employed borrowers.

A 20% down payment is normally required, and a minimum credit score of 620 is required. 680 credit score borrowers can qualify for a 15% down payment.

Borrowers with 720 credit scores can put in a 10% down payment. The amount of down payment requirement is dependent on borrowers’ credit scores. There is no private mortgage insurance required. There is no loan cap with bank statement loans for self-employed borrowers.

Agency Guidelines Versus Lender Overlays

All mortgage lenders need to follow agency lending guidelines for them to get their mortgages they fund insurable and be able to sell them on the secondary market. More importantly, lenders want to feel confident that borrowers can repay their mortgage and will not default on their new home loan. Most borrowers are under the belief that income tax returns are required when applying for home loans. This belief holds true for self-employed home buyers, but more and more lenders are not requiring income tax returns for W2 Only Wage Earners. Consult with the loan officer before amending tax returns to increase adjusted gross income before applying for a mortgage.

W2-Income-Only Mortgages Automated Underwriting System Finding

Agency Mortgage Guidelines on Government and Conventional Loans

Why Income Tax Returns Are Required By Lenders

Lenders need to meet agency mortgage guidelines on government and conventional loans. Lenders are very careful about ensuring their clients can repay their new mortgages. Mortgage companies also need to ensure they do not have difficulty meeting their mortgage obligations every month.

Lenders do not want to see homeowners struggling to pay their monthly mortgage payments every month. This is why mortgage agencies and lenders have maximum debt-to-income ratio caps.

Residual income is an important factor mortgage underwriters look at on each file. All mortgage bankers and correspondent lenders sell their loans after they fund. The secondary market will not purchase loans that do not conform to Fannie Mae and Freddie Mac agency guidelines or loans that are not performing. Lenders want to check borrowers’ income for consistency and ensure no mortgage fraud.

What Is IRS FORM 4506-T?

Borrowers must complete and sign IRS FORM 4506-T as part of their mortgage docs. IRS Form 4506-T provides the mortgage lender authority to represent borrowers in receiving a copy of borrowers’ IRS transcripts. The 4506-T form from the IRS gives lenders all financial documentation, including W2s, 1099s, and other tax forms by the IRS.Income Tax Returns and IRS verification validates borrowers’ W2 income, 1099 income, other income, adjusted income, and write-offs tax filers filed.Mortgage Underwriters will cross-reference and cross-check borrowers’ income tax returns with the IRS transcripts; this is how they validate income when lenders run the Automated Underwriting System (AUS). There are many times AUS will not require federal income tax returns. Mortgages With No Tax Returns are becoming increasingly common with government and conventional loans.